In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

Else Nutrition Holdings (BABY.TO)

Market Cap ~ $38 million

Else Nutrition Holdings Inc. engages in the development, production, and sale of food and nutrition products for infants, toddlers, children, and adults in North America and Israel. It offers baby snacks; baby feeding accessories, such as feeding bottles and teats; plant-based baby formula products; toddler, children, and adult nutrition products; and complementary food products.

The stock is up 67.5% on news that its highly acclaimed, Plant-Based Complete Nutrition Toddler Drink in the United Kingdom, cementing its presence through partnerships with leading UK distributors. This milestone is a direct result of the Company’s strategic initiatives to expand into new international markets and marks the Company’s first foray into the multi-billion-dollar European market.

A major pop after recently printing new all time record lows. The stock could be seeing a trend reversal but today’s daily candle close will confirm this. The stock must confirm a close above the $0.26 current lower high to confirm a reversal.

Pond Technologies (POND.V)

Market Cap ~ $3.7 million

Pond Technologies Holdings Inc. engages in the cultivation of microalgal biomass using available sources of carbon dioxide (CO2) rich emission sources from industrial plants in Canada. The company operates through Nutraceutical Products and Technology Services segments. Its resultant algae are used in the production of nutraceuticals, as well as algae strains for the expression of complex proteins used in diagnostics and therapeutic treatments, aquaculture, and animal feeds.

The stock is up 100% on news on a settlement with Crystal Wealth Loan and and upsizing of a $8 million private placement.

The stock is beginning to range after printing record lows. We seem to have the outline of a dirty looking cup and handle pattern. The trigger would be a close above $0.04.

Organigram Holdings (OGI.TO)

Market Cap ~ $164 million

Organigram Holdings Inc., through its subsidiaries, engages in the production and sale of cannabis and cannabis-derived products in Canada. It offers medical cannabis products, including cannabis flowers, gummies, cannabis oils, and vaporizers for civilian patients and veterans; adult use recreational cannabis under the SHRED, Big Bag O’ Buds, Monjour, SHRED’ems, Edison Cannabis Co., Edison JOLTS, Tremblant, and Laurentian brands; and cannabis edibles products and concentrates. The company also engages in the wholesale shipping of cannabis plant cuttings, dried flowers, blends, pre-rolls, and cannabis derivative-based products to retailers and wholesalers for adult-use recreational cannabis. It sells its products through online, as well as telephone channels.

The stock is up 28% on news of a CAD $124.6 million follow-on strategic equity investment from BT DE Investments Inc.

The stock has gapped up and broken above the resistance zone around $1.75. The next resistance comes in at $2.50.

Canuc Resources (CDA.V)

Market Cap ~ $26 million

Canuc Resources Corporation, together with its subsidiaries, engages in the acquisition, exploration, development, and extraction of natural resources and precious metals in Canada, the United States, and Mexico. It explores for silver, lead, gold, copper, and zinc deposits. The company holds interest in the San Javier Project located in the state of Sonora, Mexico.

The stock is up 39% on no news.

A breakout is being confirmed which is confirming the current higher low in a new uptrend. This looks bullish.

Hercules Silver Corp (BIG.V)

Market Cap ~ $210 million

Hercules Silver Corp., a junior mining company, engages in the acquisition, exploration, and development of resource properties in the United States. The company explores for silver, lead, and zinc deposits. Its flagship property is 100% owned Hercules Silver Project located in Washington County, Idaho.

The stock is up 19% on news that Barrick Gold has invested in Hercules Silver. Barrick has agreed to purchase 21,265,370 units of Hercules Silver in a non-brokered private placement at a price of C$1.10 per Unit for gross proceeds of C$23,391,907.

New all time record highs. If the stock does pullback, the $0.95-$1.00 zone is where one would expect buyers to re-enter on a correction.

Top 5 Losers

Golden Minerals Company (AUMN.TO)

Market Cap ~ $6.4 million

Golden Minerals Company, a precious metals exploration company explores for mineral properties. It explores for gold, silver, copper, zinc, lead, and other minerals. The company holds a 100% interest in the Rodeo gold mine situated in Durango State, Mexico; and a 100% interest in the Velardeña and Chicago gold-silver mining properties and associated oxide and sulfide processing plants located in the State of Durango, Mexico. It also holds a 100% interest in the El Quevar advanced exploration silver property situated in the province of Salta, Argentina; Yoquivo property situated in Chihuahua State, Mexico; Sarita Este gold-copper property situated in the province of Salta, Argentina; and diversified portfolio of precious metals and other mineral exploration properties located in Argentina, Nevada, and Mexico.

The stock is down 38.3% on news of a public offering of an aggregate 6,000,000 shares of its common stock, Series A warrants to purchase up to 6,000,000 shares of common stock and Series B warrants to purchase up to 3,000,000 shares of common stock, at a public offering price of $0.70 per share of common stock and accompanying warrants. The Series A warrants will have an exercise price of $0.70 per share, will be exercisable immediately and will expire five years after the initial exercise date, and the Series B warrants will have an exercise price of $0.70 per share, will be exercisable immediately and will expire 18 months after the initial exercise date.

New record lows for the stock and it could drop even further if we cannot confirm a close above $0.80 on the daily close.

SolGold (SOLG.TO)

Market Cap ~ $465 million

SolGold Plc, a mineral exploration and development company, explores for and develops mineral properties in Ecuador, Australia, Chile, and Solomon Islands. The company primarily explores for copper, gold, silver, and molybdenum deposits. Its flagship project is the Cascabel Project that covers an area of approximately 50 square kilometers located in Imbabura province, Northern Ecuador.

The stock is down 11% on no news.

The stock is ranging between $0.14 and $0.20. A close above $0.20 would trigger a reversal.

C-COM Satelitte Systems (CMI.V)

Market Cap ~ $42 million

C-Com Satellite Systems Inc. develops and deploys commercial grade mobile auto-deploying satellite-based technology for the delivery of two-way high-speed Internet, VoIP, and video services into vehicles. The company offers iNetVu, a proprietary mobile auto-deploying antenna for the delivery of satellite-based Internet services into vehicles while stationary virtually anywhere one can drive. It also provides driveaway, flyaway, manpack, and fixed motorized antennas. In addition, the company offers controllers and accessories, such as powersmart products, VSAT satellite beacon receivers and transportable cases, driveaway transportable skids, custom integrations, and VSAT satellite system cables. Its products and services deliver solutions for fixed and mobile applications.

The stock is down 9% on no news.

The stock is just holding a range and waiting for a breakout to trigger the next move.

Gold Bull Resources (GBRC.V)

Market Cap ~ $3.2 million

Gold Bull Resources Corp. operates as a gold focused exploration and development company. It holds 100% interest in the Sandman project that consists of 761 mineral claims, which covers approximately 117 square kilometers located in Humboldt County, Nevada; and Big Balds project that comprises 120 lode mining claims located south of Elko, Nevada.

The stock is down 13% on no news.

The stock has rejected resistance around the $0.50 zone. $0.25 is near term support.

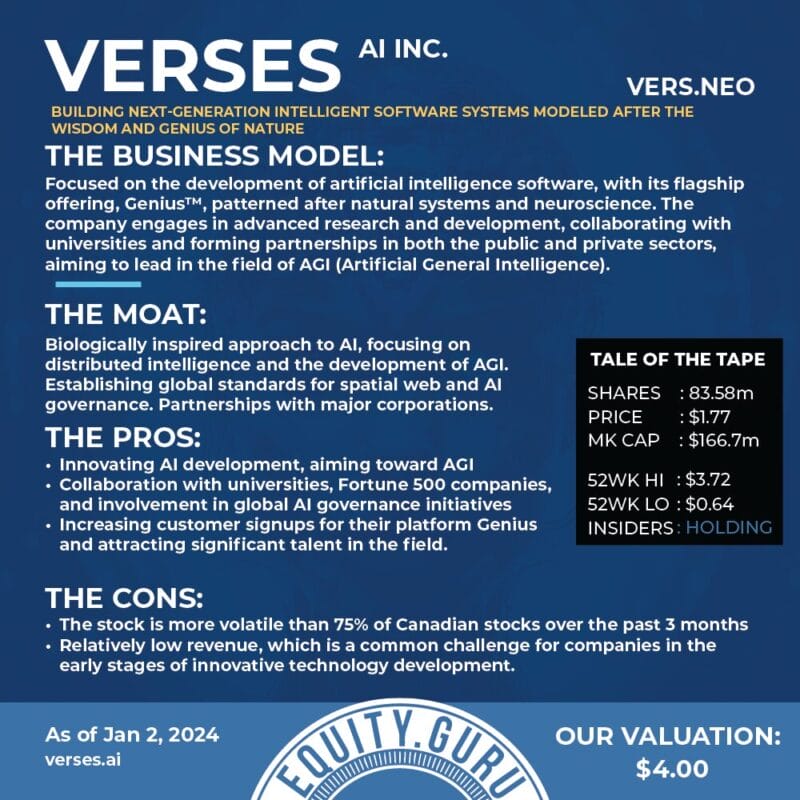

VERSES AI (VERS.NE)

Market Cap ~ $132 million

VERSES AI Inc., a cognitive computing company, engages in the development of artificial intelligence (AI) software. The company offers KOSM, a network operating system for enabling distributed intelligence; and Wayfinder, an AI assisted order picking solution. It is also developing GIA, an AI powered personal assistant for everyone.

The stock is down 8.8% on no news.

The stock recently tested the $1.60 resistance zone and could not breakthrough. Watch near term support here at the $1.20 zone.