Bank earnings kicked off with some surprising news. Mega bank Goldman Sachs (GS) reported an earnings miss. Their largest earnings miss in a decade as revenue fell and expenses and loan loss provisions came in higher than expected.

Here is what Goldman Sachs reported vs analyst expectations:

- Earnings: $3.32 per share vs. $5.48 estimate of analysts surveyed by Refinitiv

- Revenue: $10.59 billion vs. $10.83 billion

The bank’s quarterly profit plunged 66% from a year earlier to $1.33 billion or $3.32 per share. This was 39% below analyst and consensus estimates. This makes this earnings report Goldman Sachs largest earnings per share (EPS) miss since 2011.

Revenues came in at $10.59 billion, or down 16% from a year earlier and below the estimate. Company wide revenue decline was driven by lower results in two divisions: Asset & Management and Global Banking & Markets.

“Widely expected to be awful, Goldman Sachs’ Q4 results were even more miserable than anticipated,” Octavio Marenzi, CEO of Wall Street consultancy Opimas, said in an email. “Revenues were largely in line with forecasts, but earnings took a big hit. The real problem lies in the fact that operating expenses shot up 11%, while revenues tumbled.”

The expectations for a miss were high because of the recent news of 3200 Goldman Sachs layoffs. The cost-cutting was a sign of things to come.

Goldman Sachs said that their operating expenses jumped 11% from a year earlier, to $8.09 billion. More than $800 million more than analysts expected. The reasons given were due to higher compensation, benefits and transaction-based fees.

Another negative data print weighing in on the stock was a $972 million provision for credit losses in the quarter, compared with a $344 million a year earlier, as the bank set aside more funds for potential losses in credit card and point of sale loan portfolios. This number was 50% more than analysts expected.

Early signs of credit deterioration? Higher interest rates are definitely hitting the middle class. As the economy slows down, more borrowers are at risk of falling behind on payments.

“Against a challenging economic backdrop, we delivered double-digit returns for our shareholders in 2022,” Goldman CEO David Solomon said in the release. “Our clear, near-term focus is realizing the benefits of our strategic realignment which will strengthen our core businesses, scale our growth platforms and improve efficiency.”

As Goldman Sachs missed on earnings, Morgan Stanley topped estimates with record management revenue. In the fourth quarter, net income fell to $2.11 billion, or $1.26 per share, from $3.59 billion, or $2.01 per share, a year ago, but it topped an analyst estimate of $1.19 a share from Refinitiv.

At time of writing Goldman Sachs is down more than 7%. The drop is putting some pressure on the S&P 500 and the Dow Jones.

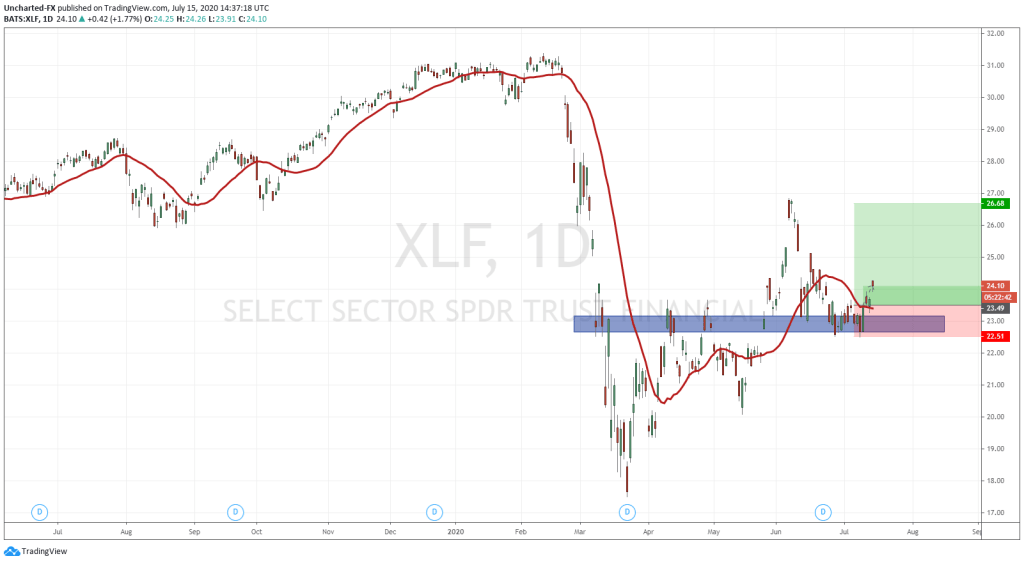

Applying my market structure technical analysis, Goldman Sachs actually triggered a breakdown back on December 5th 2022 when a double top pattern was confirmed and triggered. We had one leg lower, or a lower high, and it seems that a second one is developing which would see us break below the $340 support and likely test the next support coming in at $310.