As per usual for the first Friday of every month, the markets were anticipating the US Non-Farm Payrolls (NFP) employment numbers. This data has always been important, but its importance has increased due to Fed Char Jerome Powell pointing to robust jobs data to counter the argument that the US economy is slowing down.

Well the data supports his claim. US jobs data for the month of January 2023 CRUSHED estimates.

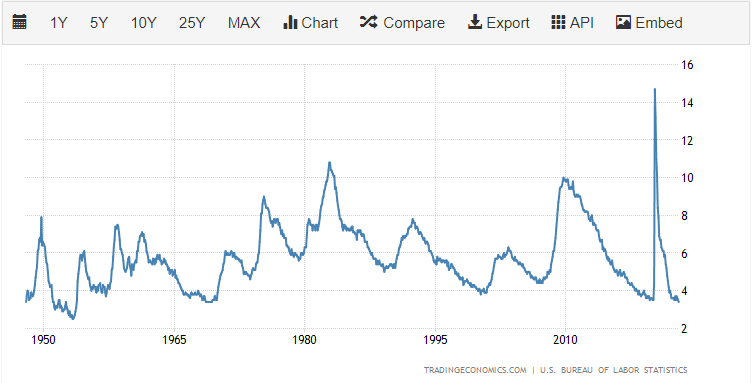

2023 is starting off strong with the biggest NFP gain since July 2022. Nonfarm payrolls increased by 517,000 for January, above the Dow Jones estimate of 187,000 and December’s gain of 260,000.

“It was a phenomenal report,” said Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute. “This brings into question how we’re able to see that level of job growth despite some of the other rumblings in the economy. The reality is it shows there’s still a lot of pent-up demand for workers where companies have really struggled to staff appropriately.”

What recession?

“Today’s jobs report is almost too good to be true,” wrote Julia Pollak, chief economist at ZipRecruiter. “Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction.”

But one of the biggest surprises was the unemployment rate. The unemployment rate fell to 3.4% versus the estimate for 3.6%. That is the lowest jobless level since May 1969.

Markets initially dropped on the data but have now reversed. Although a few markets remain in the red, and the intraday charts show potential reversals.

With employment numbers coming in strong, the Fed’s ‘soft landing’ remains in play. Where they will be able to raise interest rates to a point to tame inflation which will not cause a recession, an economic slowdown or hit the labor market.

Jerome Powell said it is likely that interest rates move higher. Today’s data means that is likely given no evidence of an economic slowdown.

There are a couple of charts indicating this post NFP:

Bond yields are rising. The 2 year is important as it tends to follow short term rates. We have a resistance zone at 4.30%, but yields have not done much in recent weeks. We either drop down, which would mean the markets think the Fed terminal rate is near. Or, we breakout which would indicate the markets are now expecting more rate hikes and higher interest rates.

We also have a very strong pop in the US dollar. The dollar has been getting wrecked ever since breaking below 110 and triggering a reversal pattern. After multiple lower high waves to the downside, and hitting a support level (although 100 is still below and a likely candidate for stronger support), the dollar could be ready to reverse.

We have had two strong green candles back to back. Yesterday’s candle also triggered a false breakdown. If the DXY can close above 103, I would say we have a strong case to make for a reversal in the US dollar.

If you think about interest rate differentials, the US is still higher than many first world nations, and will get stronger if the Fed maintains the course and further raises interest rates. Fundamentally, money tends to flow to the higher yielding currency.