Fortune Bay (FOR.V), a Canadian-based gold and uranium explorer operating in Canada’s top-ranked jurisdiction, filed an NI 43-101 PEA Technical Report for the Goldfields Gold Project in Saskatchewan.

The wholly-owned Goldfields Project is located approximately 13 kilometres from Uranium City in northern Saskatchewan and is comprised of 12 mineral dispositions covering a total of 5,031 hectares. The Project includes the Box and Athona gold deposits, as well as other gold occurrences discovered during historical exploration. The Box and Athona deposits were discovered in the 1930s by surface prospecting.

The project is located within a historical mining area and benefits from established infrastructure, including a road and hydro power line to the Box deposit. Nearby facilities and services in Uranium City include bulk fuel, civil contractors and a commercial airport.

Goldfields has a history of gold production with 64,000 ounces of gold extracted from the project between 1939 and 1942. It has also had numerous exploration drilling campaigns with over 1,000 drill holes on the property as well as historical mining studies completed by previous owners of the project.

Historical work at Goldfields also included prospecting and mapping, trenching, sampling, ground and airborne geophysical surveys predominately focused on known gold occurrences discovered during early prospecting.

Fortune Bay commenced exploration activities on the property in 2015 and carried out additional field investigation of selected targets in 2021, along with reinterpretation of historical (2010) Titan DC/IP data. Results were integrated with all compiled historical exploration information in 2021 to generate exploration drill targets searching for additional gold deposits within the Goldfields Syncline.

The most recent PEA Technical Report of Goldfields Gold Project provides a base case assessment for developing the Goldfields mineral resource by conventional open-pit mining methods, and gold recovery with a standard free milling flowsheet.

The economic model supports an operation with low capital cost and high rate of return over an 8.3-year mine life, with an average annual production of 101,000 ounces of gold.

Highlights from the Goldfields PEA include:

- Robust economics with after-tax net present value (NPV) (discount rate 5 per cent) of $285-million, internal rate of return (IRR) of 35.2 per cent and payback of 1.7 years estimated with gold price of $1,650 (U.S.) per ounce;

- Average annual gold production of 101,000 ounces over life of mine (LOM), with an average of 122,000 ounces per year in the first four years;

- 8.3-year LOM producing 835,000 ounces of gold;

- Average cash cost of $778 (U.S.)/oz and all-in sustaining cost (AISC) of $889 (U.S.)/oz gold;

- Initial capital expenditure of $234-million.

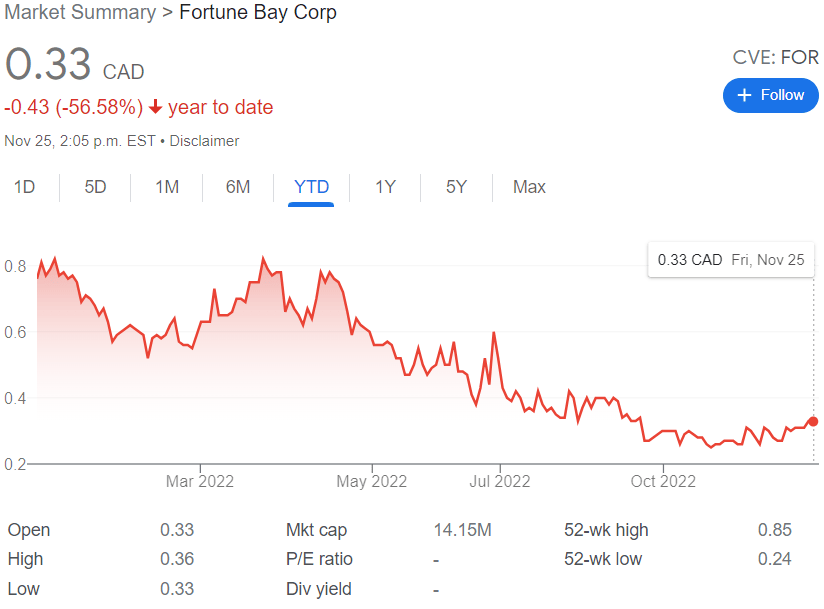

Fortune Bay currently trades for $0.33 CDN per share for a market cap of $14.15 million.