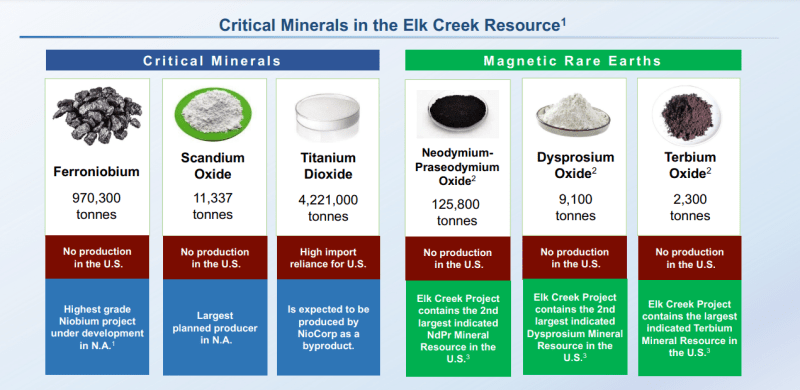

NioCorp Developments (NB.TO) is developing the Elk Creek Critical Minerals Project in Southeast Nebraska. This mine will produce strategic/critical minerals such as niobium, scandium and titanium. Several rare earths will also be produced from this mine. In fact, Elk Creek is the second largest indicated-or-better rare earth resource in the US.

Rare earths are definitely an interest for investors given the recent geopolitical ongoing relations with China. China dominates the rare earths markets and with the push for energy security with uranium, one could think that rare earth metals security is a policy the US government will push. This would mean more investment in developing domestic rare earth mines. NioCorp Developments meets the criteria.

Today, NioCorp announced is has executed a contract with Zachry Group to develop a cost for the surface facilities associated with NioCorp’s Elk Creek Critical Minerals Project in Southeast Nebraska. The contract represents the first phase of engineering, procurement, and construction (“EPC”) contracting for the $1.2 billion Project.

Zachry is widely recognized as one of the world’s leading turnkey engineering, construction, maintenance, turnaround, and fabrication companies. Zachry serves companies in the energy, chemicals, power, manufacturing, and industrial sectors.

“We are very pleased to take this important next step with Zachry as it positions NioCorp to advance to a construction start following receipt of sufficient project financing,” said Mark Smith, Chairman and CEO of NioCorp. “Zachry is a highly respected company with an excellent track record of success in large projects such as ours, and I am pleased to continue our partnership with Zachry as we work together to bring the Elk Creek Project to commercial reality.”

Scott Honan, NioCorp’s Chief Operating Officer, added: “Zachry has a large craft workforce and a strong presence in Nebraska. Together with our long relationship with the Zachry team, this makes for a great fit with the Elk Creek Project. Having spent time at Zachry’s offices and multiple project sites, I am confident that Zachry can execute their scope of work on our Project in a safe, timely, and cost-effective manner.”

“We are excited to work with NioCorp to support the development of critical minerals that will help the United States transition to a lower-carbon economy,” said Ralph Biediger, EPC President, Zachry Group. “We look forward to bringing our decades of EPC experience to bear on this vitally important project and continuing our long-term presence in Nebraska.”

NioCorp’s demonstration plant continues to show strong rare earth recovery, and the company is finalized financing before its SPAC acquisition which would see NioCorp listed on the US Nasdaq exchange. The combined entity would see NioCorp have access to as much as $285 million (USD) in net cash. Cash which would be deployed to advance the Elk Creek Minerals Project into production.

The technicals are something I have covered here on Equity Guru plenty of times. I told readers that we had a false breakdown below $1.00 which is very bullish. My major resistance zone was $1.10. We have now closed above this zone triggering a double bottom reversal pattern.

We are well above my moving average, and also are now back above a key trendline. All signs point to momentum higher. Catalysts going forward include more demonstration testing and the big US SPAC acquisition which would see NioCorp traded on the Nasdaq. Meaning more eyeballs on the stock and US money being able to buy shares. A higher low looks to be confirmed with a daily close above $1.36, although some analysts would argue it has already been confirmed with a candle close above recent body highs.

The next resistance zone comes in at $1.50. If we can take this out, then we will test the previous highs at $1.75. The stock remains bullish as long as it remains above the key trendline and the $1.10 key support.