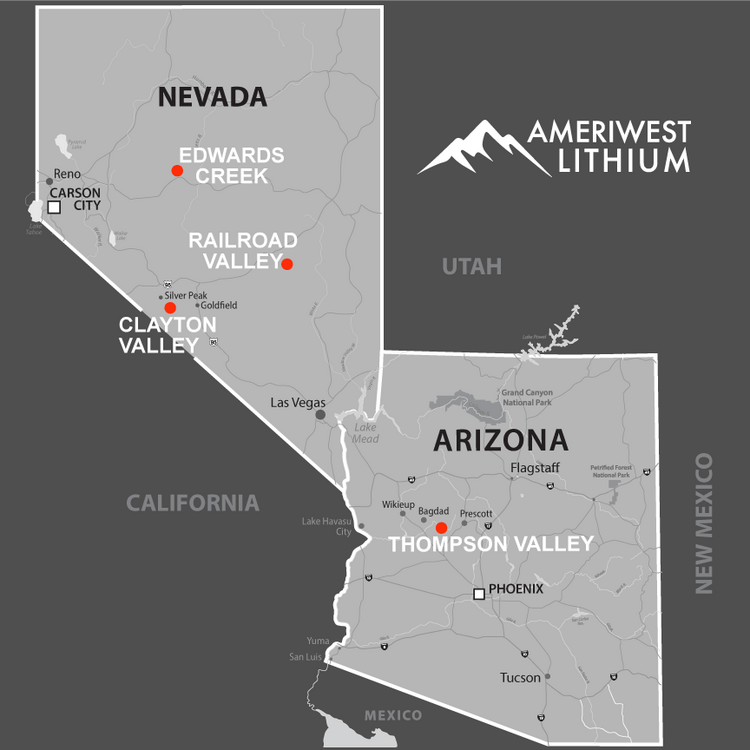

Ameriwest Lithium (AWLI.CN) is an exploration company focused on developing strategic lithium clay and brine mineral resources in Nevada and Arizona.

The Company is currently exploring its 6,900-acre Thompson Valley lithium clay property in Arizona. In Nevada, it is exploring its 15,300-acre Railroad Valley lithium brine property, its 22,210-acre Edwards Creek Valley lithium brine property, its 5,760-acre Little Smoky Valley lithium clay property, and its 7,380-acre Deer Musk East lithium brine property.

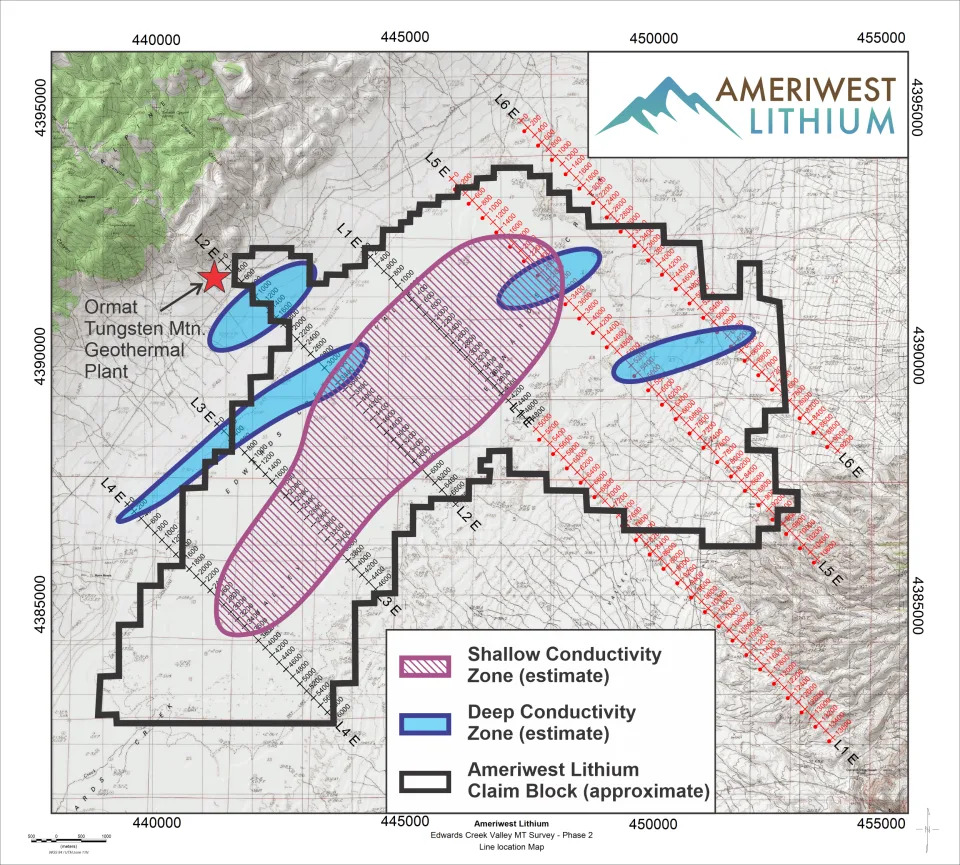

Today’s news has to do with the Edwards Creek project in Nevada. Ameriwest Lithium announced that results from a magnetotelluric (MT) geophysical survey at Edwards Creek shows potential to host a much larger shallow brine target than previously thought.

David Watkinson, President, and CEO of Ameriwest stated, “We are extremely excited by the results of the MT Survey, especially the delineation of a large near surface brine target that appears to be almost 20 square kilometers in size. The Company plans to move forward with permitting to test this shallow target with drilling and will ultimately follow up with testing of the deeper targets in the future.”

An MT survey measures electrical resistivity of the subsurface. Low electrical resistivity, which is the same as high electrical conductivity, is known to be caused by the presence of highly saline water within the pores of a host reservoir. The saline water, or brine, may host lithium.

The MT result above shows a large shallow near surface zone of high conductivity in the dark colors.

Next steps? Drilling and sampling to determine whether significant lithium concentrations within the brine have been discovered.

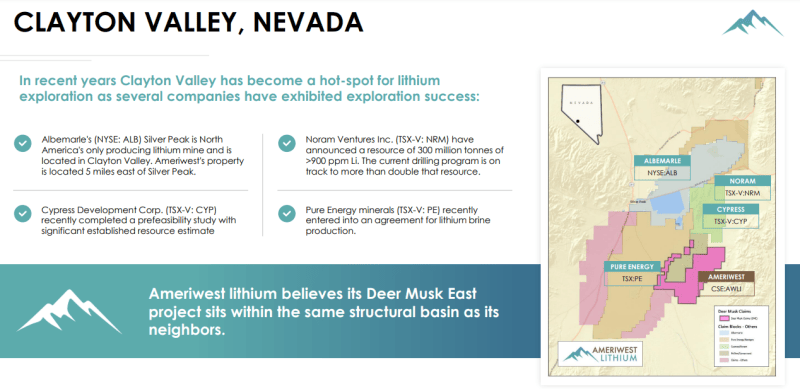

The company believes this property has the potential to host a large lithium brine deposit based on geophysical studies, and similar characteristics this shares with those located in Clayton Valley, Nevada which is the new hotspot for lithium exploration success.

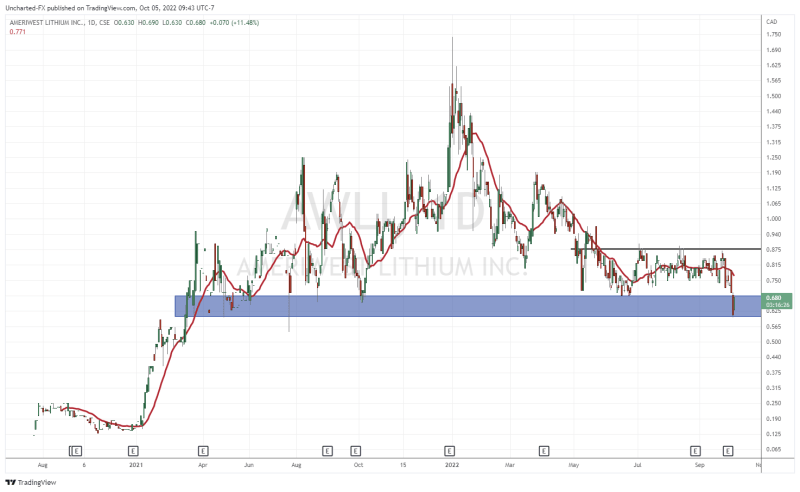

Today’s news has seen the stock pop over 11% at time of writing. This pop is occurring at a major support zone for the stock. A support zone which has been held since 2021. One can make the case that this support has already been taken out with a break below $0.685, and this price action is just the retest before a move lower.

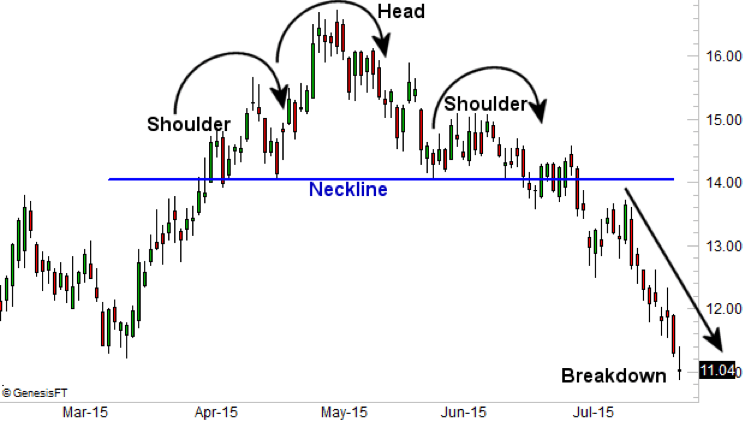

What worries me about the chart is the appearance of a broader head and shoulders pattern.

You can clearly see the structure with the head and two shoulders.

What I would be watching for is a close back above $0.685, to reclaim what was once support. This would be an encouraging sign for bulls and hint at a false breakdown. The next resistance then comes in at the $0.875 zone. An area which will need to be taken out for further upside momentum for the stock. Drill results and confirmation of the MT finds would be the type of catalyst which would get us this kind of breakout.