“I’ve never seen the fundamentals for uranium so good in my multi-decade career.”

The above statement has been registered in the last two weeks in writing, audio, or video by pretty much all the OGs in the nuclear space.

The reasons, beyond an existing supply and demand gap of roughly 40 million lbs. per year, are all over the news if you know where to look:

“Japan hopes to restart four more nuclear reactors by winter”

“European Parliament backs nuclear and gas in EU taxonomy”

“Gas crisis spurs Germany to mull extending life of nuclear plants”

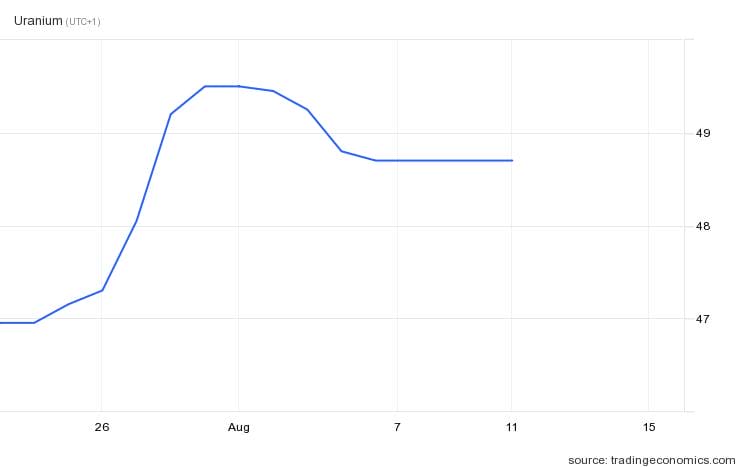

So, it begs the question, with an already tight market, why isn’t the price exploding upwards?

Take a quick look at the spot price per pound, as it hasn’t moved one inch since the 5th of August.

Let’s focus on two main reasons:

Spot is mainly a trading vehicle

Unlike gold, silver and other hot commodities that have a much deeper spot market, uranium is typically extracted from the ground when miners have negotiated a contract several years earlier. Selling into the spot market would back-fire as this is thinly traded and their clients (Utility Companies), are much more concerned with the security of actual delivery of the goods than price. The quoted spot price helps them to calculate a premium for the long-term contracts, which can span anything from 3 to 15 years. Only about one third of market participants (miners and utilities) act in the spot market according to the World Nuclear Association, so the lack of trading is likely a reflection that traders are mostly away in the sun sipping margaritas this time of year.

Time lag

Absolutely anything related to nuclear power has a massive lag. From initial opportunity to power generation takes several years in planning and permitting. For its fuel it’s no different. There is a long timeframe between mining, processing, and having the mineral ready for nuclear power usage that spans roughly 18 to 24 months once it’s mined. That’s only after uranium has been found, millions of dollars have been put into the ground to ascertain size, grade and shape of the resource and then comes more millions and years of trying to figure out if it can be extracted profitably. The last price squeeze happened in 2007 and the memory of eye-watering prices is long gone, as the market went into a painful bear market spanning almost a decade.

The elastic band at its most stretched the moment before it snaps.

This creates, in my honest opinion, a massive buying opportunity, as more people seem to have realized uranium is turning into a long-term trend and prices of these equities are beginning to recover.

But if the thesis of uranium has been popular and well publicized, where is the hidden value?

There are often overlooked areas of interest that investors should notice.

One of them is safer, multi-project companies that option out projects to be drilled by third parties. Also known as project generators, these companies tend to do well historically because their expenditure is contained to a few more prospective assets while other projects are explored without much or any cost. Another benefit is the fact of possible positive news flow from exploration partners. If they find something interesting, it means you also own it. Great deal all around.

There are two companies I’d like to highlight that follow this model:

Skyharbour Resources Ltd. (SYH.V)

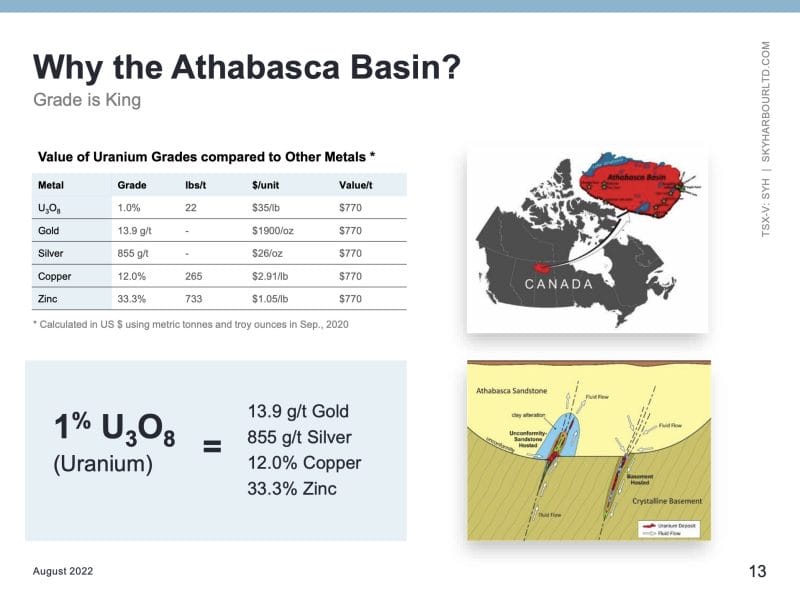

Management, board, and advisors are the who-is-who in the mining industry. Lots of previous successes and current operators of successful companies. At around 50m market cap, they hold a portfolio of over a dozen projects around the Athabasca Basin, which is commonly known as the Saudi Arabia of uranium mining, with grades in the region topping 1% in some instances. How does that compare to other minerals? Look at the chart below and try to not fall of your chair.

With uranium looking more favorably, they’ve been able to forge partnerships with Rio Tinto, Orano (Areva), Azincourt Energy and others.

They are advancing the Moore Project which has had positive drilling results of over 4% uranium to date.

Purepoint Uranium Group (PTU.V)

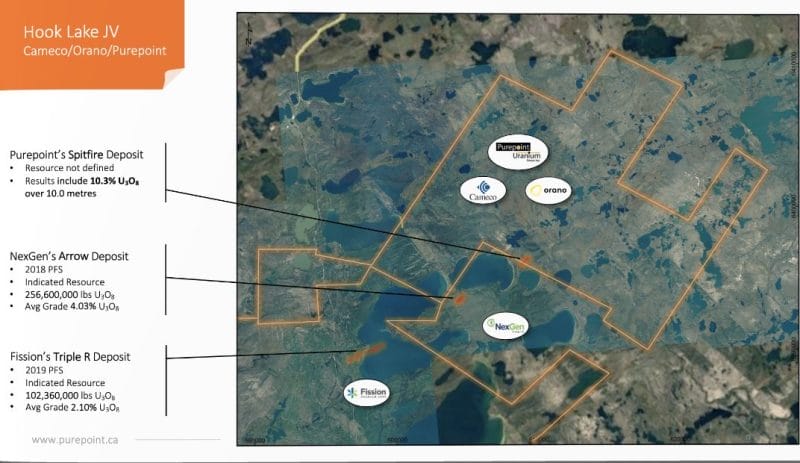

Another company in the Athabasca Basin, Purepoint has secured a joint venture on the Hook Lake project with Orano and Cameco. They hold 100% ownership in 10 projects in the east region of the basin.

One thing I like about these guys is that they run a tight ship – you’re not going to see these guys overspending on General Administrative without good reason. But what I really love is that they’ve been able to find as much as 10% uranium over 10m in their JV project with the two producing companies mentioned previously. Just for the sake of comparison, the basin’s darlings Nexgen and Fission have demonstrated resources of 4.03% and 2.1% U3O8, respectively. They take an admin fee for this JV and that keeps their lights on while minimizing the need to come to the market and dilute. With drilling planned for 3 of their projects in Q3, I’m expecting lots of news from Purepoint.

–Fabi Lara