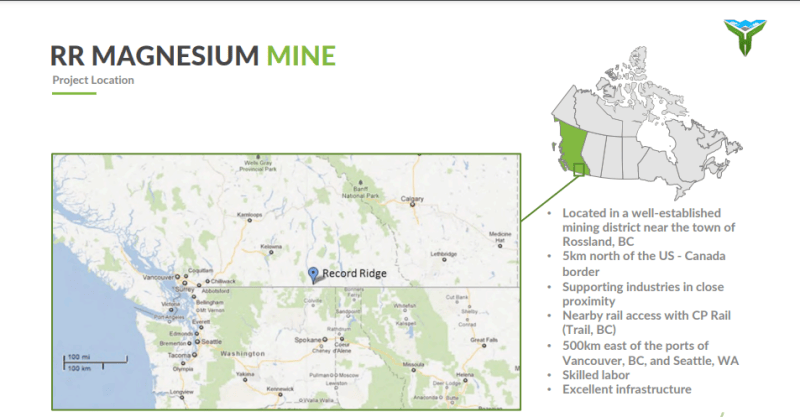

West High Yield resources (WHY.V) is a company with the objective to bring into production one of the world’s largest, greenest deposits of high-grade magnesium. The Record Ridge magnesium deposit is located 10 kilometers southwest of Rossland, British Columbia has approximately 10.6 million tonnes of contained magnesium based on an independently produced preliminary economic assessment technical report.

The stock recently was on a tear after a press release of the positive pre-feasibility study for a viable Magnesium Oxide production facility. Kicking things off has a low capital intensity, with initial capital expenditures of $205.4 million including mine pre production, processing, and infrastructure.

The first offering consists of the sale of up to 1,500,000 units at a price of CAD $0.50 per unit for gross proceeds of up to $750,000. Each flow-through unit consists of a common share and one half of one common share purchase warrant. Each warrant, together with CAD$0.70, will entitle the holder thereof to acquire one additional Common Share for a period of eighteen months from the date of issuance.

The second offering consists of the sale of up to 1,190,476 units at a price of CAD $0.42 for gross proceeds of up to CAD $500,000. Each unit consists of a common share and a common share purchase warrant. Each Standard Warrant, together with CAD$0.70, will entitle the holder thereof to acquire one additional Common Share for a period of twenty-four months from the date of issuance.

The proceeds will be used for working capital purposes and expenses. Flow-through units will be used by the company to incur CEE and CDE that will qualify as “flow-through mining expenditures” in respect of the Company’s Record Ridge magnesium deposit and Midnight gold claim.

I released my technical analysis on the stock on November 21st 2022. West High Yield Resources met the criteria for a trend reversal set up. Not only did we confirm a breakout of the range with a large green candle, but we also took out the first resistance zone at $0.30. Now, $0.30 becomes the new support or price floor. As long as the stock remains above this support, we can expect to see more highs.

The stock did hit my second resistance zone at $0.565. This remains the key level for bulls. Fortunately for bulls, the stock has just made one higher low in the current uptrend. And according to market structure theory, we should expect to see at least one more. This next higher low swing should take us above our key resistance zone.

The stock could see some more pullback as traders take profits after such a large move and as we head into the Christmas trading period. Pullbacks will likely see buyers step in as long as we remain above our $0.30 support level.