In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Dixie Gold (DG.V)

Market Cap ~ $5.3 million

Dixie Gold Inc. engages in the exploration and development of mineral resource properties in Canada. The company primarily explores for gold, uranium, and lithium deposits. Its principal project includes the Red Lake gold project that consists of 1,044 mining claims covering an area of approximately 21,258 hectors located near Red Lake, Ontario.

The stock is up 122% with the announcement that it has entered into an agreement whereby it is contemplated that Dixie Gold will be acquired (the “Takeover Transaction”) by ASX-listed issuer Omnia Metals Group Ltd. Under the negotiated Agreement, Omnia made binding terms to acquire 100% of the issued and outstanding common shares of Dixie Gold in exchange for 166,666,667 common shares of Omnia and a further C$3 million cash component.

A very strong pop and gap up on the news. Message boards are discussing what the shares and cash equate to. Numbers being floated include $0.54.

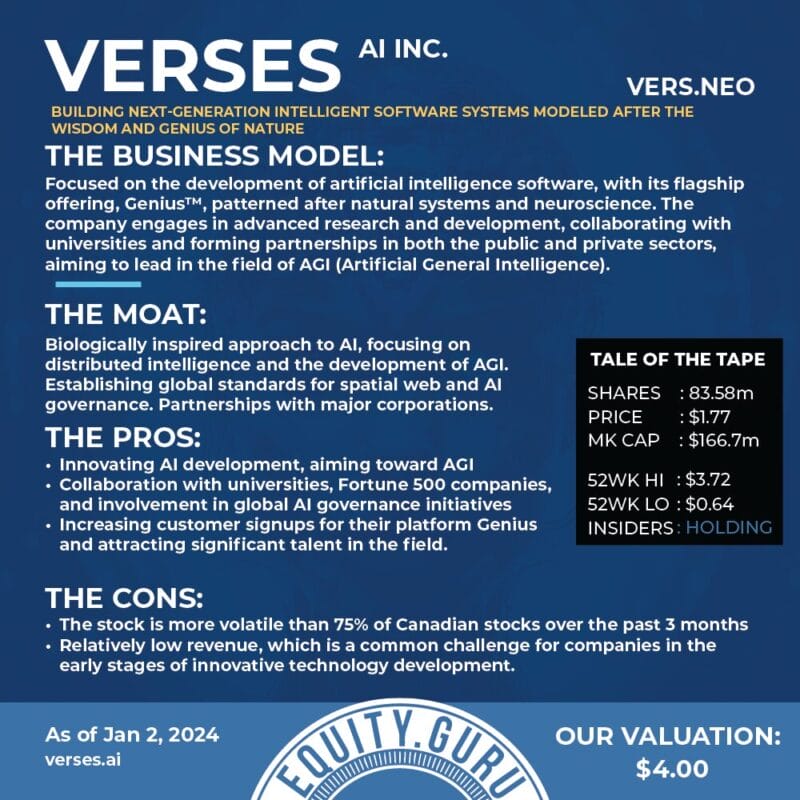

VERSES AI Inc (VERS.NE)

Market Cap ~ $169 million

VERSES AI Inc., a cognitive computing company, engages in the development of artificial intelligence (AI) software. The company offers KOSM, a network operating system for enabling distributed intelligence; and Wayfinder, an AI assisted order picking solution. It is also developing GIA, an AI powered personal assistant for everyone.

The stock is up 16.6% on news that it will launch its intelligent software platform, Genius™, for exclusive private beta partners and a demo of select Genius™ capabilities during a November 3rd webinar. Early signups have surpassed 1,500 customer sign ups.

The stock has gapped up on the news and is back above the $1.00 zone. Key resistance is approaching at $1.20.

Westbridge Renewable Energy (WEB.V)

Market Cap ~ $73 million

Westbridge Renewable Energy Corp. engages in the acquisition and development of solar photovoltaic (PV) projects in Canada, the United States, and the United Kingdom. The company’s flagship asset is the Georgetown project, a 278MWp solar PV plant covering an area of approximately 710 acres located in Vulcan County, Alberta. It also holds 100% interest in the Accalia project, a 221MWp solar PV plant covering an area of approximately 1,120 acres located in Cameron County, Texas; and 75% interest in the Sunnynook project, a 330MWp solar PV plant with a 100MW battery energy storage system covering an area of approximately 940 acres located in Sunnynook, Alberta, Canada.

The stock is up 15.6% on no news.

The stock is looking to confirm a breakout above $0.75 which would take us to retest the resistance zone of $0.85.

Aptose Biosciences (APS.TO)

Market Cap ~ $29 million

Aptose Biosciences Inc., a clinical-stage biotechnology company, discovers and develops personalized therapies addressing unmet medical needs in oncology primarily in the United States. Its clinical programs include APTO-253, which is in Phase 1a/b clinical trial for the treatment of patients with relapsed or refractory blood cancers, including acute myeloid leukemia (AML) and high-risk myelodysplastic syndrome (HR MDS); and Tuspetinib, an oral potent myeloid kinase inhibitor that is in Phase 1/2 clinical trial to treat patients with relapsed or refractory AML.

The stock is up 14% on no news but is reporting Q3 2023 financial results on November 9th 2023.

This looks like a very promising reversal chart. The stock appears to have bottomed with a pattern at $3.00 and has now broken above a resistance zone. Watch for today’s candle to close above $4.00 to trigger further upside. Remember though that earnings are upcoming and will be a key fundamental event.

Avila Energy (VIK.C)

Market Cap ~ $7 million

Avila Energy Corporation, an integrated energy company, engages in the exploration, development, and production of oil and natural gas in Canada. Its properties include the West Central Alberta assets located 50 kms southwest of Edmonton, Alberta; and the East Central Alberta assets located 90 kms east of Red Deer Alberta.

The stock is up 11% on no news.

Another chart for reversal traders to keep an eye on. A long range has been developing and a breakout above $0.06 would trigger the reversal.

Top 5 Losers

Corus Entertainment (CJR-B.TO)

Market Cap ~ $129 million

Corus Entertainment Inc., a media and content company, operates specialty and conventional television networks, and radio stations in Canada and internationally. It operates in two segments, Television and Radio. The Television segment operates 33 specialty television networks and 15 conventional television stations. It is also involved in the production and distribution of films and television programs, and animation software; and merchandise licensing and book publishing activities. In addition, this segment provides social digital agency and social influencer networks, as well as media and technology services.

The stock is down 28% on news of its Q4 2023 and year end results. Results can be seen here.

A breakdown which is seeing the stock print new all time record lows. The next support area would be the $0.50 zone. For the stock to reverse, it would need to fill the gap and force a close above the $0.90 zone.

Medicenna Therapeutics (MDNA.TO)

Market Cap ~ $18 million

Medicenna Therapeutics Corp., an immunotherapy company, engages in the development and commercialization of Superkines and empowered Superkines for the treatment of cancer and other diseases. It develops MDNA55, an interleukin- 4 (IL-4) EC for the treatment of recurrent glioblastoma, as well as for brain tumors. The company also develops MDNA11, an enhanced version of IL-2 to activate and proliferate the immune cells needed to fight cancer; MDNA209, an IL-2 antagonist for autoimmune diseases, such as multiple sclerosis and graft versus host disease; MDNA413, a dual IL-4/IL-13 antagonist to treat cancer immunotherapies; and MDNA132, an IL-13 Superkine for solid tumors.

The stock is down 22% on news it is delisting from the Nasdaq and cutting back its management team.

The stock is printing new all time record lows as it continues to sell off after breaking down below $0.375.

Sassy Gold (SASY.C)

Market Cap ~ $3.7 million

Sassy Gold Corp., an exploration stage company, identifies, acquires, and explores for precious metal resources in Canada. It explores for gold and silver deposits. The company’s flagship property is the Foremore property that consists of 35 mineral claims covering an area of 14,585 hectares located in the Eskay Creek District of British Columbia. It also has an option to acquire 100% interest in the Gander South, the Little River, the Hermitage, the Gander North, the Carmanville, the Cape Ray, the Mount Peyton, and the BLT properties located in Newfoundland.

The stock is down 28% on no news.

The stock is breaking down and printing new all time record lows. It will need to reclaim $0.065 to create some positive momentum.

Generation Mining (GENM.TO)

Market Cap ~ $46 million

Generation Mining Limited, a mineral exploration and development stage company, focuses on base and precious metal deposits in Canada. It explores for molybdenum, tungsten, palladium, copper, platinum, gold, and silver deposits. The company holds 100% interest in the Marathon Palladium and Copper project covering an area of 22,000 hectares located in north-western Ontario. It has an option to acquire a 100% interest in the Davidson molybdenum project located in British Columbia.

The stock is down 19% on news of a CAD $15 million bought deal financing.

The stock is printing new all time record lows on the news and needs to reclaim $0.28 to turn things around.

PyroGenesis Canada (PYR.TO)

Market Cap ~ $86 million

PyroGenesis Canada Inc. designs, develops, manufactures, and commercializes plasma processes and solutions worldwide. It offers DROSRITE, a process for enhancing metal recovery from dross without any hazardous by-products; plasma atomization process that allows produce and sell high purity spherical metal powders; PUREVAP, a process to produce high purity metallurgical and solar grade silicon from quartz; and PUREVAP NSiR, which is designed to transform silicon into spherical silicon nano powders and nanowires for use in lithium-ion batteries.

The stock is down 11% on news that it intends to delist from the Nasdaq.

The stock is breaking below key support and the important psychological $0.50 zone. There appears to be support around the $0.40 zone.