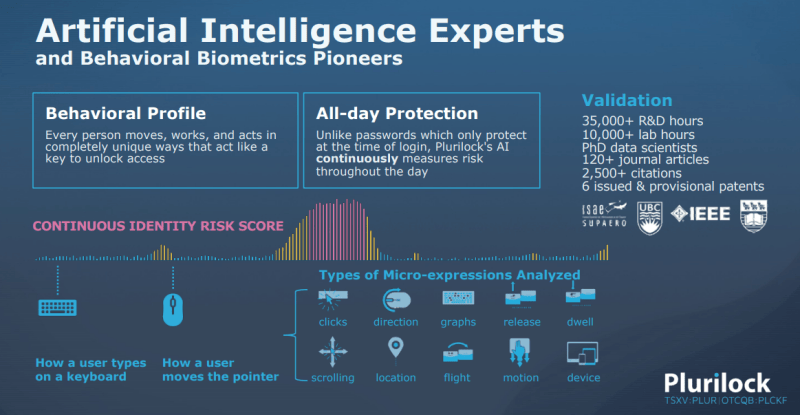

Plurilock Security (PLUR.V) is a Canadian identity-centric cybersecurity solutions play. The cybersecurity company provides multi-factor authentication (MFA) solutions using behavioral-biometric, environmental, and contextual technologies.

What the heck does all that mean?

Machine Learning that reduces or eliminates the need for passwords by measuring the pace, rhythm and cadence of a user’s keystrokes to confirm their identity. No more having to remember your first pet’s name for a password!

Today, Plurilock announced the release of an AI-driven security automation application that is powered by ChatGPT.

The technology demo showcases the capability of using a Large Language Model (LLM) form of AI, specifically ChatGPT, to address common business workflows. Specifically, security questionnaires that are frequently used between organizations to assuage the security posture of one organization doing business with another.

The new demonstration enables users to upload security questionnaries and instantly complete them with content, saving hours of repetitive work by security teams.

For access to Plurilock Labs cybersecurity AI answers tool and to see a demonstration of the potential of LLMs, readers can explore the tool here.

ChatGPT is the hottest thing right now when it comes to technology and investing. Many of my computer science friends are telling me how significant ChatGPT is… and are worried about losing their jobs. AI and investing in anything associated with ChatGPT is something they are looking at.

With today’s ChatGPT related news, Plurilock Security stock is currently over 19% at time of writing with over 191,000 shares traded.

This news comes after a busy few weeks from Plurilock which included the closing of financing of $1,556,120.30, receiving multiple sale orders for the company’s flagship software platform from three overseas customers, and announced that contracts and orders for 2022 totaled roughly US $42.3 million in sales.

The main customer was the National Aeronautics and Space Administration’s (NASA) Solution for Enterprise-Wide Procurement (SEWP) program, a U.S. Government-Wide Acquisition Contract Vehicle (GWAC). Plurilock continues to get deals with government and defense verticals.

The stock has recently printed all time record lows at $0.12. The stock was on the radar for bottom pickers.

My readers know I look for stocks which have been in a long downtrend and then show some signs of basing which indicates the exhaustion of selling pressure. We have that here.

Plurilock stock looks to be confirming an inverse head and shoulders reversal pattern. The trigger can be confirmed by the end of trading today with a close above $0.135. So far so good, but we still have some trading left for the day.

A breakout would trigger the pattern, and the stock can build momentum as long as it remains above $0.135. There is some resistance at $0.175, but the major zone comes in just above the $0.25 level.