In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

PlantFuel Life Inc (FUEL.C)

Market Cap ~ $949,000

PlantFuel Life Inc., a plant-based wellness company, provides health supplements, nutraceuticals, and plant protein-based products under the PlantFuel brand name in the United States.

The stock is up 50% on no news.

An interesting technical play for bottom pickers. The stock has been bottoming after a major drop this year. We seem to be developing the structure of a cup and handle technical pattern. A reversal pattern. However, this pattern is not triggered until the stock closes above $0.20.

Volcanic Gold Mines (VG.V)

Market Cap ~ $9.3 million

Volcanic Gold Mines Inc. engages in the acquisition and exploration of resource properties. The company explores for gold and silver deposits. It holds an option to earn a 60% interest in Holly and Banderas gold-silver properties located in Guatemala.

The stock is up 21.2% on news of a bonanza grade gold discovery on the high grade Mila prospect in the Motagua project in Guatemala. Continuous line rock chip sampling across mixed outcrop, subcrop, boulder fields of 34 m averaging 42 g/t gold and 24 m averaging 54 g/t gold.

A huge gap up for the stock with strong fundamental news. The market clearly likes the news. Resistance comes in at $0.23, and we shall see if this news momentum continues and brings in more volume. The stock has broken the previous lower high and accordingly, should be starting a new uptrend with higher lows and higher highs.

HPQ Silicon Inc (HPQ.V)

Market Cap ~ $108 million

HPQ Silicon Inc., together with its subsidiaries, provides silica and silicon-based solutions in Canada. It is also developing a portfolio of silicon and silica products primarily for battery and electric vehicle manufacturers, and hydrogen applications; and carbon particles for capacitor applications. In addition, the company engages in developing the PUREVAP Quartz Reduction Reactors, a process to transform quartz into silicon metal; and the PUREVAP Nano Silicon Reactors, a process to make the nano silicon materials from silicon chunks.

The stock is up 18% on news that the enhancements made to improve liquid silicon fluidity at the Gen3 QRR reactor’s base in September 2023 played a pivotal role in successfully achieving the final critical milestones, completing a successful silicon pour.

A gap up popper but profits are being taken. It is happening at the upper portion of the trendline channel the stock is in. However, the breakout above the $0.28 zone is something to note. This price level has been key resistance looking to the left. A retest should see buyers support the stock.

Arbor Metals (ABR.V)

Market Cap ~ $122 million

Arbor Metals Corp. identifies, acquires, explores for, and develops natural resource properties in Canada. The company holds interests in the Jarnet Lithium Project, which comprises forty-seven map designated mineral claims covering an area of approximately 3,759 hectares located in the James Bay Region of Quebec.

The stock is up 18.8% on no news. On September 24th 2023, the Company announced it had identified new pegmatite outcrops at the Jarnet Lithium Project.

The stock has been on a major tumble with message boards talking about finding anything strange and asking “what the heck is happening” and “who’s buying?”. The trend is apparent, and today’s price action could just be a dead cat bounce. For bulls looking for a reversal, some sort of range developing would be a positive sign that selling pressure is exhausting. Or a climb back over the $2.60 zone.

Blackrock Silver Corp (BRC.V)

Market Cap ~ $57 million

Blackrock Silver Corp. engages in the acquisition, exploration, and development of mineral properties in the United States. The company primarily explores for gold and silver deposits. Its flagship property is the Tonopah West silver-gold project that consists of 100 patented and 279 unpatented claims covering approximately 25.5 square kilometers located in the Walker Lane trend of western Nevada.

The stock is up 13.5% on news of an updated mineral resource estimate for the Tonopah West Project. The Updated MRE contains a total of 0.57 million ounces of gold and 47.74Mozs of silver or 100.04Mozs of silver equivalent, which is a 135% increase over the maiden resource estimate for Tonopah West.

Good price action with a gap up, but crucially for bulls, the stock could be on the way to take out the lower high at $0.33. If so, then the current downtrend is over and a new trend would begin.

Top 5 Losers

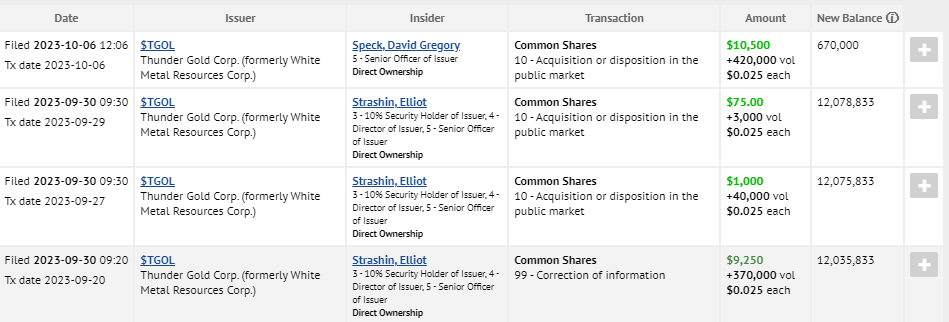

Thunder Gold Corp (TGOL.V)

Market Cap ~ $3.4 million

Thunder Gold Corp., a junior exploration company, engages in the acquisition, exploration, and development of mining properties in Canada. Its flagship property includes the Tower Mountain gold project that consists of 205 single cell mining claims, 24 boundary claims, and 3 owned patents covering an area of approximately 2,850 hectares located in northwestern Ontario.

The stock is down 20% on no news. However on October 6th 2023, it should be noted that there was insider buying:

Sonoro Energy Ltd (SNV.V)

Market Cap ~ $23 million

Sonoro Energy Ltd. explores for, appraises, develops, and produces oil and gas resources in Southeast Asia. The company holds a 25% interest in the Selat Panjang Production Sharing Contract covering an area of approximately 940 square kilometers located in Riau province, Central Sumatra.

The stock is down 13.8% on no news but there is plenty of chatter on message boards.

The stock was on a tear this year hitting yearly highs at $0.36. This occurred as the Company graduated from the NEX to the TSXV as a tier 2 oil and gas issuer on September 15th 2023. Since then, the stock has been dropping. With today’s price action, Sonoro is about to test a key support zone at $0.10. A filling of the gap would be bearish, but let’s see if bulls will defend.

Trillion Energy International (TCF.C)

Market Cap ~ $53 million

Trillion Energy International Inc. operates as an oil and gas exploration and production company with assets in Turkey and Bulgaria. It owns 49% interests in the SASB natural gas field covering an area of 12,387 hectares; 19.6% ownership interest in the Cendere oil field; and 50% operating interest in the Bakuk gas field located near the Syrian border.

The stock is down 13.8% today on no news and there are plenty of comments on lively message boards. Six days ago, the Company announced it had commenced an oil exploration program.

Looking at the chart and you can understand why the message board is seeing a lot of traffic. The stock continues to sell off and is taking out recent lows. The next major psychological support zone comes in at $0.50.

St-Georges Eco-Mining Corp (SX.C)

Market Cap ~ $31 million

St-Georges Eco-Mining Corp. engages in the exploration and evaluation of mineral properties in Canada and Iceland. The company primarily explores for gold, nickel, lithium, copper, cobalt, silver, magnesium, and palladium, as well as platinum group metals.

The stock is down 13.3% on no news and on a press release dated October 2nd 2023, the Company mentioned there is no undisclosed adverse material situation that would explain the decline in the Company’s stock trading price over the past few weeks.

The long downtrend has broken with the stock bouncing at $0.06. Today’s decline can most likely be seen as investors taking profits after a plus 100% gainer from the recent bottom at $0.06. The $0.16 zone is resistance, but the stock has definitely broken out of the long downtrend.

Reklaim Ltd (MYID.V)

Market Cap ~ $8.4 million

Reklaim Ltd. operates consumer data and privacy platform in Canada and the United States. The company offers compliant and first-party data to brands and agencies, platforms, and data companies. Its platform also allows consumers to visit the platform, confirm their identity, and unveil data collected and sold.

The stock is down 11.8% on no news. A month ago, the company announced a debt reduction.

An interesting chart set up with today’s price action potentially just being a correction. The stock has gone from lower highs to lower lows to now higher lows and higher highs. A trend shift has occurred and the stock is currently correcting to retest current support around $0.06.