Prismo Metals (PRIZ.CN) shares are up over 9% with no news. Many are speculating that good news in the form of positive assays are coming.

The junior mining company is focused on precious metal exploration in Mexico. The objective is to locate and develop economic precious and base metal properties of merit with a focus on targeting underexplored districts proven to produce top-tier assets.

The Company has entered into two property option agreements: (1) the ProDeMin Option Agreement whereby the Company was granted the option to acquire a 75% interest in the Palos Verdes Property; (2) and the Cascabel Option Agreement whereby the Company was granted the option to acquire a 100% interest in the Los Pavitos Property.

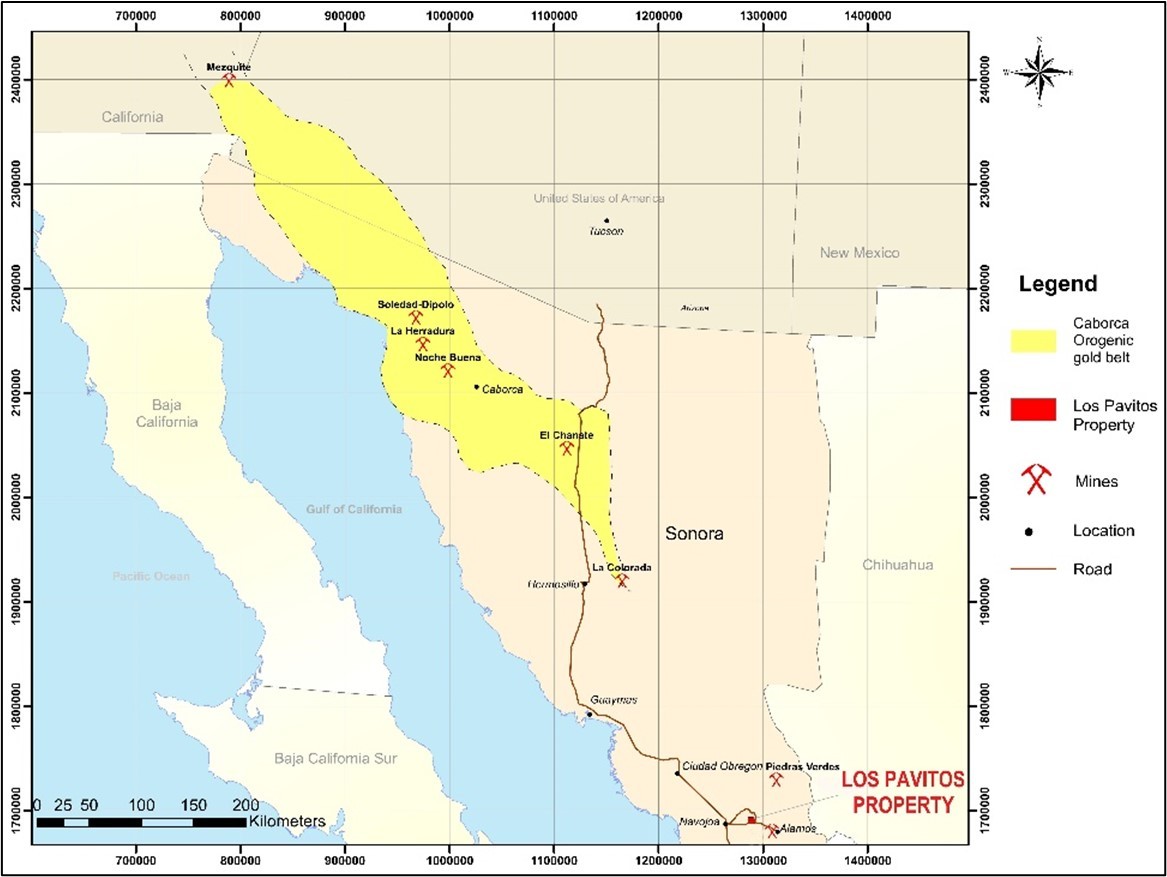

The Los Pavitos project is located in the Alamos region of southern Sonora state and is surrounded by many active exploration and mining projects. To exercise the Cascabel Options, the Company is required to incur USD $1.5 million in exploration expenses over the five-year period of the Cascabel Option (of which CAD $ 210,000 has been incurred to date), pay an additional USD $500,000 Cascabel and issue to Minera Cascabel an additional 2,000,000 common shares.

The most recent press release from Prismo Metals has to do with Los Pavitos. On August 29th 2022, the company announced it has received data from the LiDAR survey and preliminary interpretation of the topographic images is ongoing. Several structural features and small mine workings are visible in the data which will help to define the major mineralized structures at the project. The analysis of the data to date has identified several areas with small prospect pits that have not yet been visited or sampled.

Dr. Craig Gibson said: “While our analysis of the LiDAR data has not yet been completed, we are delighted with the results to date. Structural features and small mine workings are clearly visible in the data, and we feel that it will greatly aid in the delineation of important structural trends as part of the process to identify drill targets for a drilling campaign planned in late 2022.”

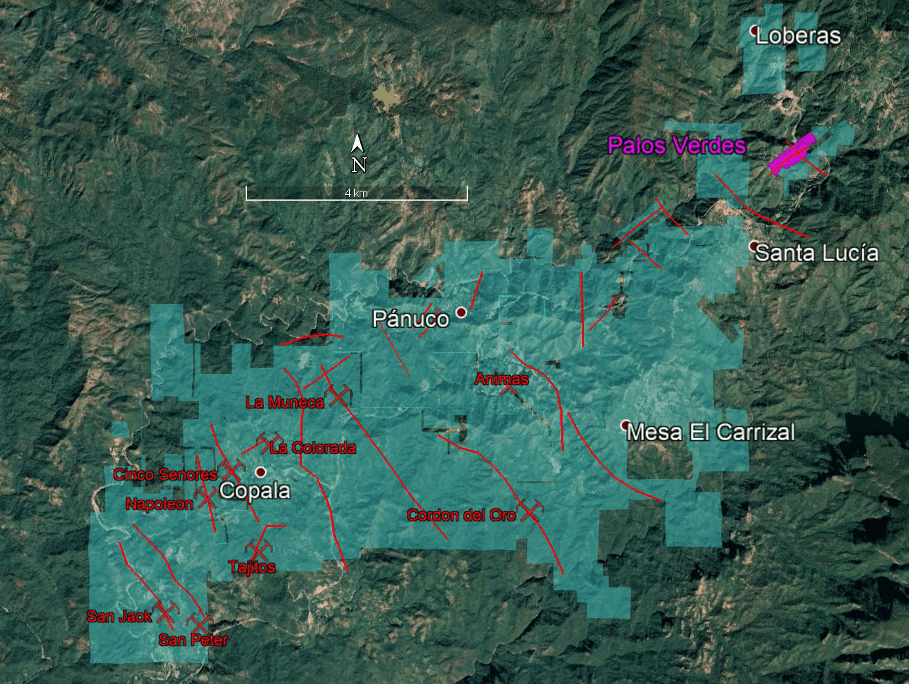

The Palos Verdes project is located in the southern part of the State of Sinaloa in northwestern Mexico. Previous owners of the property have done limited sampling. ProDeMin compiled a sample database with 61 samples taken by previous workers at the project with values of as much as 4.15 g/t Au and 732.7 g/t Ag.

The project just sits outside the Panuco-Copola mining district. This district is historically the most important silver producer in Sinaloa with abundant mines and prospects. Currently several small mines produce minerals for a few mills in operation in the region. Much of the district has been consolidated by Vizsla Resources and their drill program is underway.

Prismo announced a 2,000 meter drill program at Palos Verdes on August 18th 2022. The drill program is designed to test the Palos Verdes vein and a structural intersection with a second vein at depths where it is believed that potential for a large ore shoot is present, similar to the drilling accomplished by Vizsla Silver on their adjacent land package.

Previous shallow drilling has intersected high grade mineralization with the best intercept of 2,336 g/t Ag and 8.42 g.t Au over a true width estimated at 0.8 meters within a larger mineralized interval with 1,098 g/t Ag and 3.75 g/t Au over a true width of 2.3 meters.

Regarding the drill program, Dr. Craig Gibson, President and CEO of the Company, said: “We are pleased to be able to conduct our program to drill holes to intersect the Palos Verdes vein at significantly deeper levels than in the previous drilling campaigns. We will be able to test the vein several hundred meters underneath the surface exposures with the first hole being underway.”

Could positive results from Palos Verdes on the way? The stock is up today over 9% with 97,900 shares traded on no news.

On the stock chart, Prismo metals remains in a channel, bouncing between the upper and lower limits of this channel. We are near the $0.25 price level which tends to be an important psychological zone for stocks priced under $1.00.

Support currently comes in at $0.19 before the lows at $0.12. Resistance comes in at the $0.31 zone. A strong close above $0.25 with a few days of remaining over this price level could build the momentum required to take out the $0.31 resistance. Of course positive news can be the major catalyst for a breakout as well.