Hey, remember back in the days when people were like, “Wait, there’s going to be weed companies and that’s going to be a thing?” and I used to do these long ‘this is what every weed stock is doing this week’ reports, and they went from a dozen companies to 40 in two weeks, and then 100 a month later and we all made stupid money and then everyone got lazy and stupid and I bailed and the whole thing ended? ‘member that? Well we’re doing that with AI now so lock in, get your seatbelt on, and hit the Full Self Driving button on your Tesla.. what could possibly go wrong?

Turns out.. less than usual.

TESLA FSD SAFETY NUMBERS BEAT THE NATIONAL AVERAGE

Elon wants you to know his AI driving tech is safe as houses. He wants you to know this so you’ll buy a Tesla.

And TSLA stock. (link)

According to the Impact Report, FSD Beta users now have 0.31 accidents per 1 million miles, showcasing the effectiveness of Tesla’s ADAS technology. In addition, Teslas with Autopilot engaged demonstrate even better safety performance, with only 0.18 accidents per 1 million miles. These impressive statistics highlight the potential for autonomous systems to drastically reduce accident rates compared to the industry average of 1.53 accidents per 1 million miles. (link)

Cool. But other companies in the FSD space are also showing good numbers – and getting approvals to roll their cars out as robotaxis, leaving Tesla behind.

As realized by most investors, TSLA’s CEO has long touted the supposed availability of its FSD technology multiple times since 2018, 2019, Robotaxis by 2020, and 2021. The optics unfortunately do not favor the automaker, given the reportedly fake 2016 promotional video, with Ashok Elluswamy, the director of TSLA’s Autopilot software, saying:

The intent of the video was not to accurately portray what was available for customers in 2016. It was to portray what was possible to build into the system.

[..] ..while General Motors Company’s (NYSE:GM) Cruise may only record 1M miles driven, it has already obtained the authority approval for paid robotaxi operations in Austin and San Francisco. The automaker may also test its Origin shuttle with no steering wheel from 2023 onwards, pending authority approval.

Even TSLA’s fellow autonomous competitor in China, Baidu, Inc. (NASDAQ:BIDU), has already obtained the relevant robotaxi permits in Beijing, Wuhan, and Chongqing. The company also claims to have accumulated over 50M KM or the equivalent of 31M miles driven on Level 4 autonomous driving, while providing over 20 daily rides per vehicle by FQ4’22.

(Link)

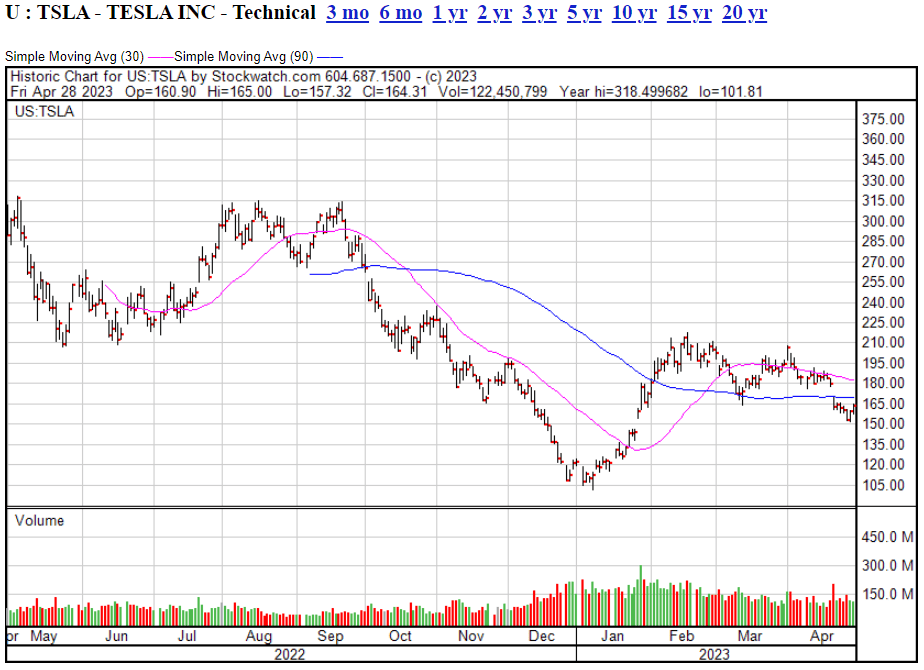

Tesla stock. Woof.

A TEXTBOOK ‘NON-AI COMPANY DRESSED UP AS AN AI COMPANY’

A TEXTBOOK ‘NON-AI COMPANY DRESSED UP AS AN AI COMPANY’

Well, it didn’t take long to mirror the weed companies of 2015; VPN Technologies (VPN.C) put out a news release in February that it was announcing a “new AI business division.”

Cool. I’m announcing that I’m qualifying for the Olympics as a 6’2″ 20-year-old Dutch skier.

The following news release is a textbook version of what to look for in a company with absolutely no game in a hot sector trying to convince you they’re all in.

VPN Technologies Inc. has introduced a new business division of cutting-edge artificial intelligence (AI) and machine learning capabilities, complementing its existing suite of software development activities. This new business division of VPN will focus on AI-enhanced software development services, intelligent networking solutions and will further the company’s ability to participate in this groundbreaking technology.

Oh cool! You just woke up one day (when AI companies were ripping) and decided you’re gonna get some of that stuff too, huh? Quick trip down to Best Buy for a copy of AI For Dummies, give Cheryl from reception her lunch break to read up and awaaaaaaaaaay we go! Let’s see how deep this sector knowledge goes!

But first, a paragraph on how big the market is because filler is important when you don’t have any actual business dealings to speak of.

AI technology has been rapidly advancing in recent years and it is expected to have a significant impact on the global economy. By 2025, the global AI market is projected to reach $190-billion, with a compound annual growth rate of 42.2 per cent from 2020 to 2025.

Amazing. We should definitely get some.

“Leveraging the power of neural networks and other machine learning techniques have proven themselves to be an integral part of our ongoing and future development,” mentions Curtis Ingleton, chief technology officer of VPN Technologies Corp.

BRO. You’re not doing any neural networking, come on. This is like saying, “Cancer is killing thousands of Canadians every year and it’s estimated that number will grow by 2030, so we’re starting a cancer division.

The company achieved great progress in advancing its core IoT (Internet of things) technologies related to its wholly owned subsidiary Greentech Hydrogen Innovations Corp. by utilizing AI and machine learning to collect, analyze and refine hydrogen market data to generate new, yet to be known datasets. “This exercise in AI development has inspired us to utilize the technology in every other business segment of VPN, and we are committed to further growth and innovation as we begin 2023,” added Mr. Ingleton.

Allow me to translate: “Have you seen this ChatGPT thing? The intern ran our marketing deck through it and it totally rewrote it in the voice of Hunter S. Thompson, which is hilarious, so we’re going to be doing that again FO SHO.”

Anyway, then there’s four more paragraphs of bullshit like this, with no detail about HOW they might use AI, only that ‘the world is going to benefit’..

As AI continues to mature and become more widely adopted, it is likely to have a significant impact on the global economy, creating new opportunities for growth and innovation, as well as presenting new challenges and ethical considerations.

Good insightful. Very genius. Much smart.

But maybe I’m just being too snarky. Maybe these guys are smarter than I think. Who knows, they might have hired a quant. Or twenty quants. So I dug in to find out what exactly is this cutting edge company?

VPN EXPLAINED:

Well, its core business is a Virtual Private Network service for people who don’t want their dealings tracked online. There’s a lot of these around and they do the job fine.

But this version of that tech is not industry leading You can tell this because the Google listing of the business has this ‘definitely not stock image’ attached and, though it looks mega official, it is what the French call ‘le fake.’

You have to really search the VPN Technologies website to find evidence the VPN app exists, but I found the link to it on Google Play and, well, let’s just say it’s not overwhelming.

Do you see what I see?

Yeah. 10+ downloads. And that’s since September 12 2020 which was, according to the description… ‘initial release’

Their website offers lot more information about how great VPN service is, but not much about how their service is, well, different or better or (ahem) real.

But hey, they also have a new subsidiary, Greentech Hydrogen Innovations Corp! Maybe the VPN business is old news, maybe the hydrogen space is what’s next!

Let’s swing back to October of last year:

Greentech’s Hydrogen-of-Things(TM) utilizes data collected from clusters of sensors distributed throughout the supply chain and leverages machine learning techniques to output yet unknown energy related findings. “We are attempting to build a novel energy grid where hydrogen takes center stage as an energy carrier.” VPN CTO & Greentech project lead Curtis Ingleton adds, “Much of the potential input to the electrical energy grid is lost due to inefficiency and inability to store accumulated energy. We aren’t just looking to fuel cars, trucks & ships but we’re looking to distribute energy on a massive scale.

So, credit where it’s due, if this reinvention of how the world does energy is real, it does mean VPN Technologies has been actually playing with AI, but only in the same way I do – by taking AI services that exist and running data through them.

We all do that. The image on this article came from Midjourney as an AI query. The text, because I wrote it late on a Friday and there may have been some whiskey involved, was sent through an AI editorial checker. For the record, it thought my article was very good.

But there’s a MASSIVE difference between using AI for things and BEING AN AI COMPANY. As an example, my business uses Photoshop and Office, but we are not competing with Adobe or Microsoft. VPN Technologies thought VPN was going to be a bigger thing than it has been, then they went into hydrogen, which was a big thing last year, now they’ve seen AI making a run and thought, we have a bit of that, bang out a news release!

And that’s why I’m here kicking them in the balls.

The problem isn’t that this tiny office on Stock Promoter Row in downtown Vancouver, staffed seemingly with a lot of ‘executives’ that hold part time positions in a lot of other microcap pubcos in the same building doing the accounts and sending out PP docs – can’t build a big technology company from scratch. It’s that they’ve tried now three times and none of them have turned out to be real.

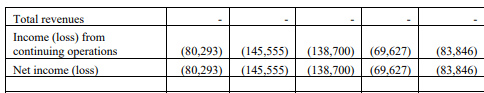

In fact, a look at the company financials from the last few years would indicate it seems to exist only to pay its handful of staff.

To be fair, nobody is getting rich here on what they’re drawing out of the company. The thing is, nothing appears to be happening at the company to justify more than these nominal amounts.

So why am I even talking about these guys?

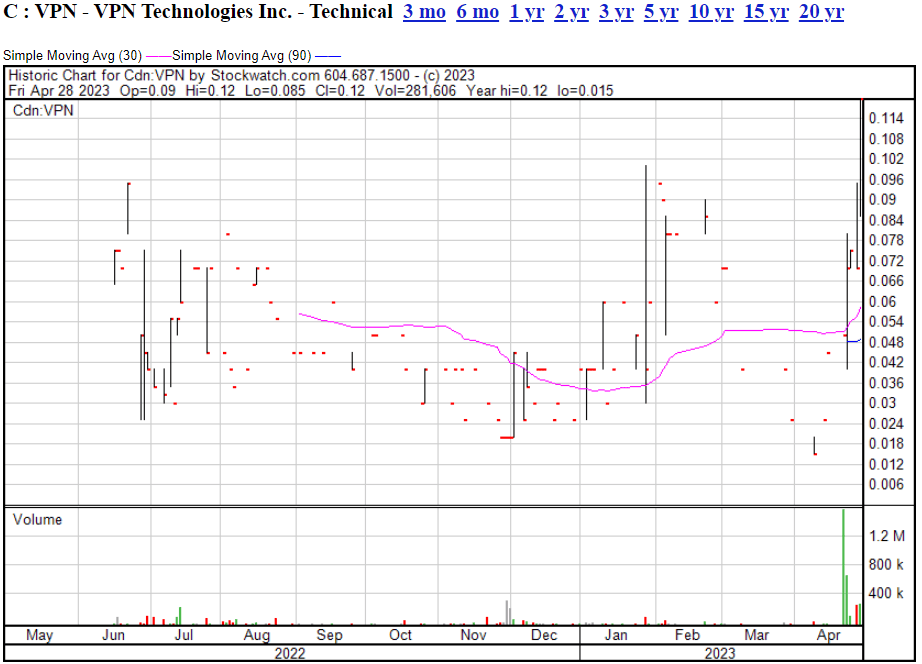

Because the stock just launched from $0.02 in December to $0.04 in mid-April, to $0.12 today. Even at a market cap of just $1.2 million, that’s a five-bagger, and that’s important because while that’s happening, the company is raising $750k in a private placement financing priced at $0.05, with a full warrant at $0.075.

The day that raise was announced, VPN traded like it hasn’t ever before, with 1.6 million shares traded (out of 10 million outstanding) on the way to an intra-day double. The trading every day since has been well above the high points of any time over the last year.

I don’t know what spurred that trading, but usually the ability to get stock at $0.05 (with a full $0.075 warrant) means people are less likely to buy it for more. In fact, most longer term holders would SELL so they could get into the cheaper PP.

Of course, there’s always the chance someone has heard big news is coming and they want whatever stock they can get. But if that were true, the company would be unlikely to raise at $0.05 when they could hold out until after the news and raise at far higher numbers. By the last financials, they have $390k in pocket, which would last them a year at the current rate without any raise required.

My thinking: This is a lifestyle company run by a three person group that uses part-timers for pubco admin purposes, holds an office on Seymour Street with all the other rounders, and raises half a million every few years to keep the lights on while putting out vague news releases about whatever hot topic is hitting the markets at a given point. My assumption is they bought a hundo grand of their own stock over a couple of days to make the raise look tempting, and that as soon as they close it, they’ll sell to pay off their credit cards.

AI? I think they’re more likely to show up with a lithium property in three months than cutting edge artificial intelligence, but what do I know?

Head on a swivel, lads.

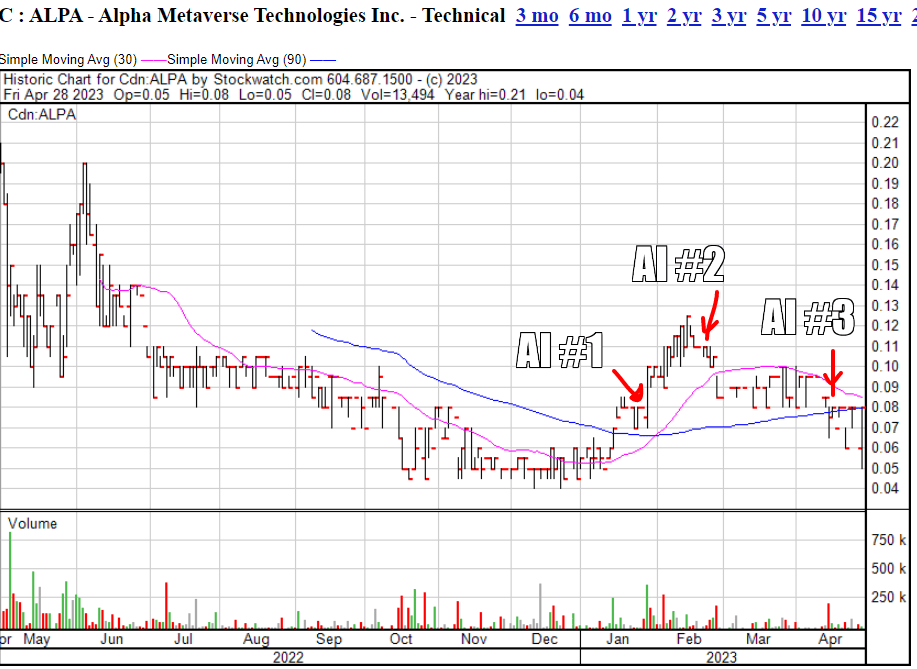

UP NEXT: ALPHA METAVERSE, NO REALLY. THEY STILL ANSWER TO THAT

UP NEXT: ALPHA METAVERSE, NO REALLY. THEY STILL ANSWER TO THAT

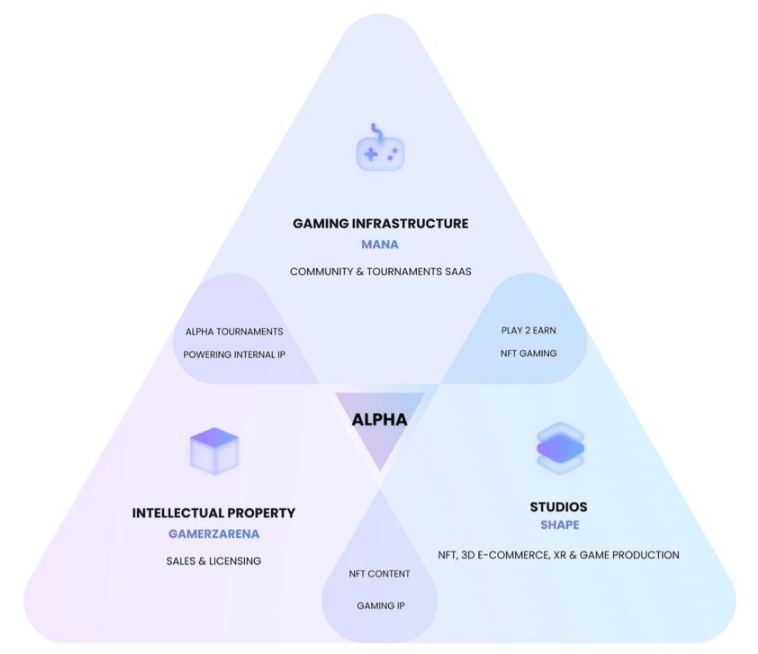

A year ago, Alpha Metaverse (ALPA.C) (which appears to have a logo that combines the Avengers and Star Trek) was in the e-sports arena, selling white label tournament tools, which was a valiant if ultimately fruitless effort because every game worth its salt has its own tournament infrastructure. Their hook was that they served crypto and play-to-earn options of which, fine I guess. Before that they jumped into the 3D NFT space, and after that it was metaverse e-commerce.

That 3D NFT deal didn’t go down like anyone wanted, with Alpha needing to defer payment.

In the event that [the acquisition target’s] earnings before interest expense, tax expense and non-cash items (“EBITDA”) for any calendar month during the Post-Amendment Period is greater than $0, Alpha shall pay the lesser of (x) the amount of positive EBITDA generated by [the target] in such calendar month and (y) the amount of cash and cash equivalents in [their] bank accounts on the date payment is required, to the Former Holders in partial or complete satisfaction of Alpha’s obligation to pay the Remaining Consideration;

In 2021, ALPA was earning $3,645 in revenues quarterly. I think my kid spent more money on Steam that year than ALPA earned as a company.

In 2022, they earned $108k in the quarter ending Sept 2022, and spent $413k doing it, and revealed tournament prizes had dropped 80% because nobody was playing. I just checked and there are five tournaments happening on site right now.

But, to be fair to Alpha, in buying what it has, it has purchased the right to claim it ‘has big partners’ and a bunch of tech, most of which came in the box with what they bought, rather than being built at home in the garage.

The problem is, all of this tech – every piece of it – is buzzword stuff that ran hot for a minute before imploding in the greater markets.

E-sports. Crypto. NFTs. Metaverse. It’s like a murderer’s row of disappointing tech shifts. If they could figure out a place to fit ChatRouelete and MySpace, you’d have the full tech failure Yahtzee.

But, recently, Alpha started using a new phrase in its news releases.. see if you can spot it.

- Alpha Metaverse opens centre of excellence for AI in 3-D

- Alpha Metaverse releases AI tool for content production

- Alpha Metaverse receives contract for AI project

The reality is, Alpha is actually in the Metaverse game, which is a hard sell now that Mark Zuckerburg drowned that whole idea in a $10 billion bucket of excrement, but big corporations love the idea of Second Life v2.0 and are prepared to drop a little budget ensuring they don’t get left behind if it should happen to take off sometime. This is how the EU spent 400k Euros on their ‘Global Gateway Metaverse’, which just six people showed up for.

The Metaverse is a giant wank right now because everyone wants to own it by making their own ‘verses’, rather than cooperating on standards for a global one that would run like the internet. It wants to be Ready Player One, but at present its a series of places where furries do VR chat. No, Payless For Shoes, I’m not interested in generating an avatar and exploring savings.

But while some companies are exploring the space, Alpha can make some money here and there. The problem, from my perspective anyway, is that they’re dressing that business up as AI business in an effort to attract shareholders.

- They’re not building 3D metaverse content, they’re ‘getting AI to build it’.

- They’re not teaching their staff how to use AI tools, they’re ‘creating a centre for AI excellence.’

- They didn’t get a metaverse contract, they have “an incredible opportunity to showcase the power of Alpha’s AI and the metaverse and how it can transform the way big brands engage with customers and create new product categories.”

They even give the game away in an effort to fill their news releases.

The new AI tool is built on advanced machine learning models like OpenAI’s products, and the tool’s automation capabilities enable the creation of high-quality concept art to develop 3-D assets with minimal human intervention. This automation reduces the potential for human error and saves considerable time and cost for businesses.

So it’s not *YOUR* AI tech, it’s OpenAI being used as a tool by your guys… got it.

THIS DOES NOT MAKE YOU AN ARTIFICIAL INTELLIGENCE COMPANY.

And it’s not just me saying so, either. The market is telling Alpha to fucking quit it.

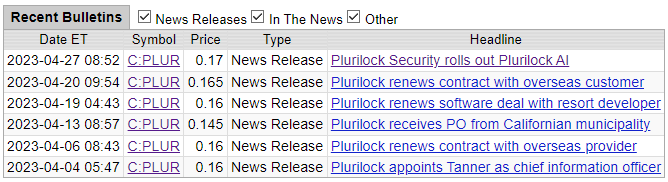

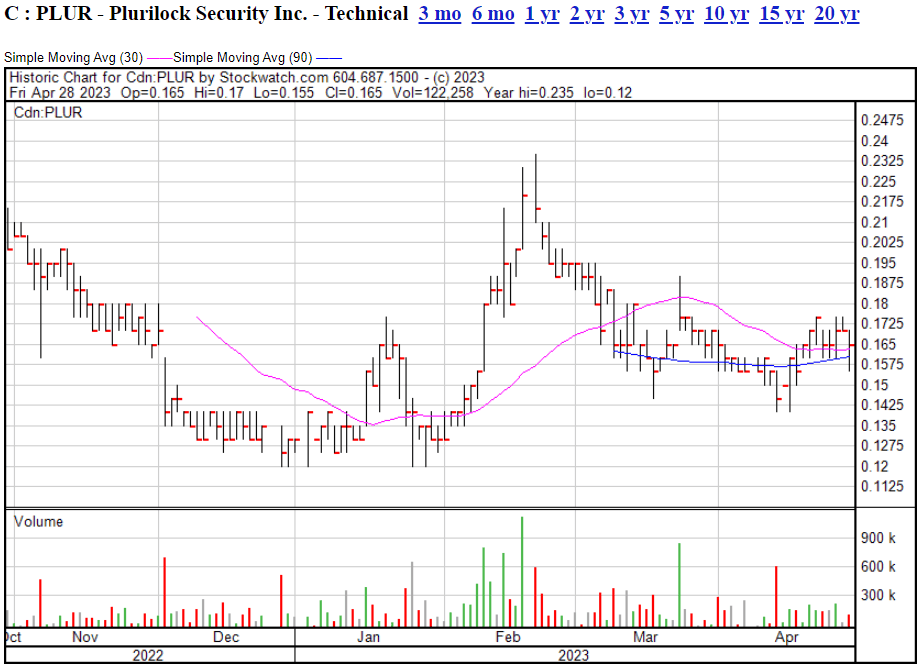

PLURILOCK ACTUALLY DOES AI, AND HAS BEEN SINCE BEFORE IT WENT NUTS

PLURILOCK ACTUALLY DOES AI, AND HAS BEEN SINCE BEFORE IT WENT NUTS

Information security company Plurilock (PLUR.V) is a good little outfit, doing solid mid-8 digit revenues with close to break even result, while racking up a relentless number of contracts and renewals with corporations, military, healthcare, and government.

The AI portion of things is unique to them, patented and developed in-house, and has been added to through acquisitions of market share and complimentary side tools.

What is the AI?

When you sign to your online accounts through a passworded login system, even a two-factor system, the problem with that process is you are, from that point forward, trusted to be who you say you are. But if you nip out for lunch or put your phone down somewhere or someone swipes your laptop at the cafe, the system has no way of knowing that the person on your keyboard isn’t you anymore. This is a BIG deal, especially at high value hacking targets like Fortune 500 companies, banks, brokerages, intelligence services, military, health records, etc etc.

What Plurilock does is map your typing, your mouse work, the tabs you have open, idiosyncrasies with your spelling and how you sign off an email and how quick you move about your screen and dozens, maybe hundreds of ID points more.

The system learns as you go, constantly updating its idea of how you do what you do, creating almost a user-specific virtual thumbprint that is constantly being checked through the day.

Plurilock owns this. It’s theirs. Anyone else who’d like to do something similar will be hearing from lawyers.

And none of it – not one speck of it – exists as a ChatGPT overlay or app or some sort of off-the-shelf software.

REAL AI, bruh. Real machine learning with data continually being sucked down, processed, and used to make the system stronger. That’s legit.

Now, Plurilock doesn’t get the AI love, because there are SO MANY SHITTY AI DEALS that pump out news releases stating that some executive’s kid knows ChatGPT and now “we’re an AI powerhouse.”

According to the company which, full disclosure, has a marketing arrangement with Equity.Guru (and I’ve also bought some stock, so you know how I feel about the company), they have around 600 partner companies and organizations, many of which they can’t name publicly because, come on… security.

They’re only just now getting around to telling people about this because, as a group that’s been using machine learning for a long time, their eye has not been on ‘feeding the markets’ buzzwords, but on closing deals.

And closing deals they are. This is just the last month.

I love this deal, though I’m over eager to see the retail investor market catch on.

UPDATE:

Today, Plurilock announced its financial results for the three and twelve months ended December 31st 2022. A record was achieved.

Key achievements include (all figures in Canadian Dollars):

- Full year 2022 revenue reached the $65-million threshold.

- Total revenue for the year ended December 31, 2022, was $64,632,371 as compared to $36,624,610 for the year ended December 31, 2021. An increase of 75% year-over-year. Revenue for the year ended December 31, 2022, and December 31, 2021, included revenue from both the Technology Division and the Solutions Division. Revenue for year ended December 31, 2022, is significantly higher than the prior year ended December 31, 2021

- Hardware and systems sales revenue for the year ended December 31, 2022, totalled $56,919,768 and compared to $33,546,047 in the prior year ended December 31, 2021. Software, license and maintenance sales revenue for the year ended December 31, 2022, was $6,970,057 compared to $2,597,826 in the prior year ended December 31, 2021. Professional services revenue was $742,546 for the year ended December 31, 2022, compared to $480,737 in the prior year ended December 31, 2021.

- Hardware and systems sales revenues for the year ended December 31, 2022, accounted for 88.1% and of total revenues compared to 91.6% for the year ended December 31, 2021. Software, license, and maintenance sales revenues for the year ended December 31, 2022, accounted for 10.8% compared to 7.1% for the year ended December 31, 2021. Professional services revenue for the year ended December 31, 2022, accounted for 1.1% of total revenues, compared to 1.3% for the year ended December 31, 2021.

- Revenue generated in the United States accounts for approximately 95% of Plurilock’s total full year 2022 revenue.

- Plurilock completed three accretive acquisitions in 2022, resulting in the expansion of its client network for potential cross-selling opportunities and the addition of new technology assets.

Thanks all, good to get back into the groove with this, we’ll be doing an AI round-up weekly or so and will continue sorting the wheat from the chaff.

As ever, if a company mentioned here disagrees with my portrayal of them, they can feel free to get in touch and I’ll gladly give them equal time to make their case.

Though our company does make a living working with companies on their marketing needs, the tenets of journalism are what has kept us around for the last decade, and no client buys our favour – only our attention. You’ve still got to do the work.

— Chris Parry

Great article Perry, as usual, sold the crap and bought the good stuff.

Thanks

Big fan and is vers going to 100 soon thx