Nextech3D.ai (NTAR.C) is a diversified augmented reality, AI technology company that leverages proprietary artificial intelligence (AI) to create 3D experiences for the metaverse. Its main businesses are creating 3D WebAR photorealistic models for the Prime Ecommerce Marketplace as well as many other online retailers. Nextech is a generative AI-powered 3D model supplier for Amazon, Kohls, P&G and other major e-commerce retailers. The Company develops or acquires disruptive technologies and once commercialized, spins them out as stand-alone public Companies issuing a stock dividend to shareholders while retaining a significant ownership stake in the public spin-out.

Today, the Company announced its financial and operating results for Q2 ended June 2023 were in line with preliminary numbers released on August 9th 2023.

Unaudited Q2 2023 Financial Highlights:

- Three month quarterly revenue up +155% compared to same period last year;

- Sequential quarterly revenue grew 8%

- Delivery of over 50,000 3D models to date

6 Months Ending Ending June 30, 2023:

- Year to date revenue up +157% compared to same period last year;

- Gross profit remained consistent at 39%

CEO Evan Gappelberg had this to say:

“Our results for Q2 were in line with our prelim numbers as we achieved record sales of $1.4 million +155% over Q2 2022. However, based on the current order flow from Amazon and others, we are projecting a breakout Q3 quarter with revenue of $1.7 million.” He continued, “In Q3 we are not only seeing our revenue accelerate but our focused team has been successful in reducing our burn down to a minimum level that I have not seen in years. I’m excited to report to our loyal shareholders that with contributions from increased revenue and shares for services on an unconsolidated basis, we’ve reduced Nextech3D.ai’s cash burn down to $300,000 which when combined with our recent capital raise, gives me the confidence in saying that we won’t need to raise additional capital for the next 12 months. Nextech3D.ai’s groundbreaking generative-AI technology positions the Company as a leading AI solution globally for scaling 3D model production in the thriving e-commerce, gaming, and manufacturing industries. Furthermore, thanks to our latest funding round, our cash position is now robust enough to accommodate the increased demand we anticipate in the second half of 2023 and beyond.”

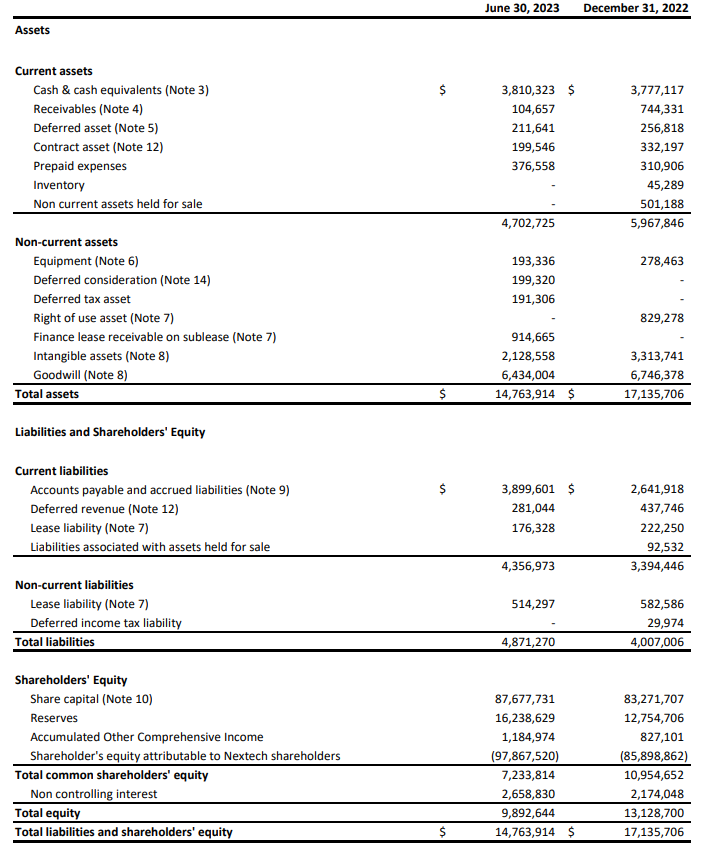

The cash position stood at $3,810,323 and working capital (current assets-current liabilities) comes in at $345,752.

The condensed consolidated interim statements of comprehensive loss and interim statements of cash flows can be seen here.

Nextech stock rejected a major resistance zone at $0.81 and then broke below a trendline triggering a downside move. The stock actually retested this trendline on July 14th 2023 which saw a huge influx of sellers. The stock then broke below the $0.50 zone and gapped down.

In my most recent technical article on the chart, I told readers to watch for buyers at the test of support at $0.36. A battle is taking place at this zone currently. The stock did print new recent lows hitting $0.34. A close below this $0.35-36 zone would lead to further weakness. The daily close candle must be assessed to see if buyers will step in to defend in volume.

Going forward, if the stock was to hold and bounce at support, a break above $0.44, the near term resistance, would be the bullish indicator for the stock. However, there is a gap that Nextech has to deal with. Gaps tend to be resistance when price gaps down. For the bulls to take control, they would need to push the price higher for a close above $0.50. This would be called “closing the gap” which tends to be followed by very bullish momentum.