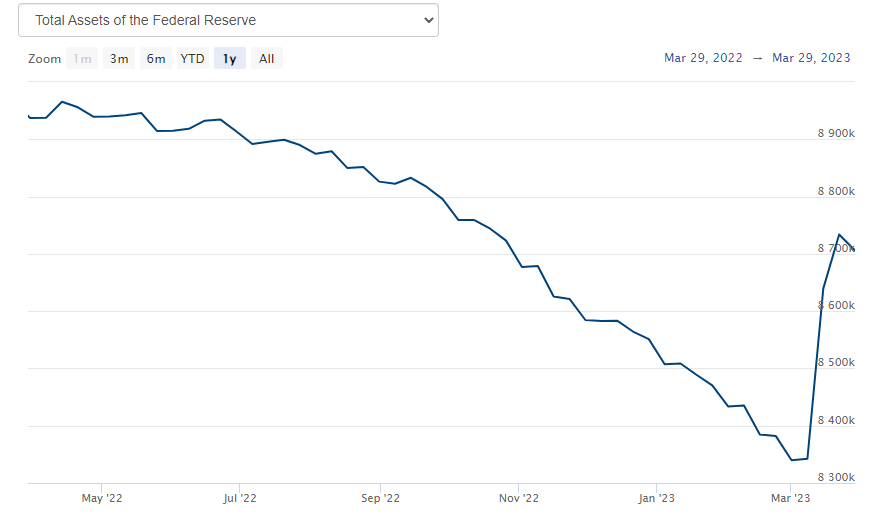

The banking crisis may be about to hit Canada. In recent weeks, we have seen regional banks in the US get hit resulting in quick action from the Fed and regulators. And leading to the Fed balance sheet expanding when they are supposed to be tightening:

Credit Suisse then raised fears that the banking crisis was going global. The result was a takeover by Swiss bank UBI.

You can understand why traders and speculators are taking positions against the banks. They believe the troubles in the financial sector are not over. With higher interest rates, banks are not making the money they used to when acquiring essentially free money in a low interest rate period and buying long term bonds. Deposits are decreasing, while lending is falling sharply. You can see why banks are feeling the pressure… especially those with highly leveraged positions.

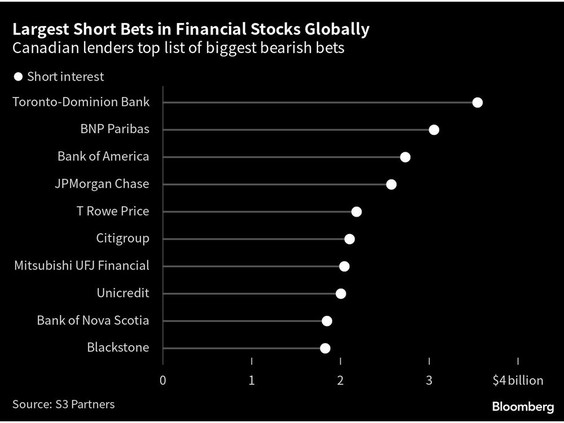

Canadian banks have been considered strong. When the Great Financial Crisis occurred, Canadian banks did not feel the impact. However, speculators have made a big bet against the Canadian banking sector.

Toronto-Dominion (TD) bank has become the biggest short in the banking industry anywhere in the world. Yes, that is right. It isn’t in Switzerland or Silicon Valley but Canada.

In recent weeks, short sellers have increased their bearish bets against TD. There is roughly US $3.7 billion on the line with this short against Canada’s second largest lender. This is the most among financial institutions globally and puts TD ahead of France’s BNP Paribas and Bank of America.

The reason for the short seems to be a bet against TD’s exposure to Canada’s slowing real estate market as well as its ties to the US market through its stake in Charles Schwab Corp and a planned regional bank acquisition.

Charles Schwab recently lost US $47 billion in market value over unrealized bond losses. TD has roughly a 10% stake in Charles Schwab and traders could be betting against TD on this news. When it comes to real estate exposure, Canadian real estate is known for being very high… some would use the word ‘bubble’. The Canadian market sees variable rate mortgages being common, and with rising interest rates and inflation, consumer insolvencies are on the rise.

TD shares are down -1.73% on the Canadian market. A lower high looks to be forming, and support comes in at the $76.50 zone.

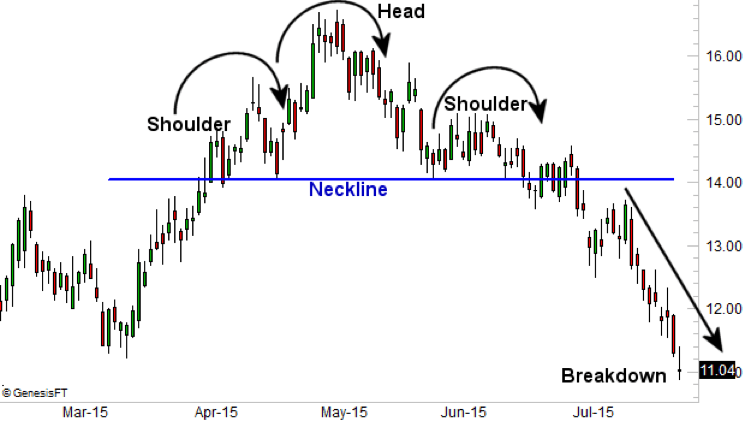

Being a technical trader, when I hear about this short position I cannot help but think big money knows something. But if it is not the fundamentals, then perhaps the technicals are showing a reason for increased shorts.

Well I see something very interesting on the weekly chart of TD:

The weekly chart shows a popular reversal pattern known as the head and shoulders being printed. This hints at a longer term move down to the $65 zone and then possibly $50. However, the pattern has not been triggered!

The neckline is still intact, which actually coincides very nicely with our recent lows support at $76.50. Once we get a weekly candle close below this level, the short trade is on and the reversal pattern will be triggered.

So are traders seeing this larger time frame pattern and betting on a reversal trigger? Possibly. If big money knows something, then I, and many others, are not privy to this information. However, as I have explained in many of my technical analysis articles, the charts tend to tell us (rather show us) what big money is doing. And in a spooky way, can tell us the news before it happens.