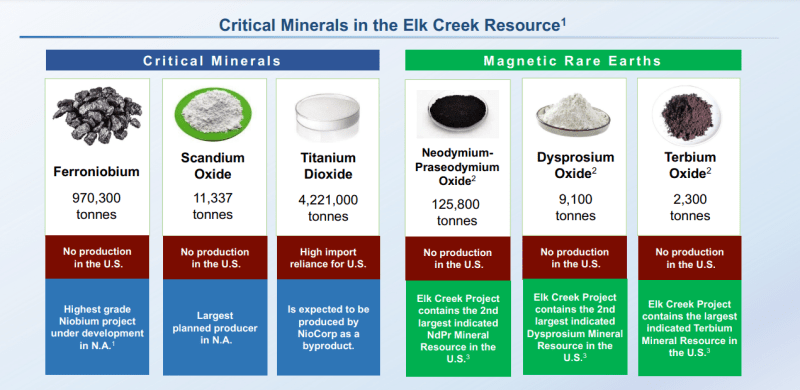

NioCorp Developments (NB.TO) is developing the Elk Creek Critical Minerals Project in Southeast Nebraska. This mine will produce strategic/critical minerals such as niobium, scandium and titanium. Several rare earths will also be produced from this mine. In fact, Elk Creek is the second largest indicated-or-better rare earth resource in the US.

Today, the company announced that its demonstration-scale processing plant (the demonstration plant) at L3 Process Development in Quebec, Canada has succeeded in producing a high-purity mixed rare earth concentrate from NioCorp’s integrated demonstration plant. Encouraging results lend support to the technical feasibility of separating high-purity oxides of several key magnetic rare earths, on which currently, the US is 100% dependent, primarily from China, from ore comprising the Elk Creek Critical Minerals Project.

NioCorp’s demonstration scale rare earth extraction and purification solvent extraction process operation is ongoing using solutions generated by the upstream operation of the demonstration plant.

Rare earths were then precipitated out of solution, producing a solid that contains 6% praseodymium (“Pr“) oxide, 25% neodymium (“Nd”) oxide, 0.35% terbium oxide (“Tb“), and 1.6% dysprosium (“Dy“) oxide, with the balance of the solids consisting primarily of rare earths with minor base metal impurities.

Based on these results, L3’s process engineering team have determined that overall recoveries for these four magnetic rare earths are likely to be greater than 92% and meet commercial purity specifications for magnetic rare earth oxides. These results are in line with bench- and pilot-scale testing of L3’s rare earth recovery system, as well as hydrometallurgical performance models that have been run on the rare earth recovery process upon which the demonstration plant is based.

NioCorp is currently focused on demonstrating its ability to recover three high-purity rare earth products:

(1) neodymium-praseodymium oxide, which is the principal component of neodymium-iron-boron permanent rare earth magnets

(2) dysprosium oxide

(3) terbium oxide

“We are very pleased to be able to deliver these outstanding results to NioCorp using the demonstration plant equipment,” said Eric Larochelle, Co-Owner of L3 Process Development. “We have established a baseline of performance in the demonstration plant solvent extraction system, and expect to maintain or exceed these results as we gain further operating experience with that system.”

“These results are right in line with our expectations and are a reflection of the excellent technical pedigree of the L3 team along with a tremendous amount of hard work to get the demonstration plant built, commissioned, and operating,” said Scott Honan, NioCorp’s Chief Operating Officer. “In the coming weeks, we look forward to seeing additional results from L3’s efforts, including the final portions of the operation involving niobium and titanium separations.”

As no economic analysis has been completed on the rare earth mineral resource comprising a portion of the Elk Creek Project, further studies are required before determining whether extraction of rare earth elements can be reasonably justified and economically viable after taking into account all relevant factors.

What a move on NioCorp in recent days. The technicals are something I have covered here on Equity Guru plenty of times. I told readers that we had a false breakdown below $1.00 which is very bullish. My major resistance zone was $1.10. We have now closed above this zone triggering a double bottom reversal pattern.

Not only this, we are back over my moving average, and also are now back above a key trendline. All signs point to momentum higher. Catalysts going forward include more demonstration testing and the big US SPAC acquisition which would see NioCorp traded on the Nasdaq. Meaning more eyeballs on the stock and US money being able to buy shares.

The next resistance zone comes in at $1.50. If we can take this out, then we will test the previous highs at $1.75. The stock remains bullish as long as it remains above the key trendline and the $1.10 key support.