Canadian-based cybersecurity company, Plurilock Security Inc. (TSXV: PLUR) (OTCQB: PLCKF), is a powerhouse in the field of frictionless authentication services and zero trust architecture, with a primary focus on enterprise and government networks. Despite the current share price levels, Plurilock shows immense growth potential and is a going concern. The company holds six issued and provisional patents for its groundbreaking technologies and is a market leader in advanced authentication.

Recently, Plurilock announced a contract renewal with an overseas property management solutions provider for its flagship software platform. This renewal signals the company’s commitment to maintaining high customer retention for its high-margin software platform, which includes Single Sign-On Access Control and Password Policy.

Plurilock’s impressive portfolio of acquisitions, such as Aurora Systems Consulting and Integra Network Corporation, has led to a near 10x increase in revenues on an LTM basis. These acquisitions have also provided the company with the opportunity to cross-sell its higher-margin proprietary products. Enhanced total gross margins are expected in 2023, with the potential for break-even to positive Adj. EBITDA margin by the latter half of the year.

Plurilock’s invisible Multi-Factor Authentication (MFA) and continuous authentication solutions utilize state-of-the-art behavioral-biometric and machine learning technology. This enables organizations to operate safely and securely while reducing cybersecurity friction.

The company’s native Cloud Access Security Broker (CASB) and Data Loss Prevention (DLP) solutions ensure that data is only accessible by authorized and known users, promoting a zero-trust security architecture. This type of security approach is highly effective at countering unauthorized access by passively and continuously verifying trusted users and devices.

Behavioral biometrics is an essential part of Plurilock’s authentication technology, which supports zero-trust policies and aids in achieving a zero-trust architecture. By monitoring users’ behavioral patterns when interacting with a system, behavioral biometrics continuously authenticates users based on factors such as typing speed, mouse dynamics, and more. This provides ongoing, passive user authentication without the need for proprietary hardware.

Unlike traditional biometrics, behavioral biometrics are continuously updated as a user’s subtle behavioral patterns change. This means that even the slightest variation from the established profile can result in access being denied and a user being locked out of the system. As a result, security teams are immediately alerted to potential threats.

Plurilock’s technology is designed to work silently in the background, monitoring users’ micro-behavioral patterns and creating profiles that differentiate between legitimate users and intruders. For instance, if an attacker uses compromised credentials to log in to an account, the behavioral biometrics system can detect unusual behavior, lock the intruder out, and notify the security team.

Behavioral biometrics offers continuous and passive identity confirmation by leveraging machine learning to create a user profile based on data such as typing habits, key press duration, and typing speed. If anomalies are detected and the user’s risk score surpasses the pre-defined threshold, access to data or applications is denied, and the user is logged out of the account.

In a recent analysis by Equity Guru’s Chris Parry, he provided insights into the information security company, Plurilock, its frictionless authentication technolgies and zero trust architecture. According to Parry, Plurilock is about to announce a deal with the Canadian Department of Defense, which is estimated to be equal to a quarter of the company’s market cap. He added that Plurilock has other deals with large companies and government groups that amount to over $40 million annually, four times its current market cap.

Parry highlights that Plurilock’s patented technology offers a step up from traditional computer security measures like passwords and logins. The company’s software monitors users’ activities, keystrokes, and patterns in real-time, making it difficult for unauthorized users to access systems. The Canadian Department of Defense, cloud-based real estate and hotel platforms, and large banks and government institutions have all chosen Plurilock for their security needs.

The AI-driven cybersecurity company has been steadily growing and making money. Parry emphasized that Plurilock is a significant player in the computer security industry, which he believes is poised for explosive growth due to the increasing use of AI.

Parry also noted that Plurilock’s insiders are buying their own stock, indicating their confidence in the company’s potential. He encouraged investors to look into Plurilock (ticker symbol: PLUR), stating that it is an AI company actively doing business with the government and other major clients.

Though Plurilock is a client of Equity Guru, Parry assures that his analysis is genuine and not influenced by this relationship. He urged potential investors to review Plurilock’s news releases and to consider the company’s potential for growth as a solid AI-driven cybersecurity provider.

In summary, Plurilock Security is an undervalued leader in advanced authentication and zero-trust architecture. With its innovative technology and strong growth potential, the company is set to revolutionize the field of frictionless authentication services for enterprise and government networks. Investors seeking a cybersecurity company with a bright future should look no further than Plurilock Security Inc.

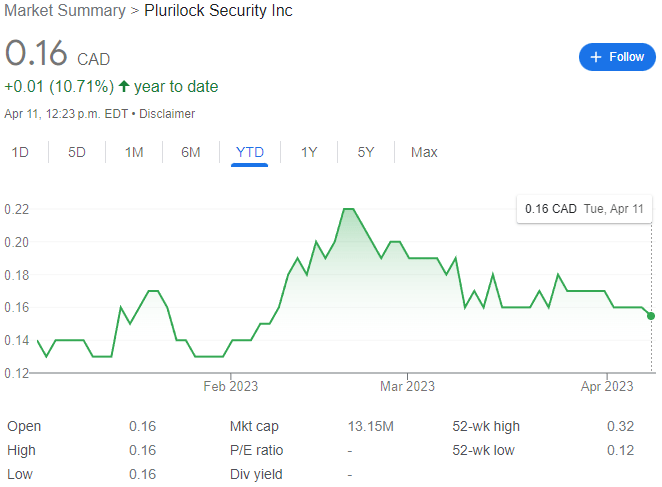

Plurilock currently trades for $0.16 CAD per share for a market cap of $13.15 million.