Interra Copper (IMCX.CN) announced that it has entered a non-binding letter of intent (LOI) with Alto Verde Copper for a proposed acquisition expected to be completed by way of three-cornered amalgamation. A newly created wholly-owned subsidiary of the company will amalgamate with Alto Verde to create a new company, (“Newco”) with Newco becoming a wholly-owned subsidiary of the company at closing.

Interra Copper will add copper exploration properties in a prolific copper belt in Chile, South America that have the potential to be scalable. The acquisition will also add significant experience to Interra’s management team.

Director and CEO Jason Nickel states, “We are excited to combine forces with Alto Verde Copper and their team as we look to develop and expand our asset base in both British Columbia and now within the prolific Chilean copper belt. The addition of Alto Verde Copper and its team broadens the Company’s overall bench strength as we continue to advance our growth plans which include a more global platform.”

A proposed private placement financing will see minimum gross proceeds of CAD $2.5 million raised at a price of CAD $0.50 per share. Warrants at an exercise price of $0.75 per warrant share will also be part of the financing.

Alto Verde is a private mining company focused in the Chilean Copper belt. Their portfolio consists of three copper exploration projects: Pitbull in the Tarapaca Region and Tres Marias and Zenaida in the Antofagasta Region. Alto Verde holds a significant land package covering an area of 16,250 hectares with the projects situated proximal to several of the world’s largest mines. Notable copper miners in the region include Antofagasta Minerals, BHP Billiton, Glencore and Freeport-McMoRan Inc., among others.

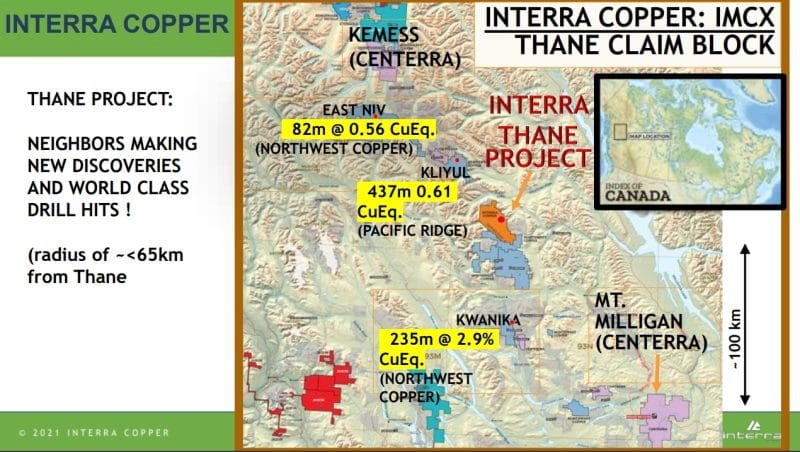

Interra Copper is betting on long term copper supply/demand dynamics to create a copper bull market. The company is focused in British Columbia’s Quesnel Terrane Copper belt.

The focus is on the Thane Project.

The Thane Property covers approximately 206 km2 (50,904 acres) and is located in the Quesnel Terrane geological belt of north-central British Columbia, midway between the previously operated open pit Kemess Mine and the current open pit Mount Milligan mine, both two copper-gold porphyry deposits. The Thane Property includes several highly prospective mineralized areas identified to date, including the ‘Cathedral Area’ on which the Company’s exploration is currently focused.

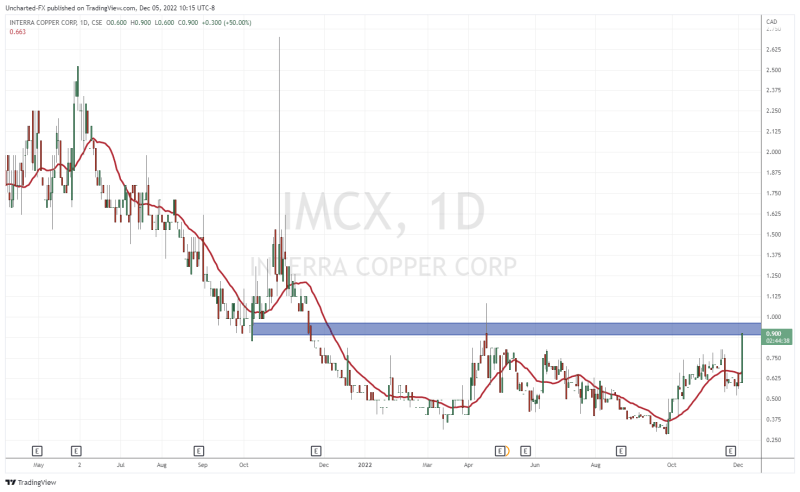

The stock is up 50% at time of writing. We are about to test a major resistance level for the stock. You can see that this zone was rejected when the stock tested it in April of this year. The $1.00 zone is also a major psychological resistance zone.

It would be very bullish seeing a close above $1.00, something the stock has not seen since 2021. If so, the momentum on this major breakout could see the stock hit $1.50.

The invalidation zone? If Interra Copper stock closes below $0.55, we would see the current higher low be taken out and it would take some time to regain upwards momentum.

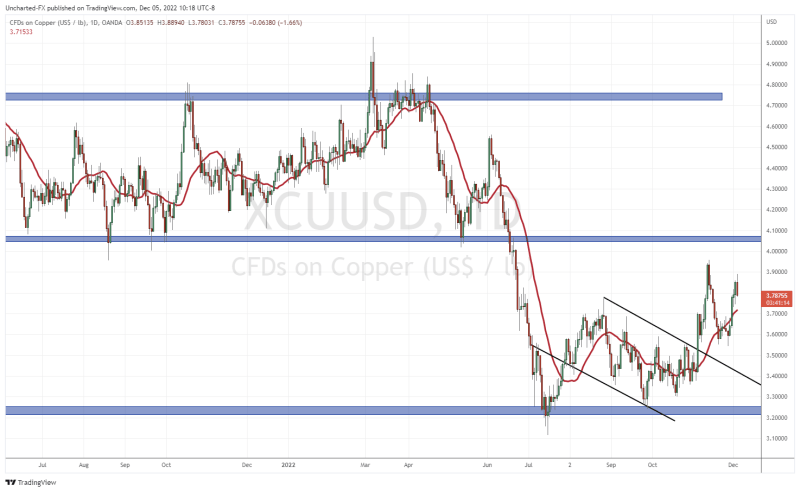

Copper prices recently broke out of a channel pattern and still remains above it. We saw some rejection at $4.00. China news, recession, and a strong dollar are all weighing on the base metal.