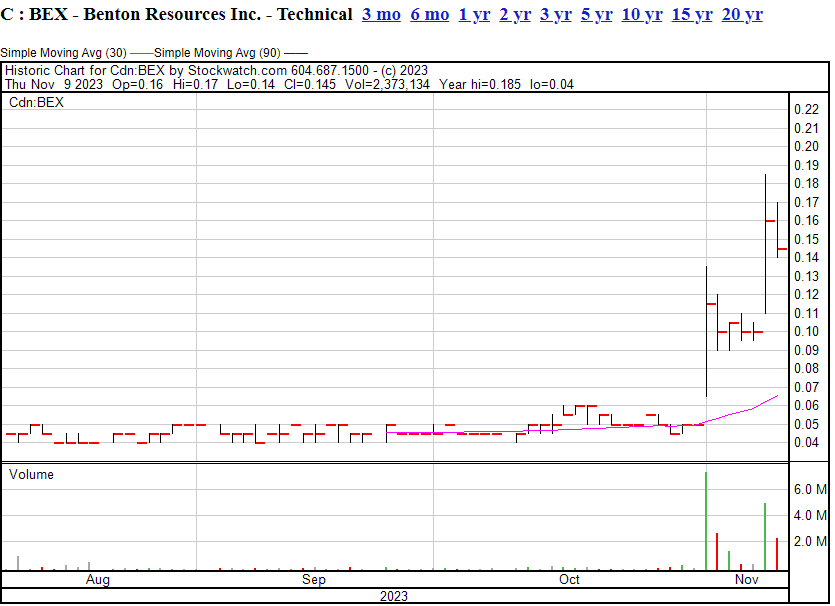

Over the last few days, holders of Benton Resources (BEX.V) stock have been eating steak and getting measured for yacht wear.

Bastards.

If you want to know why, it’s because of the following, on a project Benton has optioned from Spruce Ridge Resources (SHL.C) :

BENTON HITS MULTIPLE HIGH GRADE COPPER ZONES IN FIRST TWO HOLES INCLUDING 8.31% CU OVER 13M AND CONTINUES TO INTERSECT COPPER-RICH MASSIVE SULPHIDES IN DRILLING AT GREAT BURNT

Benton Resources Inc. has received partial assay results from its inaugural drill program at the Great Burnt copper-gold project in Newfoundland. Holes GB-23-01 and GB-23-02 both intersected excellent copper grades including 4.13 per cent Cu over 3.25 metres from 69.05 to 72.30 m and 8.01 per cent Cu over 4.30 m from 82.8 to 87.10 m in GB-23-01 [and a bunch more but it’d be boring to just repeat it all, safe to say it was good stuff].

Since that news, Benton has been aggressively getting its hands on more turf and its market cap has risen in response.

Spruce Ridge stock has also gone up, but it’s mired in legal claims against its former CEO, who they accuse of misappropriating some $630,000. The claim has yet to be tested in court but looks bound for such an outcome. That’s given Benton a chance to progress the property while Spruce Ridge is busy trying to tie its shoelaces and boy howdy, does it look like it’s worthy of progressing.

To earn a 70% interest in Spruce’s Newfoundland properties, Benton must complete $2.5 million in exploration expenditures within 36 months of the date of the Option Agreement (in addition to other terms). All of which has meant a 200% jump in Benton’s share price in just over a week.

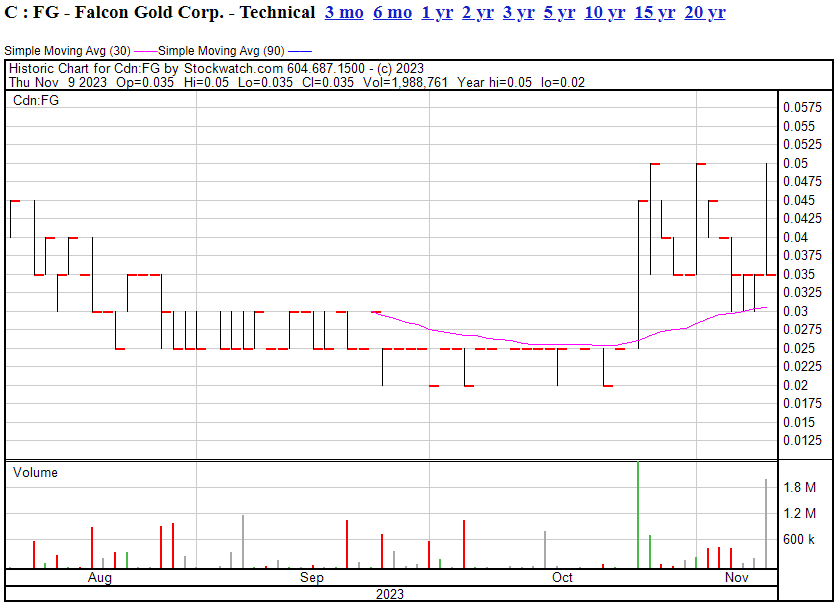

Meanwhile, just next door, Falcon Gold (FG.V) bought 2,275 hectares of ground in the Great Burnt region just days before Benton went bonkers there, and they too are experiencing an increase in demand. So much so, in fact, that a recently announced private placement is being re-priced upwards, from $0.025 to $0.03, with a corresponding increase in the number of shares available from 6 million to 10 million.

Let’s be very clear – financings are RARELY increased as they’re being undertaken, unless there’s a real demand blow-up. Usuallly management is happy enough to just increase the size of the financing, but the price too? THAT’S BULLISH.

Makes sense though, when the stock is trading at double the original share price, and at times more than 50% above the increased price.

To be clear: If you’re offering a share for $0.03 with a full warrant included, and people are still buying shares for more on the open market, you’re in a good situation.

Says FG CEO Karim Rayani, “These new claims lie along the same conductive trend which hosts significant gold and copper mineralization held by the Spruce Ridge/Benton Resources JV yet have never been drill tested or subjected to any systematic exploration programs. Our desktop studies have shown this is a drill-ready project – exploration and drill plans are now in the permitting stage. We look forward to announcing our exploration and drilling plans in the coming months.”

Rayani isn’t blowing smoke – in fact, he’s due to take 1.6m of the shares in the FG financing himself, increased price be damned.

When the CEO is not only buying his own stock, but increasing the price on himself, you’d have to figure there’s a little self belief that they’ve snuck their way into a project with some potential.

— Chris Parry

FULL DISCLOSURE: Falcon Gold is an Equity.Guru marketing client