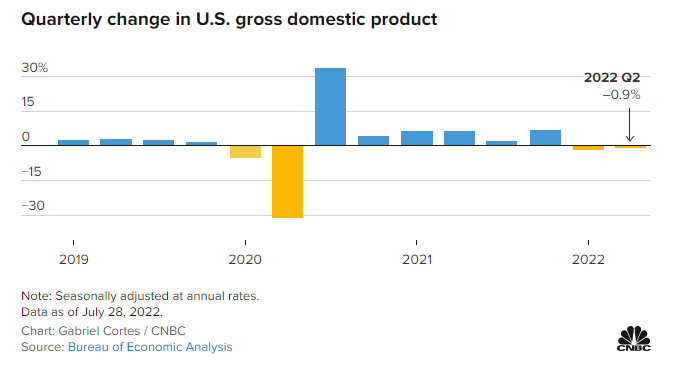

US GDP fell 0.9% in the second quarter. This is the second straight GDP decline in a row and officially meets the definition of a recession.

Gross domestic product fell 0.9% at an annualized pace for the period, according to the advance estimate. That follows a 1.6% decline in the first quarter and was worse than the estimate for a gain of 0.3%.

Mainstream financial media is calling this a “strong recession signal”. Even Jerome Powell himself avoided using the ‘r word’ at his press conference yesterday. The White House certainly won’t admit it, but many who participate in the real economy definitely feel it. The combination of inflation and rising interest rates is squeezing the middle class, and a recession seems imminent.

Now it is in the hands of the National Bureau of Economic Research. This entity declares recessions and expansions in the US, and won’t make a judgement for months. Everyone else is calling it for what it is: an official recession.

Many analysts are not using the r word. They admit the economy is slowing down, but no recession.

“We’re not in recession, but it’s clear the economy’s growth is slowing,” said Mark Zandi, chief economist at Moody’s Analytics. “The economy is close to stall speed, moving forward but barely.”

Jerome Powell also did not think the US economy is in recession:

“Think about what a recession is. It’s a broad-based decline across many industries that’s sustained more than a couple of months. This doesn’t seem like that now,” he said. “The real reason is the labor market has been such a strong signal of economic strength that it makes you question the GDP data.”

By the way, Powell was expecting Q2 GDP to be barely positive.

I think the most interesting element in this recession saga came from the White House. Over a week ago, a post came out on the White House blog which seems to redefine a recession. A whole group of us who took economics 101 were taught two negative quarters of GDP growth is the rule of thumb for recession. Now we are being told that 1+1 does not equal 2 all the time.

The Twitter-sphere was talking about this. The big question is whether this is just political to save an unpopular administration heading into the mid-term elections? Or if this is a way for the Fed to keep raising interest rates to tame inflation.

I say the latter because generally when the economy enters a recession, central banks CUT interest rates to try and spur the economy. I believe the markets think we are near the end of the current rate hike period. The thinking is that a recession is demand killing, and hence should allow for inflation to peak and drop as people spend less money. For non-monetary inflation, less demand and more supply means prices fall.

But I would be a bit careful. If CPI data continues to rise then the markets may flip and start pricing in MORE rate hikes from the Fed. Right now, the bond markets are pricing in recession:

Regular readers of my work are probably sick of this chart by now, but this is THE most important chart to be watching. The US 10 year yield is dropping, and could be triggering a reversal pattern known as the head and shoulders pattern if we close below 2.70%.

This is indicating that yields are dropping, or investor’s are buying bonds. Sure buying bonds can be seen as a risk off move. When stock markets are falling and there is fear, money runs into the safety of the US Dollar and bonds. I don’t think that is happening right now.

I believe that investors are buying bonds because they believe we are near the end of the current rate hike cycle. If a recession is here or coming, then the Fed will cut rates. What this means is that bonds yielding at these levels will be worth more than the bonds issued later with a lower interest rate due to Fed cutting rates.

This is what I am seeing on the chart, and all it would take is for a really strong CPI to change the opinion of the markets. But it is clear that the Fed has two options:

The markets had a mixed reaction on the open but at time of writing, it seems things are turning around. We had a strong close post Fed and Jerome Powell and as a trader, I really want to see follow through today rather than a muted gain.

A recession could actually be bullish. Why? Well if the Fed begins to cut interest rates, then money has to go somewhere to look for yield. The only option for gains? The risk on assets such as stocks and cryptos.

So, what do you think? Are we in a recession or not?

Happy trading.