Medexus Pharmaceuticals (MDP.TO) is a specialty pharma company whose stock is on fire! The stock rallied 34% from its opening price to its highs last week. And it has both the technicals and the fundamentals to sustain this momentum.

It is very important to highlight that Medexus is a specialty pharma company. They are NOT biotech. There is no research and development of drugs here. Medexus is all about sales and marketing, bringing over drugs that are already licensed in Western Europe and then bringing them to North America. In doing so, Medexus has carved up a very nice niche as they are not competing with the big pharma. Big pharma is looking for drugs which can bring them a profit in the billions. Medexus picks up under the radar drugs which can bring them revenues in the hundreds of millions.

In terms of business, things are steaming on. Medexus recently released financials for Q1 2023. The results turned out to be the strongest fiscal Q1 in Medexus’s history. Back to back records as last quarter, Medexus announced record Q4 revenue in the company’s history. Here are the details for Q1 2023.(note that the numbers are in US dollars):

- Delivered record total revenue of $23.0 million in fiscal Q1 2023, an increase of 33% compared to $17.3 million in fiscal Q1 2022 and an increase of 13% compared to $20.3 million in fiscal Q4 2022. This represents the strongest fiscal Q1 in Medexus’s history. Primary drivers for the $5.7 million increase over fiscal Q1 2022 were an increase in net sales of IXINITY and recognition of a portion of revenue from Gleolan sales in the United States.

- Achieved Adjusted EBITDA of $1.9 million in fiscal Q1 2023 compared to $(4.9) million in fiscal Q1 2022 and $1.1 million in fiscal Q4 2022. Organic increases in product revenue, a reduction in research & development costs, and recognition of a portion of revenue from Gleolan sales in the United States were the primary drivers of the $6.8 million increase over fiscal Q1 2022. Medexus achieved this Adjusted EBITDA increase while continuing to maintain appropriate investments in preparations for a commercial launch of treosulfan in the United States.

- Yielded operating profit of $0.0 million in fiscal Q1 2023, a $7.2 million improvement compared to operating loss of $7.2 million in fiscal Q1 2022.

- Produced net loss of $1.4 million in fiscal Q1 2023, a $5.2 million improvement compared to $6.6 million in fiscal Q1 2022.

- Generated Adjusted Net Loss* of $3.6 million in fiscal Q1 2023, a $6.2 million improvement compared to $9.8 million in fiscal Q1 2022.

- Held cash and cash equivalents of $7.3 million (with $8.7 million of total available liquidity) at end of fiscal Q1 2023.

Here’s what CEO Ken d’Entremont had to say:

“We are proud to announce the strongest fiscal Q1 in our company’s history driven by a strong base business and complemented by initial revenues generated through our license agreement for Gleolan in the U.S. We anticipate completing our transition to full commercial responsibility for Gleolan within the current quarter and will begin to report Gleolan net sales in our revenues starting at that time. So far Gleolan sales have performed to our expectations, and we are excited about Gleolan’s contribution to growing our revenues over the coming quarters.”

“We are also moving forward with Treosulfan. In July 2022, our partner medac resubmitted the Treosulfan NDA to the FDA. If the response is considered complete by the FDA, a subsequent FDA approval will allow for the commercial launch of Treosulfan in the U.S. in the first half of calendar year 2023. If approved, Treosulfan is expected to significantly contribute to our sustained overall growth in the years ahead.”

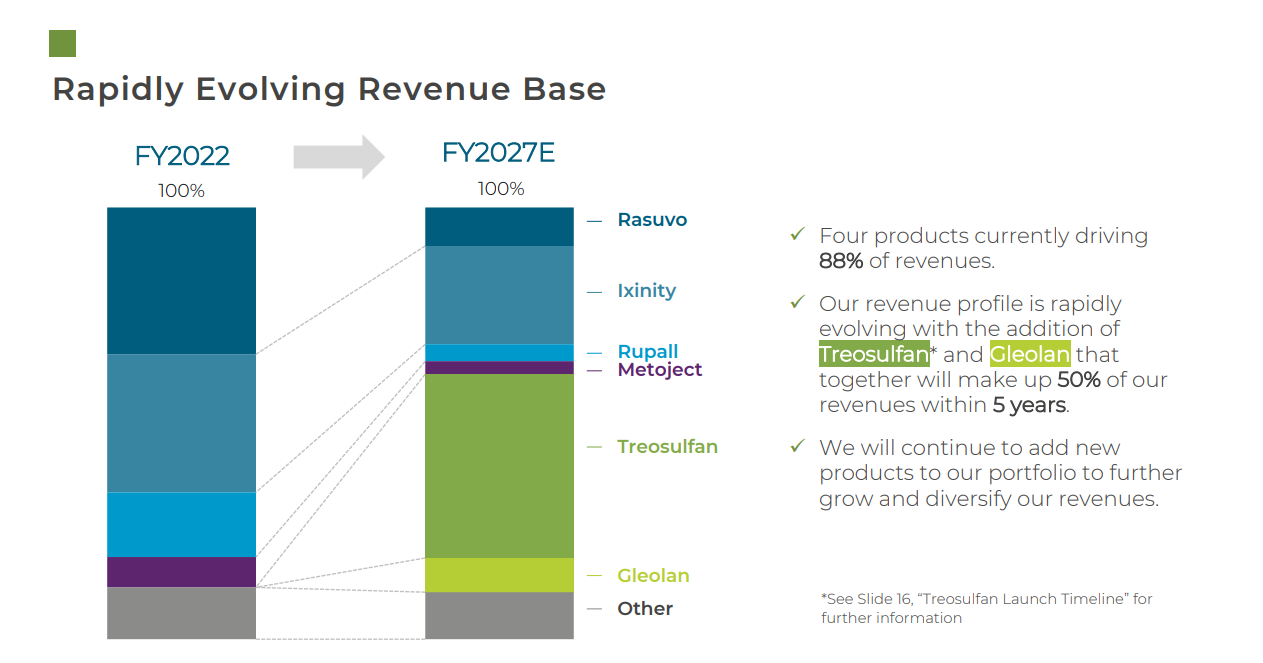

The CEO makes mention of the drugs Gleolan and Treosulfan, and by looking at the above image, you can tell why they are so important. Treosulfan together with Gleolan, will make up to 50% of Medexus’ revenues within 5 years. It seems as if the market is focusing a lot on Treosulfan, and fair enough, the stock did sell off hard on the FDA news in 2021. Things are back on track. The stock will get a positive reaction once positive news is confirmed. However, I think the markets should also be excited about Gleolan and the revenues it brings currently, and will bring in the future. I will definitely be watching Q2 earnings for Gleolan net sales.

The stock has had an amazing summer. Back in mid July 2022, the stock found buyers near the major support zone at $1.50. This zone was previous all time record lows which the stock formed back in March 2020. If we had broken that, things would have been super bearish.

But we reversed. A large wick candle on July 14th 2022 hammered the bottom. Taking out $2.00 was huge as we closed above a lower high and my moving average. This meant that the downtrend was over and a new uptrend had begun. An uptrend that is currently in motion.

A major resistance (price ceiling) zone was $2.50. Medexus stock held this zone as support (price floor) multiple times in the past as you can see from my chart. When support’s break, it leads to more downside. Once support is reclaimed, it points to bullishness.

Note that during July 25th- August 8th, the price stalled at $2.50. A major resistance zone that saw some selling. As I just said, once price reclaims what was once support, it is very bullish. Medexus did this with style. The giant green breakout candle you see on August 9th 2022 was a reaction to Q1 earnings. This 18% breakout day means the stock has taken out a major resistance zone. As long as Medexus now remains above $2.50, this uptrend remains intact.

$3.50 is the next resistance zone, so I would expect to see some selling just like we did at $2.50 around the $3.50 zone. The stock has many potential catalysts to break above though. This was a stock trading above $7.00. It was just the Treosulfan news which brought it down. Now that issue is being solved. The last half of 2022 is going to be huge for Medexus.

In summary, the stock is trading cheaper than it was before the Treosulfan news. And we are months away from this being resolved. The company is reporting record quarters of earnings. The fundamentals are strong, and the technicals took out a major level. You have a winning combo when both fundamentals and technicals are aligned!