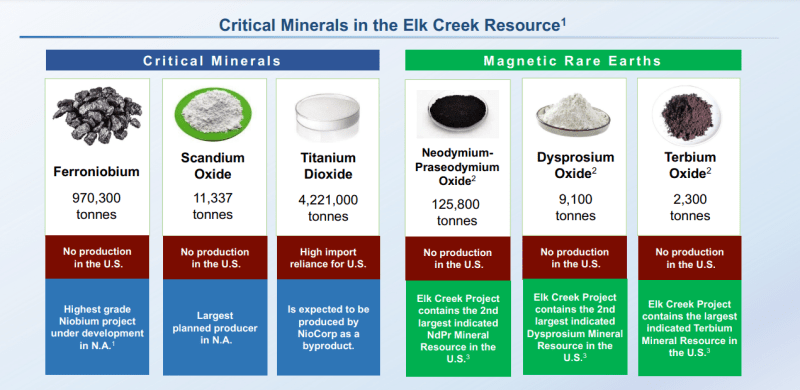

NioCorp Developments (NB.TO) is developing the Elk Creek Critical Minerals Project in Southeast Nebraska. This mine will produce strategic/critical minerals such as niobium, scandium and titanium. Several rare earths will also be produced from this mine. In fact, Elk Creek is the second largest indicated-or-better rare earth resource in the US.

Rare earths should be considered by investors even more given the recent developments on the geopolitical stage between the US and China given China dominates the rare earths markets. Rare earth metals security is a theme which will be similar to the current energy security theme, where Western nations wean off reliance on Eastern players such as Russia. For investors, this opportunity means that the US government will most likely encourage domestic production of rare earths for metals security. NioCorp fits the bill with an advanced project and a large resource.

Today, the Company announced that it has expanded its existing non-revolving credit facility between the Company and its Executive Chairman, Mark Smith, to US $4 million from the previous limit of US $3.5 million.

Funds drawn on the credit facility will assist the Company in continuing its work to secure project financing for the Elk Creek Project and move the project to a construction start.

The credit facility bears an interest rate of 10%, is secured by the Company’s assets pursuant to a general security agreement, and is subject to a 2.5% establishment fee. The amounts outstanding under the credit facility will become due on June 30, 2023.

Recently, NioCorp announced it has executed a contract with Zachry Group to develop a cost for the surface facilities associated with NioCorp’s Elk Creek Critical Minerals Project in Southeast Nebraska. The contract represented the first phase of engineering, procurement, and construction (“EPC”) contracting for the $1.2 billion Project.

News releases have also been showing that the demonstration plant in Quebec, Canada is showing strong rare earth recovery and lends support to the technical feasibility of separating high-purity oxides of several key magnetic rare earths.

Financing is key and the company will have access to a big chunk of cash once the SPAC acquisition goes through and the company is listed on the Nasdaq exchange. NioCorp would use these proceeds to advance its Elk Creek Project and moving it into commercial production.

The technicals are something I have covered here on Equity Guru plenty of times. I told readers that we had a false breakdown below $1.00 which is very bullish. My major resistance zone was $1.10. We have now closed above this zone triggering a double bottom reversal pattern.

We are well above my moving average, and also are now back above a key trendline. All signs point to momentum higher. Catalysts going forward include more demonstration testing and the big US SPAC acquisition which would see NioCorp traded on the Nasdaq. Meaning more eyeballs on the stock and US money being able to buy shares.

The next resistance zone comes in at $1.50. If we can take this out, then we will test the previous highs at $1.75. The stock remains bullish as long as it remains above the key trendline and the $1.10 key support.