VERSES Technologies (VERS.NE) , a next-generation AI company providing foundational technology for the contextual computing era announced today that it has been selected by 686 Technical Apparel to optimize the flow of its products within its distribution center.

“We are pleased to help 686 better understand the dynamics in their warehouse and how to streamline operations,” said James Hendrickson, President and GM of VERSES Enterprise. “I’ve been a fan of the 686 brand for a while so it’s a treat to contribute to their internal logistics.”

“686 is working with VERSES because we see the benefit in leveraging their AI technology to advance our inventory management and distribution,” said Dave Richards, Director of Operations for 686. “Outdoor apparel is our livelihood, and we are confident that working with VERSES will further improve our process of getting equipment into the hands of our loyal customers.”

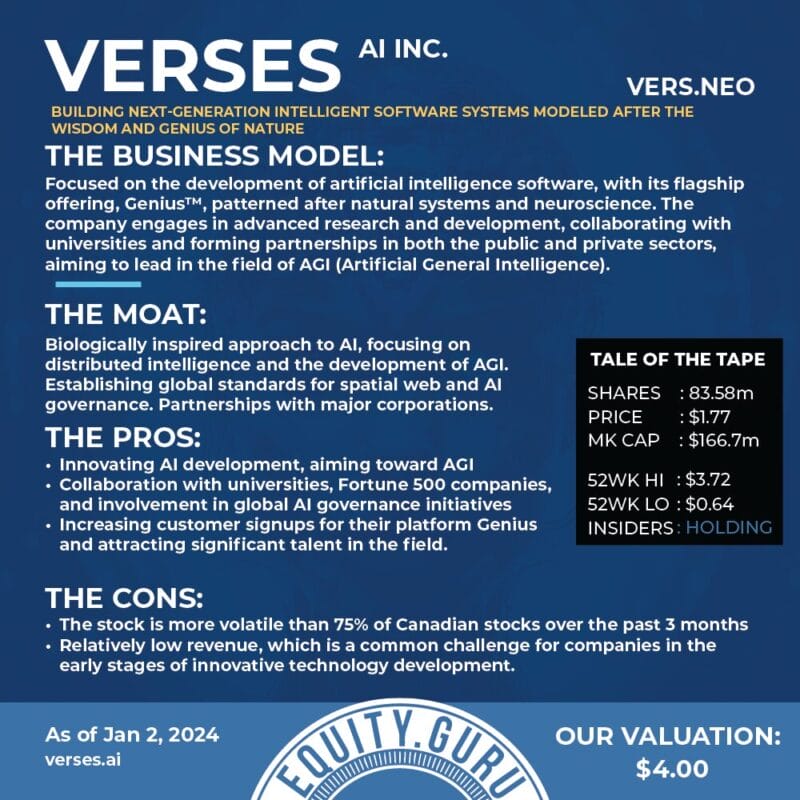

VERSES’ KOSM, the world’s first network operating system for enabling distributed intelligence, provides a suite of services and tools for modeling a site along with its operating procedures in order to generate intelligence in the form of recommendations. The VERSES WAYFINDER™ mobile app then guides workers to deploy these recommended activities resulting in a boost to picking performance, reduced errors, expedited onboarding of new employees, and improving the placement and flow of goods.

It was in November 2022 that VERSES announced another partnership to alleviate supply chains with Blue Yonder, a company specializing in digital supply chain and omni-channel commerce fulfillment providing solutions to over 3500 of the world’s largest retailers and warehouse distribution providers across 78 countries.

Back in September 2022, I outlined that the stock broke down below a major support level. This was the $0.95 zone. I did tell investors that I expected the stock to drop to its next support level. Nothing to do with the fundamentals of the company, but due to a technical breakdown.

Technically, the stock has broken back above what was a previous resistance zone at $0.73. The original break occurred on November 22nd 2022 but momentum stalled at $0.85 and we did not hit our resistance zone at the $0.95 level.

It seems now the stock is ranging between our support zone at $0.73, and interim resistance at $0.85. On January 4th 2023, the stock rallied hard (20%) but failed to takeout $0.85. We can safely say $0.85 is a resistance zone to be aware of with the stock rejecting this zone 3 times. We now wait for a breakout.