Most investors and traders tend to focus on US and Western headlines when it comes to providing a reason for a stock market move. But as I have written about in the past, Asia is becoming more important for various reasons. We have Japan with the Bank of Japan and the potential to impact global bond markets. And then we have the country which some say is on the trajectory to overtake the US as the number one economy in the world AND become the next hegemon. China.

If you have been following the markets for sometime, then you have already experienced China headlines impacting the markets. China growth data and its impact on commodities, such as copper, is probably what you are most used to. However, those who like to look into the details of market moves may realize that the People’s Bank of China headlines have impacted global equity markets. Instead of looking to Asia, western financial media points to some random unimportant US data that’s not even high risk in terms of market moving to come up with a reason to explain a market move.

If there is one takeaway from this article: keep eyes on Asia. Asia is important and is about to get even more important when it comes to economics and geopolitics.

But back to China.

China has always been that growth story. When analysts want to gauge the health of the world economy, many look to Chinese exports and economic data. Post covid, the US and western economic recovery was strong. However China really showed no post covid recovery after longer and stricter lockdowns.

While the US and other Western central banks are raising interest rates to combat inflation and slow down their economies by targeting money velocity, the People’s Bank of China (PBoC) has been cutting interest rates and has been maintaining an easing monetary policy to try and spur the Chinese economy.

In fact just today, the PBoC did a surprise rate cut lowering the rate on its one year loans, or medium term lending facility, by 15 basis points down to 2.5%. This is the most China has cut rates since 2020. This move came after July data showed weaker consumer spending growth, sliding investment, and rising unemployment.

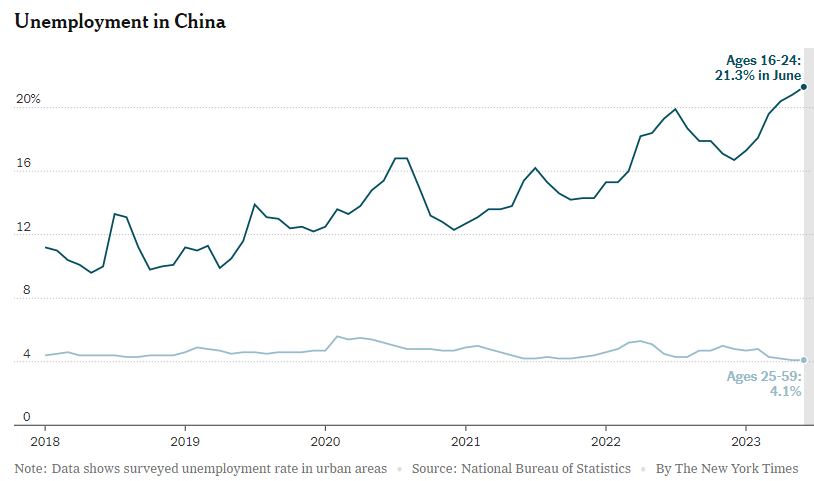

Youth unemployment has been a hot topic in recent months as Chinese data showed the seventh consecutive monthly increase in youth unemployment. The unemployment rate among those 16-24 years old in urban areas hit a record 21.3% in June 2023 and has been rising since.

What about now? Well we won’t know as China halted reporting youth employment data after the record breaking 21.3% number in June 2023. It can be summed up by one Chinese commentator:

“Put in a clearer way,” one person wrote, “the current data looks very bad, so don’t look at it for now.”

But things are just getting worse for China.

Bank loans plunged to a 14 year low in July 2023. Exports are contracting (which could also say something about the global economy…). And China is in deflation.

China’s National Bureau of Statistics announced that CPI dropped annually in July for the first time in two years dipping down 0.3% which actually was a bit better than estimates of a 0.4% decrease.

This means that China is experiencing deflation, the trend of prices falling throughout the economy. The opposite of what the Fed and other Western central banks are facing as they tighten policy to try and tame soaring prices.

“Deflation means the real value of debt goes up,” David Dollar, a senior fellow at the Brookings Institute’s China center, told Insider. “High inflation we know is bad, but it does help manage debt burdens over time. Deflation does the opposite.”

And with a country whose growth was largely fueled by a lot of debt, this could be a problem. This plus all the other economic woes is compounded by the fact that China is run by the Communist Party (CCP) and risks of social unrest are rising.

Even US President Joe Biden recently said that China’s economy is a “ticking time bomb“. With China in trouble, the internal economic and social tensions could have an effect on how Beijing interacts with the world. Some even go as far as saying that China will need an external distraction to shift attention away from internal woes. Eyes are on Taiwan and potential conflict. War tends to be what dictators resort to when they think their grasp on power is in danger, and distracts from domestic issues. In China’s case, a war economy may even have an added bonus of spurring manufacturing and potentially the economy as a whole.

Remember Chinese real estate issues? Well they are back in the headlines. One of China’s largest property developers is at risk of default and a financial conglomerate with 1 trillion yuan ($138 billion) under management missed payments on investment products, stoking fears about possible contagion spreading through global markets.

China’s largest private real estate developer Country Garden is seeking to delay payment on a private onshore bond for the first time. Analysts warned that a rise in default by trust companies, also known as shadow banks, which have strong ties to the domestic property sector, will further weigh on the world’s second-largest economy. This puts even more pressure on the CCP to act. The real estate sector accounts for roughly 25% of the Chinese economy.

This truly is a critical moment for China, for global markets, and the whole world.

The China 50 recently broke out of a range but the Country Garden headlines has seen price retreat and trigger a false breakout or fakeout.

The Shenzhen index is also falling and is at risk of breaking down below this range to test November 2022 lows.

The Hang Seng index, which is how most foreigners play China, is testing a key support zone. A support zone which is in danger of breaking down given fundamental headlines.

In my most recent Market Moment article, I told readers that US markets are bearish and even gave my nullification point. But stock markets are continuing to move as predicted and the downtrend remains intact as long as we hold the current lower high.

I will end off with one more chart worth watching:

The US dollar is gaining against the Chinese Yuan. In other words, the Chinese Yuan is falling. It is now at its lowest since November 2022. But those lows could be taken out if USDCNH breaks out above the 7.35 zone. Some see this as China devaluing the currency in an attempt to boost exports and manage the cheaper debt. Others see it as investors betting on continued China weakness and even the Chinese dumping the Yuan as they lose faith in the CCP and its policy attempts to stop the bleeding.

Major things are happening in China and the unfolding events will impact global markets and potentially the world order if desperate geopolitical actions are taken. Keep eyes on the Yuan and the situation with Country Garden. Global markets are already feeling the fear.