Standard Uranium (STND.V) announced today that it has closed the second and final tranche of its non-brokered private placement as announced by the company on September 7th 2022.

The second tranche saw Standard Uranium sell 750,000 units at a price of C$0.11 per unit and 15,386,154 flow-through (FT) units of the Company at a price of C$0.13 per FT unit for aggregate proceeds of C$2,082,700.02.

When combined with the first tranche, Standard Uranium has sold 9,923,259 Units and 24,330,554 FT Units for aggregate gross proceeds of C$4,254,530.02.

Each unit consists of one common share and one half of one common share purchase warrant. Each FT unit consists of one common share issued as ‘flow-through share’ and one half of one warrant. Each whole warrant entitles the holder to purchase one common share of Standard Uranium at a price of C$0.17 at any time on or before that date which is 24 months after the issue date.

Net proceeds from the private placement will be used for exploration and working capital purposes.

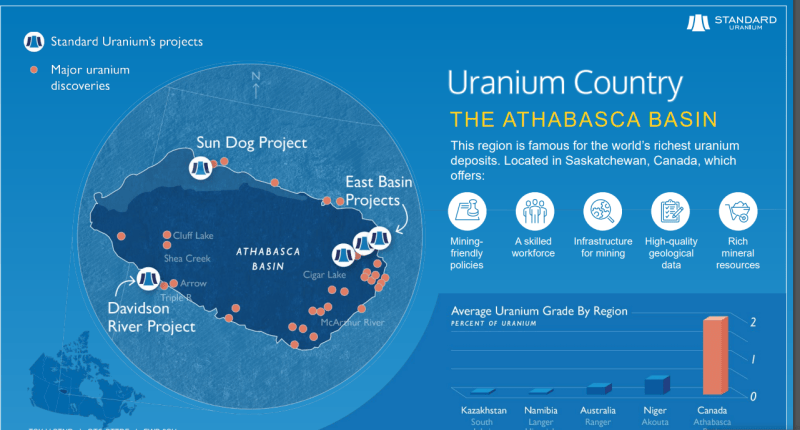

Standard Uranium is an exploration company and evaluates, acquires and develops uranium properties in Canada. Its flagship project is the Davidson River Project. The Davidson River Project is located in the heart of the Patterson Lake Uranium District (Southwest Athabasca region). Surrounded by major players in uranium exploration and development including Cameco, Orano, NexGen, Fission Uranium, Fission 3.0, Denison, Purepoint, UEX, ALX and Skyharbour. Other projects include the Sun Dog and East Basin Projects.

Drilling at the flagship Davidson River Project was successfully completed ahead of schedule and under budget as detailed by a July 21st 2022 press release. The company now has the funds to continue exploration and create catalysts for shareholders.

Standard Uranium has been in a downtrend and is now in the range, or consolidation phase. This is positive for technical traders as a consolidation is a phase which tends to come before a new uptrend.

Support comes in at $0.07 (which is the previous record all time lows) and resistance comes in at $0.145. Support is an area where buyers enter and we can expect to see a wall of buyers at $0.07. For those wanting to enter on a technical breakout, we would need $0.145 to break. This triggers the end of the range and the beginning of a new uptrend.