Neo Performance Materials (NEO.T), a company focused on the manufacture of advanced industrial materials critical to modern technology, announced financial results from its 2022 second quarter today.

The company reach record revenues, net income and adjusted EBITDA for the six-months ending June 30, 2022, since re-emerging as a public company in 2017.

Revenues for the quarter totaled $168.2 million USD, a 24.5% increase from the same a year earlier with operating income of $21 million, a 15.2% YOY.

Neo’s adjusted net income came to $15.9 million in Q2 2022, or an EPS of $0.39 per share for an adjusted EBITDA of $26.5 million.

The advanced material producer declared a quarterly dividend of $0.10 per common share on August 11, 2022 for shareholders of record at September 20, 2022.

Every one of the company’s three business segments brought in higher revenues, driven mostly by higher rare earth prices and strong demand for Neo’s magnetic rare earth products.

Neo recorded cash and cash equivalents of $61.14 million as of March 31, 2022.

Volumes in the company’s Magnequench segment experienced a decline driven largely by the recent spike in Covid 19 cases which propelled shutdowns in Asia.

Company CEO, Constantine Karayannopoulos, commented, “The Neo team achieved another strong quarter, and I am very pleased with our ability to continue to outperform in the face of macroeconomic uncertainty, continuing supply chain challenges, and deteriorating economic sentiment or outlook in some economies.”

The global rare earth permanent magnet market was estimated at $16.4 billion in 2021 and is expected to climb to $23.4 billion by 2027 at a CAGR of 5.88%.

During the quarter, Neo published its first annual sustainability report which also launched a formal reporting process.

As a testament to the company’s commitment to ESG, its European rare earth processing plant in Estonia, the only operating rare earth separations and rare metal processing plant in the European Union, had been awarded a Gold Medal by EcoVadis for its 2021 sustainability programs.

This award has been granted to three of the company’s five flagship rare earth facilities.

In other news, there were two appointments to the company’s board, Yadin Rozov and Zhe Zhao to fill the vacancies left by the resignation of Brook Hinchman and Gregory Share.

Rozov is a 20-plus-year investment professional with deep experience in capital markets, corporate finance, investment banking and investment management. Zhao is a VP in the Global Opportunities group at Oaktree Capital Management and was responsible for sourcing and analyzing long and short investment opportunities across a wide range of security classes.

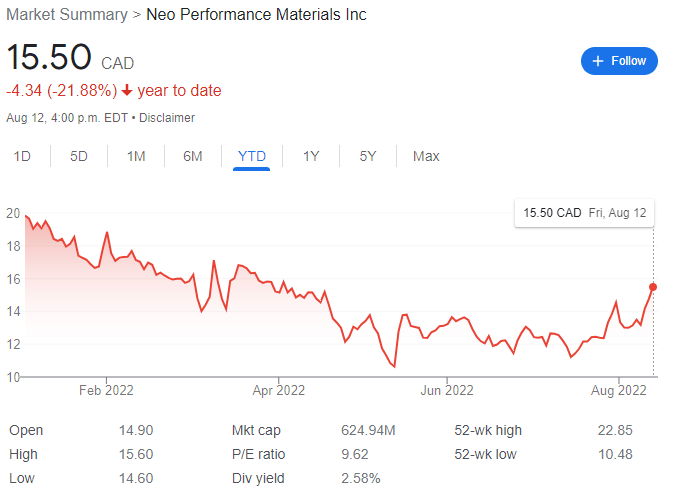

Neo currently trades at $15.50 CAD per share for a market cap of $624.94 million.

–Gaalen Engen