My first crush was a boy named Tommy in elementary school. In retrospect, I don’t know if I liked him or if we were both just short. At age 11 things like matching height or who could run the fastest mattered in terms of choosing a romantic partner.

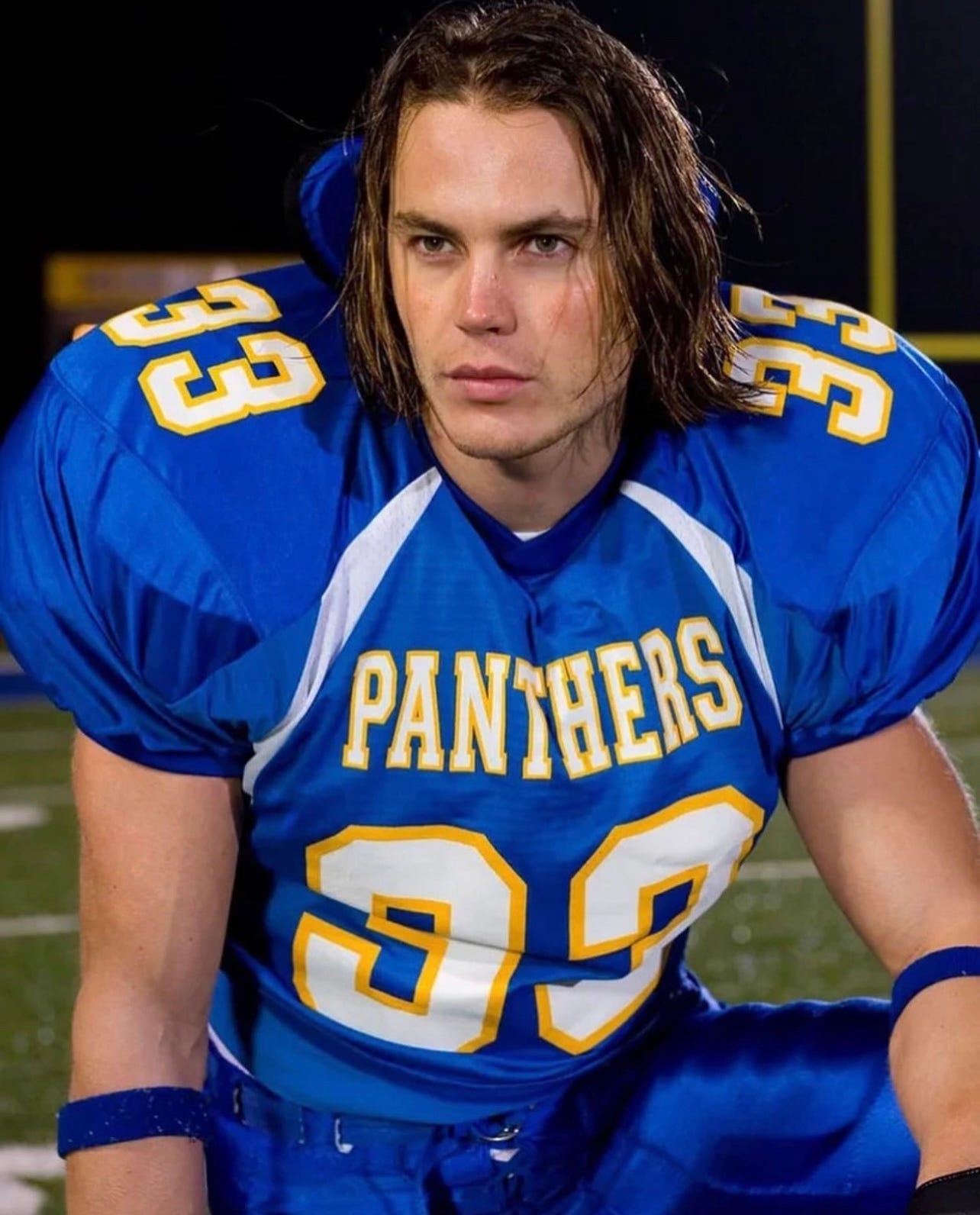

My first onscreen love was Tim Riggins in Friday Night Lights. He had everything a teen girl could dream of; glossy brunette hair, big arms, a spot on the star football team, a laissez-faire womanizer front (with overt underlying childhood trauma), and alcoholism. As I watched him roll around the dirty couch in his trailer park, surrounded by a collection of empty beer bottles, missing the first day of school at Dillon High, my impressionable young mind thought – my guy.

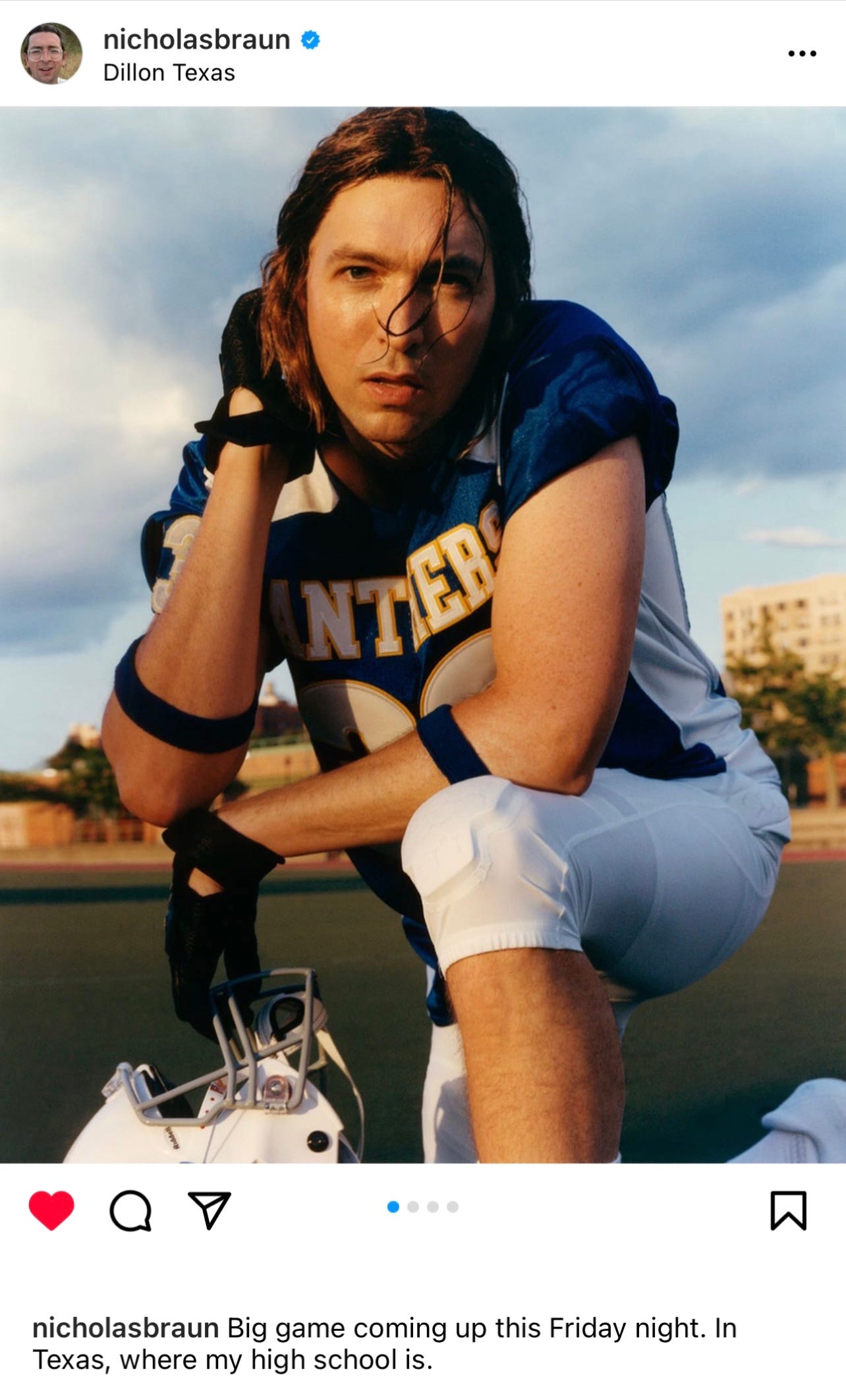

Much later in life, the show Succession came out. A man named Nicholas Braun plays the role of Cousin Greg. As soon as I watched his character smoke up in a cheap car outside of his workplace (an amusement park), I was taken. I’m not sure if it was his painfully awkward demeanor or giraffe-like stature that did it for me – probably a combination of both. But I learned that I liked people whose mere existence was amusing. As if whatever higher power that makes us poured in a little too much of something and a little too little of something else.

And just last week, that same higher power brought me (specifically), a gift in the form of an Instagram post that actually made me think wow, social media isn’t so bad.

I then saw this photo of Neil Patrick Hariss’s new tat of a bunny in a magician’s top hat and realized oh, never mind, it is so bad after all. (As though simply admitting you’re an adult man who’s into sleight of hand isn’t cringey enough).

Much to my dismay, my boss does not pay me to share My Dear Diary to all of you people – though I know you’ve been oh so riveted by my divulgence. And I intend to keep this next part tantalizing despite the fact that I will now be talking about an investment strategy called dollar-cost averaging rather than sexual awakenings.

Just pretend Tim Riggins is reading this out loud to you in front of a fireplace with a scotch (maybe even in his trailer park). I guarantee this will keep up the allure. And, may I remind you, there is nothing sexier than being financially literate!!

What is dollar-cost averaging, you ask?

What a hot question!

Dollar-cost averaging is investing the same amount of money at regular intervals.

For lack of an original metaphor, this is not rocket science. You invest $100 every two weeks from your paycheque? You’re dollar-cost averaging!

If you’re a big feelings type of person, dollar-cost averaging can help take the emotion out of investing. It compels you to continue investing the same amount regardless of market fluctuations, which in turn helps you avoid that niggly temptation to “time” the market.

In my humble, always unsolicited opinion, making your financial life as stress-free as possible should be priority #1. I know that is oxymoronic, a stress-free financial life, but this strategy is a cute little tool to avoid worrying about market volatility and other icky things that give you wrinkles.

3 Reasons to Dollar-Cost Average:

1. Reduced risk

Risk is a very romantic notion in terms of one’s love life.

Take, for instance, the ending of Good Will Hunting when Matt Damon drives off and leaves everything behind because he’s “gotta go see about a girl”.

Or in the Titanic when Rose tells Jack “I’ll never let go”. This one presents more of a physical risk, but you get the picture. I’d rather die with you than live without you sort of manic energy.

On the other hand, risk, in terms of one’s financial life, is not a very romantic notion at all.

Dollar-cost averaging (DCA) is our new romantic hero, financially speaking. It allows you to spread out your investing intervals which also means spreading out your investment risk. The cost of your investment averages out over time as you buy at high and low prices. Basically, if the value of the investment were to decline, the decrease could be less compared to if you invested a lump-sum amount at a high price.

2. Convenience

We’re busy people. Not only do we have to fit in time to go for walks, drink our coffee, and mindlessly troll Instagram for the worst ink collection in history (Neil Patrick Harris don’t think I missed that Series of Unfortunate Events inspired eyeball). We also need to find time for, like, a job, spending time with friends and family, and maybe even a love life?! It is safe to say that spending your precious hours on investing is just one thing too many.

With DCA you’re investing at regular intervals, regardless of whether prices are up or down, so there’s no need to time the market or think about when the optimal time is to invest. This could be ideal if you have a longer investing horizon. And if you have a shorter investing horizon you’re probably in finance or have a gambling problem – regardless, you should then seek information elsewhere.

3. Budgeting

I am a complete hypocrite to pretend to know anything about budgeting. I make an undetermined amount of money yearly (it spans from being able to take a hotels-only European vacation to living under the Burrard Street bridge – give or take some drama) so the concept of budgeting is quite foreign to me. But in gathering knowledge from outside sources (i.e., real life adults who budget) it is safe to say that dollar-cost averaging can fit into your financially literate life swimmingly.

You can set a predetermined amount each month to invest while considering other financial priorities like paying rent or student loans. All this to say, you can reach your investing goals in time while staying within your budget! What a stunningly practical concept.

3 Reasons Some Financial Bros Choose Not to Dollar-Cost Average:

1. Lower returns

I am a firm believer in setting a low bar. It leaves little room for catastrophic disappointment yet ample space for pleasant surprise. If you walk into a blind date expecting very little, you cannot be disenchanted. If you go in expecting a young Brad Pitt circa 1985, there may be a degree of dismay. (I’m sure a therapist would have something to say about this mindset being closed off and too self-protective, but I cannot help but be a cynic by nature).

With dollar-cost averaging, in the long-run, you may receive less returns on your investment compared to investing a lump-sum amount. By spreading out your investment purchases, only some of your funds will benefit from being invested early. You may miss out on capital gains, interest or dividends. However, if you’re running about trying to time the market to make it big, you set yourself up for probable disappointment. To each his own.

2. Increased costs

This was the only real hitch to DCA that I could get behind. When making multiple investment purchases over a period of time, you incur more trading or transaction costs compared to investing a one-time, lump-sum amount. But, for aforementioned convenience purposes, this may be worth the extra cost. To each his own.

3. Missed opportunities

I missed my opportunity to go to the gym this morning. Again. For my 56th day in a row. Am I any worse off for it? Probably. Do I care? Not at all.

This is the same way I feel about this “disadvantage” of dollar-cost averaging, but I have to write about it anyway in order to be, like, “a good financial educator”. I guess that in theory, there could be situations where it would be advantageous to invest a larger amount, such as if you anticipate prices to increase soon. However, with dollar-cost averaging, you only commit a fixed dollar amount at each investing interval. Of course, the flip side of this is the ability to budget and feel secure so… To each his own.

Until next week.