Northstar Clean Technologies (ROOF.V), a Canadian company focused on the recovery of components from single-use asphalt shingles, announced today that it had signed a binding term sheet with Renewable U Energy Inc for a strategic financing of debt and securities.

The financing, composed of common shares in the company and secured convertible debentures, is meant to facilitate Northstar’s proposed phase 1 expansion plan for the construction of three scale-up asphalt shingle reprocessing facilities in Calgary, the greater Toronto area and the Pacific Northwest, United States.

The transaction provides Northstar with over $43.5 million CAD which will fully finance its phase 1 expansion plans. The alignment with Renewable U as a long-term partner provides benefit of a three-facility structure that avoids time-consuming financing endeavours on an individual facility basis.

Northstar will retain full management for the partnership leading engineering, procurement, construction, operation, and continuing optimization of each facility.

The deal includes a non-brokered private placement of $1.95 million to Renewable U of up to 4.88 million common shares. The transaction also includes the issue of up to $4.8 million in secured convertible debentures with an interest rate of 6% per annum, convertible to common shares from year 2 until the date of maturity of each debenture.

The private placement also includes the issuance of an aggregate of 4.5 million non-transferable common share purchase warrants of Northstar to Renewable U which can be exercised at a price of $0.60 per common share for a period of up to 24 months from the date of issuance.

The purchase warrants are subject to acceleration if at any time after the date that is four months plus one day after issuance, the closing price of Northstar common shares on the TSX Venture Exchange equals or exceeds $1.25 per share for 10 consecutive trading days.

Aidan Mills, Northstar CEO and director, commented on the transaction, “Over the last several months, we evaluated detailed proposals from a wide variety of potential funding partners and considered each in considerable detail, both quantitatively and qualitatively. At the end of this extensive process, Renewable U was our most attractive financing option. We are delighted to partner with Renewable U on the strategic financing of our phase 1 expansion program. We believe this financing option effectively advances our strategy of creating stakeholder value by both minimizing dilution and securing debt funding for our first three facilities. With Renewable U, we have a long-term partner that fully understands our business and we now look forward to building a long-term relationship together through the successful delivery of our leading-edge technology. With debt funding for three facilities secured, this not only gives us the ability to fully focus on the delivery of the Empower Calgary facility, but also progress the development for the following two facilities without the significant distraction of seeking additional funders. Strategically, this partnership provides Northstar with a solid funding platform, which is exactly the outcome we hoped for from our funding process.”

In other news, Northstar recently announced that it had obtained an 80-tonne purchase order of liquid asphalt by a major international manufacturer.

The writers at Equity Guru did a roundtable analysis video on Northstar back in December 2021:

Northstar reported it had $2.3 million in cash as of June 30, 2022, with a working capital surplus of $1.7 million.

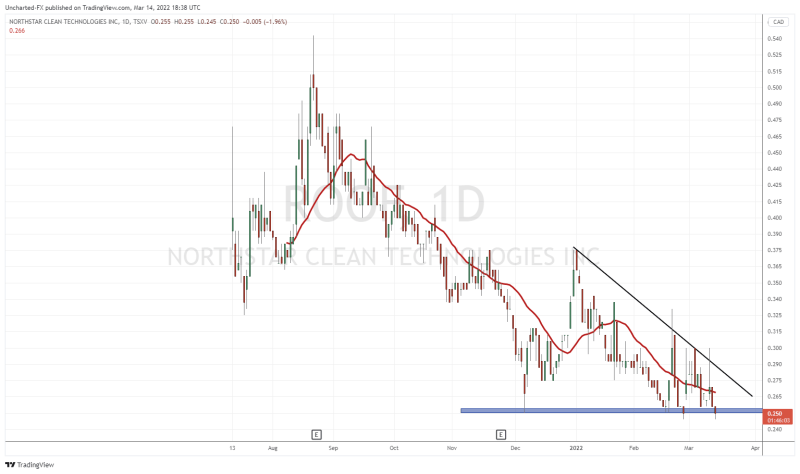

The company currently trades at $0.20 per share for a market cap of $20.26 million.