Toronto Dominion (TD) Bank has recently become the world’s most shorted bank, sparking concerns of a potential banking crisis in Canada. Hedge fund bets against TD Bank reached a staggering $4.2 billion, with analysts raising concerns about the bank’s exposure to the U.S. regional lenders. This article delves into the factors contributing to this scenario and discusses the possibility of a banking crisis hitting Canada.

The Situation:

TD Bank’s acquisition of the U.S. regional lender First Horizon Corp for $13.4 billion has been a major contributor to the increased short interest. This deal would elevate TD to the sixth-biggest commercial bank in the U.S. from its current position as the tenth-largest. However, some shareholders have urged the Canadian bank to either scrap the deal or renegotiate a lower price.

The First Horizon deal has also led to increased speculation about TD Bank’s exposure to the U.S. market, with its stake in Charles Schwab Corp. Charles Schwab recently lost $47 billion in market value over unrealized bond losses, and TD holds approximately a 10% stake in the company.

Factors Contributing to the Short Interest:

- Exposure to the U.S. regional lenders: The acquisition of First Horizon Corp has raised concerns about TD Bank’s exposure to the U.S. regional lenders, especially in light of the recent regional bank crisis.

- Slowing Canadian real estate market: Some analysts believe that the increased short interest in TD Bank is a bet against the slowing Canadian real estate market.

- Charles Schwab stake: TD Bank’s 10% stake in Charles Schwab, which recently lost a significant portion of its market value, has also contributed to the short interest.

Analyzing the Technicals:

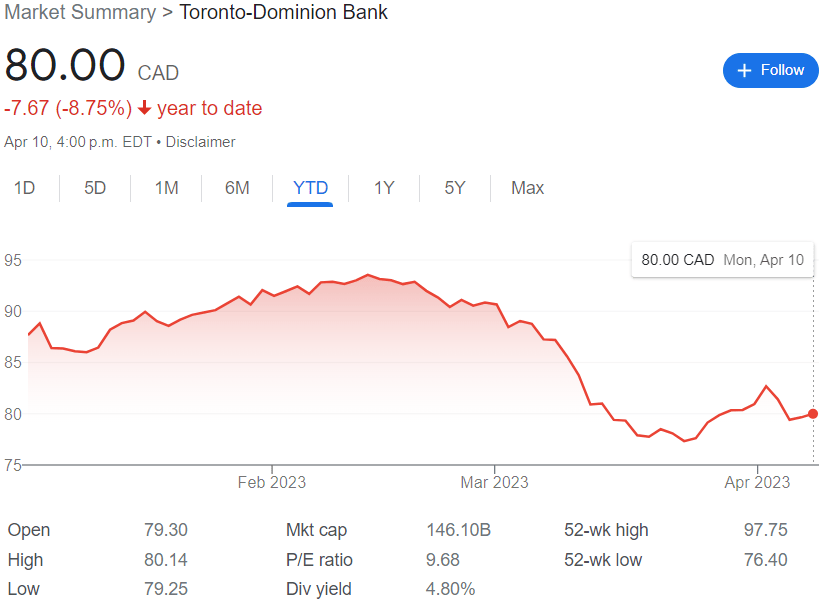

A recent analysis by Vishal Toora revealed a head and shoulder pattern in TD Bank’s weekly chart, indicating a potential trend reversal. The head and shoulder pattern is a quintessential reversal pattern that many technical analysts look for. If TD Bank’s stock closes below the neckline support level of 76.50, this reversal pattern would be triggered, indicating potential further declines in the stock price. Watch his video here!

Liked what you saw? You can watch more Chart Attack videos here.

Is a Banking Crisis Imminent in Canada?

The increased short interest in TD Bank has led to concerns about a possible banking crisis in Canada. However, Canadian banks have historically been strong and stable, even during the 2008 financial crisis. Many analysts believe that TD Bank is one of the “too big to fail” banks, similar to Credit Suisse, and that a banking crisis in Canada is unlikely.

Conclusion:

While the increased short interest in TD Bank raises concerns, it’s crucial to consider the historical strength and stability of Canadian banks. Although there are undeniable challenges for TD Bank, such as its exposure to the U.S. regional lenders and the slowing Canadian real estate market, it is too soon to predict a banking crisis in Canada. It is essential for investors to keep a close eye on TD Bank’s stock performance and any changes in market conditions that may affect the bank’s stability.

TD Bank currently trades at $80.00 CAD per share for a market cap of $146.10 billion.

TD is too big to fail, and the Titanic was unsinkable, until it sank.

Is my TD bank account insured?

TD is a member of the Canadian Insurance Deposit Corporation (CIDC) and as such, the CDIC protects your GICs, foreign currency and savings /chequing accounts.