As has been the case in recent months, US consumer price index (CPI) data have been highly anticipated. This is due to the market moving narrative of the Federal Reserve raising interest rates to tame inflation. The markets have been pricing in a Fed pause following one more rate hike, however any surprise inflation data could cause the Fed to be more hawkish.

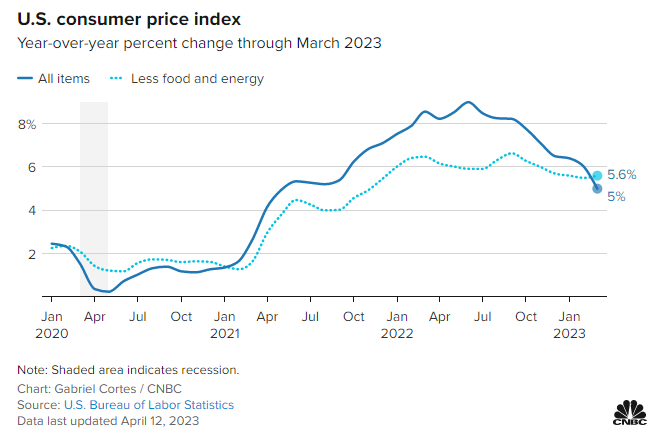

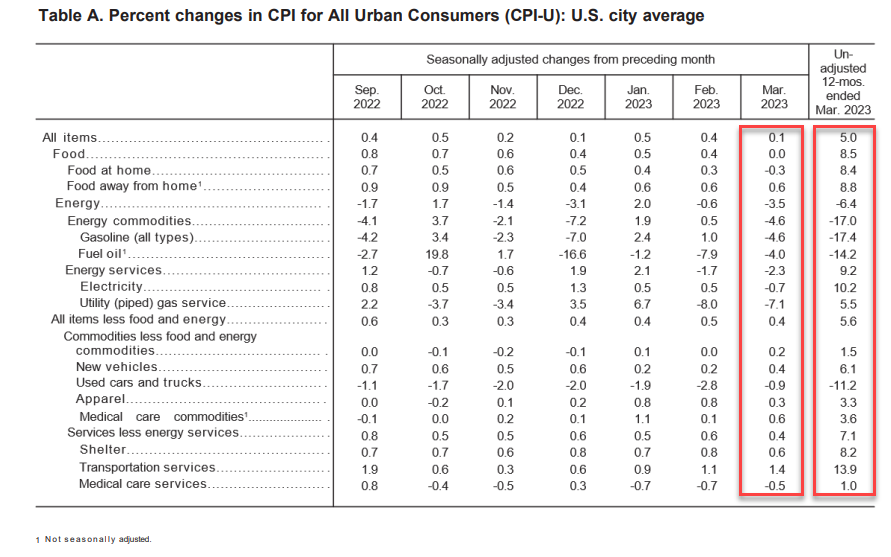

Inflation cooled in March, rising 0.1% for the month beating estimates of 0.2%. Inflation rose 5% from a year ago, beating estimates of 5.1%. It appears as if the Fed’s rate hikes are showing more impact.

If we exclude food and energy, core CPI increased 0.4% and 5.6% on an annual basis, both meeting expectations.

Inflation is still well above the Fed’s 2% level but we are seeing continuing signs of decelerating, or disinflation. The headline annual increase for CPI was the smallest since June 2021.

Food inflation remained unchanged according to the food index. A 3.5% drop in energy costs helped keep headline inflation in check. Food at home fell 0.3%, the first drop since September 2020, though it is still up 8.4% from a year ago.

A 0.6% increase in shelter costs was the smallest gain since November, but still resulted in prices rising 8.2% on an annual basis. Shelter makes up about one-third of the weighting in the CPI.

Used vehicle prices, a major contributor to the initial inflation surge in 2021, declined another 0.9% in March and are now down 11.2% year over year.

“As the economy slows, consumer prices will decelerate further and should bring inflation closer to the Fed’s long-run target of 2%,” Roach said. “Markets will likely react favorably to this report as investors gain more confidence that the next Fed meeting may be the last meeting when the Committee raises the fed funds target rate.”

At time of writing, the US stock markets are green for the day recovering from early losses.

The S&P 500 is still in its uptrend breaking above recent trendlines. However, a resistance zone is being tested and price action will be important in the coming days. A break above the 4200 zone will be bullish, while a large engulfing candle (red) here may provide ammo for bears.

The Nasdaq broke out a few weeks ago but there has been no momentum going forward. Understandable given the liquidity anticipating the CPI data, but now the data has passed and we await further momentum. A potential retest around the 12,600 zone is still possible.

Perhaps the most bullish setup is the Dow Jones. This market recently recovered the major breakdown at 32,500 and then confirmed a breakout in recent days above 33,640. Going forward, as long as the Dow Jones remains above this level, more highs are expected.

Bond yields here are rising which is worth keeping an eye on. Many traders were expecting bonds to be bid up, resulting in a drop in bond yields, as markets price in one more rate hike. If we see yields continue to rise here, this would put pressure on equities.

The US Dollar is seeing a drop post CPI. Some are saying the dollar is dropping due to geopolitical headlines regarding the dollar being dropped for trade between certain countries. However, this drop seems to be the market pricing in a less hawkish Federal Reserve.

Gold had a major pop last night and early this morning hitting the recent highs at $2020. An intraday pullback now even with a weak US Dollar. The $2000 zone is once again being tested as support and bullish traders would want to see this zone hold.

Not much reaction on Bitcoin, however the bullish break remains in play. For more information and our trading game plane, be sure to check out my recent Bitcoin article regarding the 10 month highs.