USD vs GOLD

If you’ve ever talked to a proper goldbug and not got into a coma, then you probably remember the reason for investing in the yellow metal. The gold story goes as follows:

- It’s a shield against inflation: Just like the mythical Hydra, when one head (inflation) grows, another (gold prices) follows. For instance, during the high-inflation years of the 1970s, the price of gold skyrocketed from about $35 per ounce to peak at $850 in 1980.

- Portfolio diversification: Gold is like that friend who always zigs when everyone else zags. It often performs differently than stocks and bonds, adding a lovely contrast to your financial landscape. During the 2008 financial crisis, while most asset values went down the drain, guess what shone brightly? Yes, it was gold, which saw a price increase of nearly 30% that year.

- The safe haven effect: When economic seas get stormy, gold is your sturdy lighthouse. Take the recent COVID-19 pandemic for example. Investors flocked to the precious metal, pushing its price to record highs of over $2,000 per ounce in 2020.

That’s all great, but let’s be honest, what we’re really after is outsized gains, and with gold hovering around $1900, a massive all-time high move to $2090 would only mean a 10% move in your investment.

Not exactly life-changing.

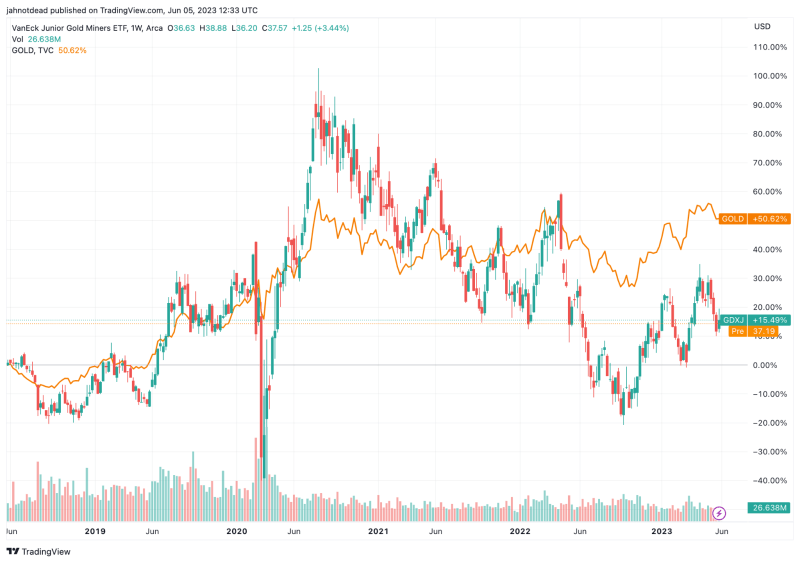

However, a closer look at the miners might actually shine some light on a thesis with much more torque: gold junior miners. A very simple chart, comparing the price of Au for the last few years versus the GDXJ, the most popular Junior Gold ETF, puts things into perspective:

Here we can see that move in gold and its relative stability has been met with not only more volatility from the GDXJ, which is to be expected, but the ETF shows a peak in August of 2020 and a downtrend that has possibly been only broken this Spring of 2023.

If you’re a resource investor, you already know what that means: the discrepancy between the price of the commodity and the miners is precisely the opportunity for investment or speculation.

The whole purpose of investing in mining stocks is to gain leverage to the price of the commodity, which would in time see movements that surpass the underlying commodity itself, just like the chart shows the bull-run of 2020.

One reason, a skeptic might say for this lag in gold mining stocks, is because the market doesn’t expect this near-$2000 to hold. Well, we’d like to challenge that with a few recent headlines that make the historical race of USD vs gold a bit…spicier.

BRICS To Ignore the U.S. Dollar & Develop a New Currency Backed by Gold?

Putin discussing pegging the ruble to gold, Kremlin says

So if the miners are relatively cheap to the precious metal of kings (and central bankers), let’s take a look at some names that are a dead bargain, but may not stay there for long:

Montage Gold

Led by a team recognized for discovering, building, operating, and growing major gold deposits in West Africa, Montage Gold is a well-funded exploration and development company focused on unlocking the potential of its flagship asset, the Koné Gold Project.

The definitive feasibility study of Koné gives us a 15 year life of mine at a juicy $1 billion NPV, with an all-in-sustaining-cost of $933 assuming the price of gold stays at around $1800/oz.

You’d think they’d be trading ever-closer to the value they have proven up, but even though the latest drill results, not yet in the DFS, have hit higher grades, the current market cap is a measly C$120m.

Brascan Resources

In the high-stakes world of microcap mining, it’s essential to know when and where to place your bets. For those willing to embrace risk for the possibility of high reward, mining companies like Brascan Resources (BRAS.C) can offer intriguing investment opportunities. But it’s not the risk alone that draws us in—it’s the strategy behind it.

Brascan Resources doesn’t place all its chips on gold, but is ready to capitalize on it when the time is right. Brascan Resources has a knack for pursuing assets in sectors that, when effectively combined, offer a trifold winning potential.

Indeed, Brascan Resources’ diverse approach mirrors the company’s leadership. The CEO and guiding force behind the company is someone who defies convention and, in doing so, drives the company towards innovation and success. Balbir Johal, Brascan’s leading man, is as unique as the company he runs. With decades of experience under his belt and a knack for shaking up the status quo, Johal’s determination and eccentricity can be infectious.

In other words, Brascan Resources is not your typical mining company. It’s a daring venture with a bold leader, multiple promising properties, and a mission to change the game. Here’s how the company plans to do just that:

1. The Alegre Gold Project in Para State, Brazil is currently producing over 1 kilogram of gold per week through small-scale surface operations. This project showcases the potential for successful gold production.

2. The Albany Forks Rare Earths Project in Ontario’s Porcupine Mining Division broadens Brascan’s reach into the market for niobium, a critical battery metal.

3. The Brasil-Li Lithium Property acquisition in Minas Gerais, Brazil situates Brascan for prime lithium exploration. This location, near major lithium deposits with existing infrastructure, is a strategic move for the company.

4. The recent acquisition of new lithium claims in the James Bay region of northern Quebec caters to the growing demand for lithium, primarily driven by the electric vehicle market.

5. A partnership with North Atlantic Aggregates through a Share Exchange Agreement gives Brascan access to a suite of potential minerals such as ilmenite (titanium dioxide), magnetite, scandium, vanadium, phosphorus, copper, cobalt, graphite, and aggregates like granite, sand, quartzite, and gabbros.

In sum, Brascan Resources is a microcap mining company that’s set to make a big impact. Under Johal’s unconventional leadership, the company is primed to make significant strides in the mining sector. It is boldly pursuing diverse projects, spreading its risks, and looking for multiple opportunities for reward.

Tempus Resources

Tempus Resources (TMRR.V), a gold exploration company, is in a unique position under the leadership of Jason Bahnsen. With a diverse background encompassing mining engineering and business administration, Bahnsen combines his technical mining expertise with his ability to handle financial matters, a combination that’s quite rare in the mining industry.

Tempus Resources Ltd. has commenced its ambitious 2023 exploration and development program at the Elizabeth/Blackdome gold projects in southern British Columbia. The program includes an exhaustive plan involving several strategic actions.

The highlight of the 2023 exploration program is the completion of around 4,000 meters of drilling at the Elizabeth Gold Project. This aims at further delineating the Blue Vein/No 9 Vein, broadening the Ella Zone, and executing additional infill drilling, which will commence in early July. Concurrently, Tempus is embarking on a property-wide field exploration to spot more brownfields targets informed by the 2021 airborne magnetic survey. Detailed mapping and rock chip sampling activities are underway.

Alongside exploration activities, the company is also engaged in updating the JORC/NI43-101 Resource estimate for the Elizabeth and Blackdome Gold Projects, which is targeted for release at the end of June 2023. Findings from the Blackdome Mill restart and expansion study, conducted by JDS Energy and Mining Inc. and the Optimize Group Inc in 2022, will also be disclosed following the updated resource estimate release. In addition, Tempus will be reviewing the haul road design and permitting linking the Elizabeth Project to the Blackdome Mill facilities, located approximately 30 km to the north.

The 2023 drilling program comes in the wake of successful 2021 and 2022 drill programs and intends to extend the 4,000 meter diamond drilling at Elizabeth. Targets of the 2023 drill program are varied, with key focus on No. 9 Vein, Blue Vein, D Vein / West Vein / Main Vein, Ella Zone, and the Listwanite Vein.

Meanwhile, Tempus is commencing a geological field study to identify potential mineralization targets outside the current drilling area, a strategic move to expand the overall resource base of the project. This comprehensive field study will entail geological mapping and rock chip sampling of new target areas, as identified by the 2021 geophysical surveys. The identified targets include several magnetic lows, promising to host gold mineralization similar to the veins presently being drilled at the Elizabeth Main area.

The 2023 exploration program also covers the Elizabeth East area where anomalous gold was identified in soil sampling in 2019. “2023 will be an exciting year for Tempus. We plan on announcing the resource estimate for both Elizabeth and Blackdome Projects, as well as the restart plan for the Blackdome mill. A 4,000 metre drilling program will target further expansion of existing veins and the identification of new veins. In addition, the Company is conducting a detailed mapping and rock chip sampling program to “ground truth” several of the brownfields targets generated by the 2021 geophysics program on the 115 square kilometre Elizabeth property,” commented Jason Bahnsen, President and CEO of Tempus Resources.

Community engagement and road development are key to advancing the project. Bahnsen has been proactive in building relationships with local First Nations groups, and has planned a manageable road construction project. Aiding the process, the company has found strong drill results that are promising for the gold exploration and mining industry.

Beyond the site’s gold veins, the project has several other factors in its favor. These include easy accessibility, existing permits, access to a fully-equipped mill, and enough land to ensure good economics. Further emphasizing this is the mill’s impressive size and efficiency. Bahnsen believes that they could get it up and running for less than $5 million when the time comes.

Surrounded by major players such as Teck Resources, Barrick Gold, Talisker Resources, and others, Tempus’ Elizabeth Blackdome Project could potentially offer milling services to these neighboring companies as an additional revenue stream.

Bahnsen underscores the potential of the region to become a vibrant mining area. With the Elizabeth project situated within the traditional and unceded lands of the St’át’imc, Secwépemc and Tsilhqot’in First Nations, Tempus maintains active dialogue with these communities. Bahnsen believes in taking this relationship seriously and the importance of local buy-in cannot be overstated.

Despite the fickle nature of small-cap mining exploration, Bahnsen is confident that Tempus is poised for swift progress. Given the solid technicals and strong community relations, plus the prospect of an updated resource estimate on the horizon, Tempus Resources seems well-positioned for growth. While there are potential risks, such as the cautious behavior of institutional investors, Bahnsen remains optimistic about Tempus’ future.