As a Canadian, I have been focused more on inflation data in my own country and that of the US. US data is important because of the Federal Reserve and their influence basically on world equity markets. When it comes to Europe, regular readers know my stance. It will be a tough Winter for Europe. Energy and fuel shortages will be a concern, and we may need to add food to that.

In my agriculture roundups, I have not focused much on Europe. But there was a MAJOR European event in this space. I am talking about the Dutch farmers protests which are still going on. If you read my piece on this protest, you will know the Netherlands are a large food exporter. The UK is one of the major destinations for Dutch exports. Naturally, if farming is hindered in the Netherlands, it will affect the UK and many other European nations. Unfortunately for Europe, this will mean higher food prices along with higher energy prices. Shortages for both are in the realm of possibility.

The combination of weather, supply chains, and the Dutch protests are already being felt. July inflation in the UK came in at 10.1%, the highest in 40 years! The Bank of England expects inflationary pressures to continue into Fall with a peak of 13.3% around October before reversing. Rising natural gas prices will play a large role in this.

Energy is making all the headlines given the rise in natural gas futures, but rising food prices made the largest upward contribution to annual inflation rates between June and July.

“Supermarkets have had little choice but to pass on price increases from suppliers, themselves contending with unprecedented inflation in raw material and ingredient input costs,” said Kien Tan, director of retail strategy at PwC.

“This has been particularly acute in labour and utility intensive categories like dairy, with reports of the price of a pint of milk having more than doubled in some stores since the start of the year.”

And it looks to get worse for Europe and the rest of the world. Unpredictable weather patterns will affect crops. In my humble opinion, we are already seeing (and soon will feel) the effects of this. I am investing in a world which will see a shift to indoor farming. This will be the way where we can provide food security as weather becomes even more predictable.

You have probably already seen the headlines of drought. Europe is being hit by extreme drought which is exacerbating their food and energy crises. It may turn out to be Europe’s worst drought in 500 years and is having an effect on food production and river transport of said food products among others.

Europe is not alone. Drought headlines are also appearing in North America and Asia. These droughts are affecting animal grazing and shipping. In China, they are resorting to cloud seeding in an attempt to promote rainfall. I recommend you all to take a look at this CBC article which has a catalog of current drought conditions from all around the world. Pretty apocalyptic.

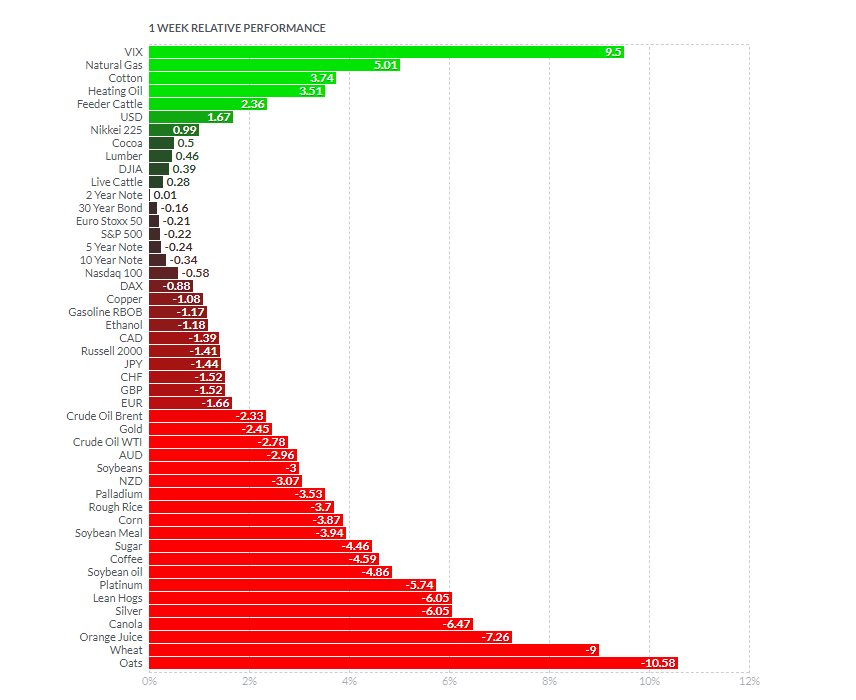

Even though we have all these headlines, when it comes to the performance of agriculture commodities, this is what we see:

Ugly. Not the best week for agricultural commodities with all of them (except cocoa) being red!

But with drought headlines and food prices rising, will these be a catalyst to cause a reversal? My favorite for this still remains corn.

Here are some headlines that made agriculture stocks move this week.

Itafos (IFOS.V)

We start off with the best looking technical set up. Itafos has been featured many times in recent weeks because of its technical breakout. We highlighted the new uptrend which began after the break above $1.80. What makes this even more appealing is the fact Itafos put out record Q2 earnings a week ago. That was the catalyst for the breakout and will be the catalyst for further momentum. The uptrend remains with buyers jumping in on the retest near $1,80. Really what any breakout traders want to see. This looks very good, and the next higher low will take us to resistance at $2.60.

CubicFarms (CUB.TO)

Onto a chart that is going south. CubicFarms cratered after releasing Q2 and full year earnings. Here are some highlights.

- The Company currently has a total of 223 modules pending manufacturing and installation, with a total estimated contract value of USD $30.7 million.

- Revenue for the three months ended June 30, 2022, was $2.9 million, up from $0.4 million in the prior period. Q2 revenue included sales of CubicFarm Systems and HydroGreen AVPs of $2.7 million, up from $0.1 million in the prior period. Revenue for the six months ended June 30, 2022, was $3.1 million, compared to $4.3 million in the prior period.

- Net loss for the three and six months ended June 30, 2022, was $9.1 million and $17.9 million respectively, compared to net loss of $6.5 million and $10.1 million in the prior period. The increased net loss in the current quarter reflected the Company’s continued expansion through staffing additions in the areas of research and development and general operations.

- Research and development expense for the three and six months ended June 30, 2022, was $3.2 million and $5.8 million respectively, compared to $1.3 million and $2.5 million in the prior period.

- Selling, general and administrative expense for the three and six months ended June 30, 2022, was $6.0 million and $11.7 million respectively, compared to $5.0 million and $8.9 million in the prior period.

The expenses are adding up, and the company has announced cost reduction measures.

“We have realigned operating expenses by reducing approximately 16.5% of our workforce and other non-payroll related overhead expenditures, resulting in an estimated $6.7 million of annualized savings, or 21.8% of the Company’s cash-based operating expenses on a trailing 12-month basis,” said Yam. “Investors can expect to see the positive impact of these initiatives and results starting from Q3 onwards. With an optimized corporate structure and cost reductions, we are better positioned to support the disciplined, long-term growth of the business.”

The stock is cratering and any hope of a basing reversal pattern is now gone with the close below $0.36. When I zoom out, the next support zone I see comes in at $0.20. If that breaks, we are then on the path to printing new all time record lows.

MustGrow Biologics (MGRO.CN)

Great news out from MustGrow. The company announced an extension of an exclusive agreement and program advancement with Japanese giant Sumitomo corporation.

- Sumitomo Corporation has extended the option for exclusive testing with MustGrow’s technology for preplant soil fumigation, bioherbicide, postharvest and food preservation for potatoes, and bananas in North, Central, and South America.

- Sumitomo Corporation continues to demonstrate positive levels of efficacy utilizing MustGrow’s technology in comparison to synthetic chemical standards.

- Sumitomo Corporation to continue driving all field development, including regulatory and market assessment work necessary for commercialization.

News of this exclusive agreement is what caused the stock to pop from $0.35 in 2020. The stock went on to hit highs at $5.00. This news is positive and the stock could finally get the momentum it needs to bounce from the $2.69 zone which has been major support. We dipped below this in recent weeks, but buyers are quick to bid the price up. I will be watching for a close above $3.00 to get things started.

Verde Agritech (NPK.TO)

Verde Agritech announced a strategic partnership with Grupo Lavoro, the largest distributor of agricultural inputs in Latin America. This will open up new markets for Verde’s multinutrient potassium products, BAKS® and K Forte® sold internationally as Super Greensand® in Brazil.

Lavoro operates over 190 stores, staffed by 2,500 employees in Brazil, many of whom are agronomists and farming specialists who work closely with its over 55,000 clients. Lavoro will be a distributor of Verde’s Products.

“There is an increasing demand for products that enable more sustainable food production methods. We are therefore proud to now offer Verde AgriTech’s Products to our portfolio, expanding the options for our clients”, commented Roberto Rosa, Lavoro’s Purchasing Director.

Good news as the stock recently reclaimed support at $7.00 and has closed above $8.00. We are very close to previous all time highs. The stock is holding up well recently, and another rally would take us to new all time record highs.

Bee Vectoring (BEE.CN)

Sticking with a Brazilian theme, Bee Vectoring announced that it has been granted a patent for BVT’s Clonostachys rosea CR-7 microbial strain (CR-7) in Brazil for use as a biological control agent in agriculture.

Brazil represents a significant market opportunity for BVT across specialty and row crops. It has a vast diversity of fruit and vegetable crops and is also the largest soybean producer in the world, with an estimated 140 million tonnes grown annually on about 100 million acres. The country is the world’s 4th largest food producer and is responsible for 10% of global food production.

“BVT’s inroads into Brazil are groundbreaking,” says Mr. Malik. “It’s rare for their authorities to allow a company to patent naturally-occurring microbial strains. The fact that we have been granted a patent for CR-7 speaks to how compelling and proprietary our technology really is. Having a patent-protected product paves the way for significant market entry opportunities with business partners in Brazil. It’s a key part of our strategy to strongly position BVT to capture global market share.”

The stock has been basing around $0.18 and this news might be the catalyst for a reversal. The technicals are turning as price crossed over my moving average. I would like to see a candle close above $0.20, and then eventually reclaim the major $0.24 resistance. At time of writing, the stock is up over 11% on this news.