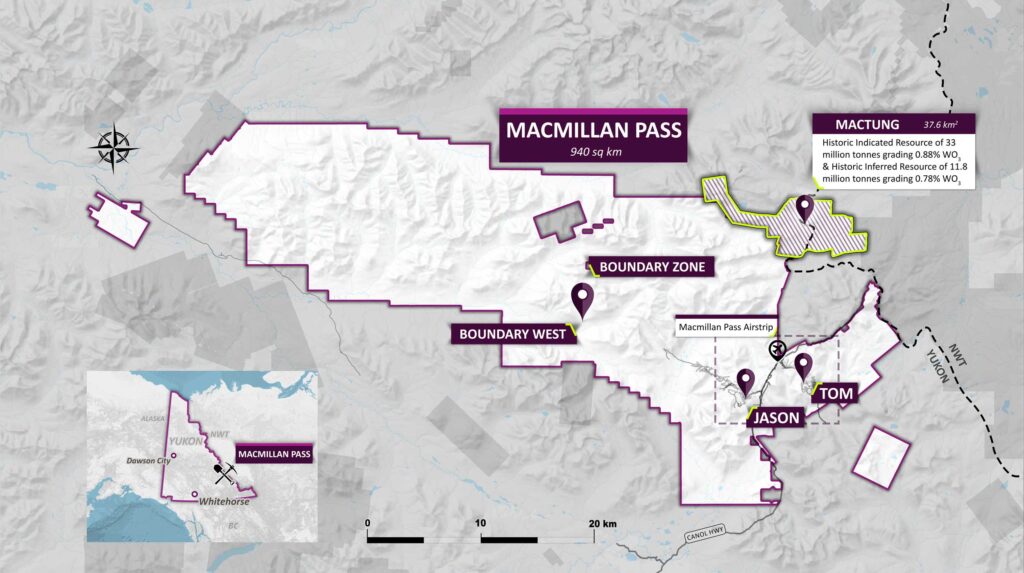

Fireweed Metals (FWZ.V) is an exploration and development minerals company exploring for zinc, lead, silver as well as gallium and germanium deposits in Canada. The company owns an interest in the Macmillan Pass Project located in the Yukon, and the Gayna River Project located in the Northwest Territories. The company has an option to acquire a 100% interest in the Mactung Tungsten project which covers an area situated both in the Yukon and Northwest Territories.

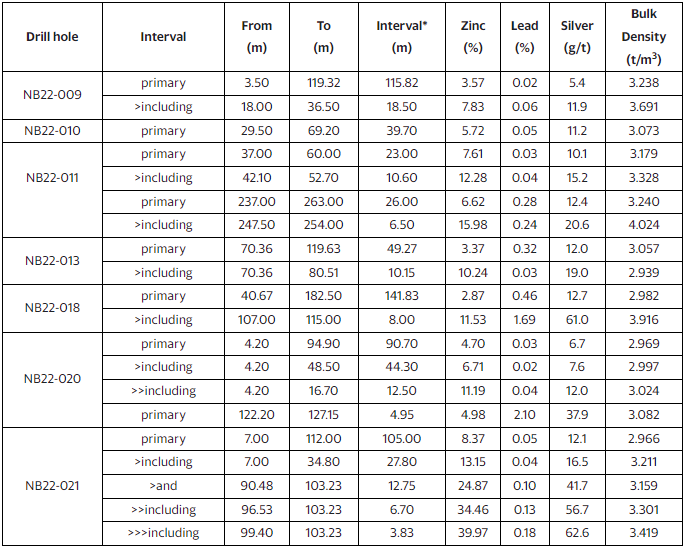

This week, the company announced additional drill results from the 2022 drill program at the Boundary Zone at the Macmillan Pass zinc-silver-lead project. Here are the highlights:

- A high grade and wide intersection of zinc mineralization in NB22-021 for 105 metres (m) of 8.4% zinc and 12.1 g/t silver starting from surface.

- A new stratiform zone in NB22-018 returned 8 m of 11.5% zinc, 1.7% lead, and 61 g/t silver.

- All holes completed hit zinc mineralization.

- Results from the last five (5) holes from Boundary Zone and nine (9) holes from the Tom deposit are pending.

Brandon Macdonald, CEO, stated “Boundary Main Zone continues to impress with not only the wide tenor of mineralization but also with high-grade intervals. Equally important is the discovery of a new stratiform zone where we expect to see good continuity of mineralization consistent with similar zones at Tom, Jason and Boundary West. With a large drill campaign planned for the summer we are looking forward to testing the extents of mineralization in these zones and growing our already world-class metal endowment.”

Here are the full drill results:

The markets responded positively with the stock closing over 6% for the day.

Today, Fireweed Metals announced that it has signed a definitive asset purchase agreement for the acquisition of 100% interest in the Mactung Tungsten Project.

This project is one of the largest and highest-grade tungsten deposits in the world. It is an advanced stage exploration project with extensive drilling, engineering, metallurgy, geotechnical, and environmental and socioeconomic baseline data collected by previous owners that supported a feasibility study in 2009 and effects assessment in the Yukon completed in 2014.

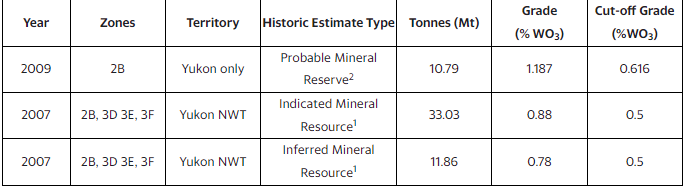

Historic 2007 indicated resources totaled 33.0 million tonnes (Mt) grading 0.88% WO3 (tungsten trioxide) plus historic inferred resources of 11.8 Mt grading 0.78% WO3. The 37.6 km2 property is located adjacent to Fireweed’s Macmillan Pass Property and accessed by the same road providing potential for future project synergies.

Here are the most recent historic mineral resource and mineral reserve estimates:

Fireweed is currently undertaking a re-sampling and assaying program on the historic core from Mactung. The multi-element assaying program includes gold, copper, and bismuth analyses aiming to examine the potential for reporting these by-product metals in addition to tungsten in an upcoming Mineral Resource Estimate anticipated to be completed within Q2 2023.

Provided below are the terms of the Mactung Asset Purchase Agreement:

Fireweed and the Government of Northwest Territories (“GNWT”) have signed a definitive Asset Purchase Agreement under which the GNWT is selling the Mactung Project to Fireweed for a total purchase price of C$15,000,000 staged as follows:

- Fireweed pays the GNWT the sum of $1,500,000 upon execution of a binding Letter of Intent (previously executed and paid);

- Fireweed will pay to GNWT an additional $3,500,000 within 18 months of the closing date of the definitive Asset Purchase Agreement (signed as described in this news release; closing date about April 5, 2023);

- Fireweed will pay to GNWT an additional $5,000,000 upon Fireweed announcing its intention to construct a mine on either the Mactung Project or any portion of the mineral property interests controlled by Fireweed in the Yukon, commonly known as the Macmillan Pass Project; and

- Fireweed will pay to GNWT an additional $5,000,000 upon Fireweed announcing its intention to construct a mine on the Mactung Project.

Mactung carries an existing net smelter return royalty (“NSR”) of 4%, which is held by a third party, 2% of which can be purchased at any time for $2.5 million. The Asset Purchase Agreement does not include responsibility for any assets or liabilities related to the defunct NATC Cantung mine located further south. The final closing date, before which all claims, leases, and regulatory approvals will be transferred to Fireweed’s ownership, is expected to be about April 5th, 2023.

From a technical analysis perspective, Fireweed Zinc stock is actually showcasing a relief in a current downtrend. A pullback to retest resistance.

A topping pattern was formed and triggered with the breakdown on February 15th 2023. Some would say this was a dirty looking head and shoulders topping pattern.

We had our first wave down, and now a pullback is in play. Note that today’s candle is showing sellers step in at the breakdown resistance zone evident by the current large wick.

A lower high could be in play which means the stock will continue its downtrend and break below the recent candle body lows at $0.80. This would then take us to the support at $0.70.

I would be watching to see how today’s candle closes. If bulls can get a close back above the $0.90 resistance zone, then the breakdown has been reversed and we would have a false/fake breakdown. Any signs of a further down move would be alleviated. As long as the price remains below $0.90, more downside is highly probable.