The boss has told me to start running the rule over weed and psychedelics companies with a view to picking out anything that’s quietly profitable, or could be soon, among the general dross of both sectors, and to say I’m excited by that would be an overstatement.

In general, cannabis companies are hamstrung by government regulations, the weight of their initial capital raises, a retail investor space that was cleaned out long ago, and a dearth of heroes that have gone against the grain.

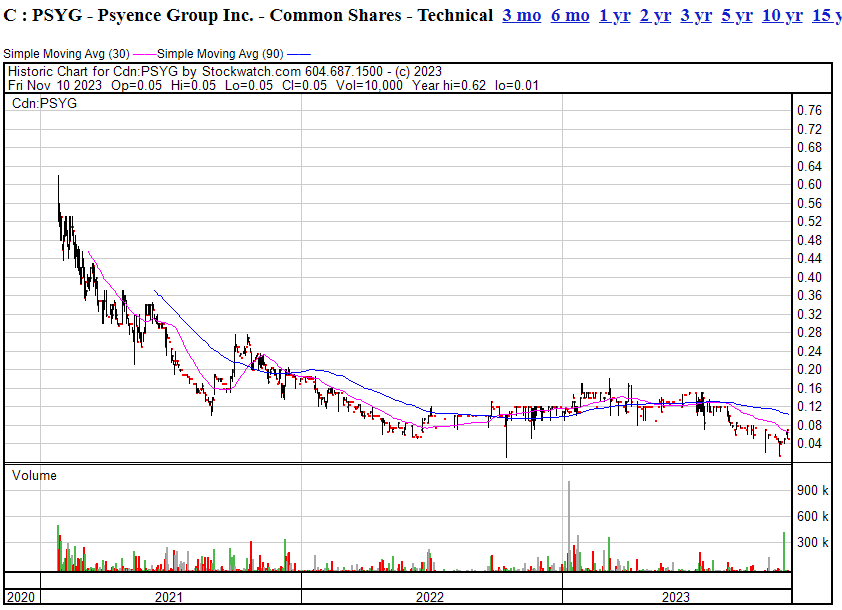

Psyence Group (PSYG.C) is, when you get right down to it, ‘shrooms from Lesotho.’ They’ve sprung up subsidiaries in all manner of countries where shrooms and their derivatives may be, or may soon be, legalized, but the market doesn’t give a shit and no matter how much they talk about ‘research’, there doesn’t appear to be an underlying business here until laws change.

The stock chart started in early 2021 at a high of $0.60 and has never looked back in its long slow slide downwards to $0.05 today.

After three years, the company earns less than my daughter.

- Revenue Streams: Psyence reported no revenue for the six-month period ended September 30, 2023, indicating it is still in a pre-revenue stage.

- Net Loss: The company reported a net loss of approximately $2.9 million for the six months ended September 30, 2023, compared to a net loss of about $2.6 million for the same period in 2022, indicating increased losses year-over-year.

- Operating Expenses: Total operating expenses for the six-month period were approximately $3 million, an increase from the previous year, primarily due to higher general and administrative expenses.

- Liquidity Position: As of September 30, 2023, Psyence had cash and cash equivalents of about $1.2 million, compared to $3.1 million as of March 31, 2023, showing a significant decrease in liquidity.

- Capital Raising: The company has been financing its operations primarily through equity financing. There is an ongoing need for additional funding to continue operations, which could lead to further dilution of existing shareholders.

- Market and Product Development: Psyence is in the early stages of developing its products and markets. It is focused on the cultivation, processing, and research of psychedelic compounds, which is an emerging and rapidly evolving industry.

- Regulatory Risks: The business is subject to complex and evolving regulations regarding psychedelics, which could impact the company’s ability to bring products to market or increase compliance costs.

- Intellectual Property: Psyence relies on intellectual property rights to protect its products and research. The ability to defend these rights is crucial for its long-term success.

- Operational Risks: As an early-stage company in a novel industry, Psyence faces operational risks, including successful product development, market acceptance, and effective management of growth.

- Strategic Partnerships: The company has entered into several strategic partnerships and agreements, which are critical for its research and development efforts.

Overall, Psyence Group Inc. presents a high-risk investment opportunity. It operates in a novel and rapidly evolving industry with significant potential. However, its current financial position reflects the typical challenges of an early-stage company, especially in this space, including reliance on capital markets for funding, regulatory uncertainties, and the need to develop and commercialize products.

Given these factors, I would assign a letter grade of ‘C’ to this investment opportunity. This grade reflects the company’s potential in an emerging market but also acknowledges the significant risks and uncertainties it faces.

— Lucy Copperpot

FULL DISCLOSURE: No commercial arrangement here