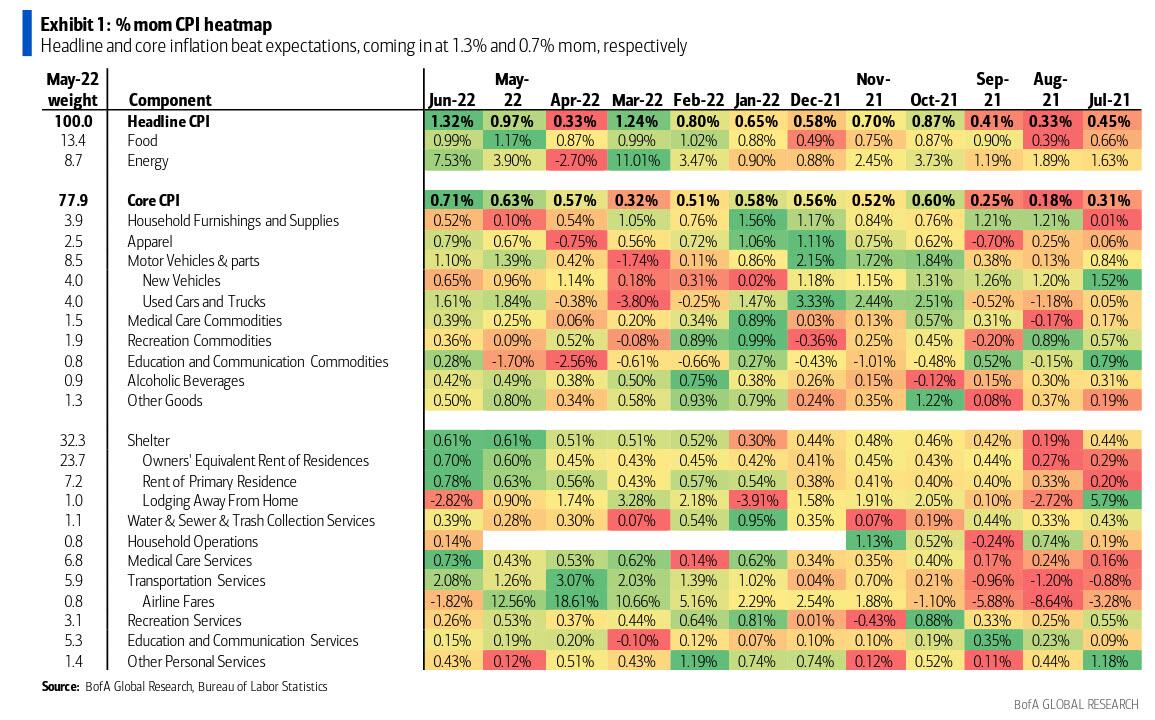

The US markets are still reeling from the ‘shocking’ CPI numbers for the month of June. US inflation is not showing signs of peaking as CPI soared 9.1% from a year ago beating estimates of 8.8%. This marked the fastest pace for inflation since November 1981.

Fast rising shelter, gasoline and food costs played a significant role in inflation. Our interest is food. The food index increased 1% with a big surge in food at home. In fact, this was the sixth straight month that food at home rose at least 1%.

When it comes to year to year, food costs rose 10.4% in June from a year ago. The largest increase since 1981. Food at home rose 12.2% the quickest pace since April 1979. Groceries are definitely getting more expensive.

According to the latest data from Datasembly’s Grocery Price Index, baking goods jumped 7.6%, snacks such as cookies and chips increased 7.5%, and dairy and eggs were up 6.9% across the US. Some places saw grocery prices jump even more!

New York City saw an 11.3% rise in produce, 11.5% in snacks, cookies and chips, and 9.5% in beverages. San Francisco experienced an 8.7% increase in dairy and egg prices. And the Southeast had the most dramatic surge in baking-goods prices, with hardest-hit Atlanta reporting a 10% jump in prices.

The good news? Even though food at home rose 1% for the month of June, it is actually down from the 1.4% increase recorded in May. The food-at-home group that includes meat, poultry, fish and eggs recorded a decline of 0.4% as beef, veal and pork became less expensive while ham and poultry prices rose. Already seeing signs of sale patterns changing? Consumers are shifting to buy what’s cheaper.

For example, meat sales were up 5.7% in terms of dollar volume in June on a year-over-year basis, but the number of pounds of meat people bought last month fell 2.7% by the same measure, according to data from 210 Analytics and IRI. Similarly, perishable sales rose 6.8% in June compared with the same month in 2021, but unit sales were off 4.5%.

Consumers will be buying less and will be shifting to purchasing less expensive grocery brands. I really wonder how this will impact the more expensive vegan/plant based food choices. With consumers already cutting costs by travelling less and looking for bargains, I don’t think the plant based space is going to cope well at all.

When it comes to Canada… we should also be expecting our grocery costs to rise.

It probably comes to no surprise if I tell you that many of the agriculture stock charts are ugly. There haven’t been many press releases as well. It makes sense. It seems companies are hunkering down preparing for September. That’s when many are thinking these markets will turn.

Below I will cover some news. But many companies that I am highlighting will have good looking technical setups. Either bucking the downtrend, or testing a major zone of support.

Bee Vectoring (BEE.CN)

Bee Vectoring had two press releases this week. First, the company announced that it closed a non brokered private placement to Sorbie Bornhelm LP, an institutional investor for gross proceeds of $3.8 million.

“Recognizing the value opportunity with BVT, the capital from Sorbie’s investment is expected to allow BVT to continue executing on its scalable growth strategy,” said Ashish Malik, CEO of BVT. “With healthy year over year sales growth in the USA and up to 90% in customer retention rates, we have successfully demonstrated the value proposition of BVT to our clients. We believe we are now well on the way to moving from a single revenue stream company to a well-diversified portfolio and we expect this transaction to support us as we work to expand the current valuation to include multiple revenue streams such as seed coating and additional third-party biologicals, as well as geographic expansion, in the next 36 months.”

The funds will provide Bee Vectoring with a consistent source of funds over the next two years. 11,176,471 shares at a price of $0.17 per share will be issued to Sorbie in this private placement.

In other news, Bee Vectoring has announced a Memorandum of Understanding with Bioglobal A.S in Turkey to accelerate Bee Vectoring’s entry into the country. Bioglobal is a leading distributor of plant protection and plant nutrition products in Turkey, the Middle East and the Caucasus. Providing a great platform for Bee Vectoring to also further expand into these adjacent countries.

“BVT aligns perfectly to Bioglobal’s core goal of providing sustainable and environmentally-friendly biological products to the agricultural marketplace,” said A. Özgür Ateş, General Manager of Bioglobal. “Pesticide residue poses a barrier to Turkish produce exports. Fortunately, BVT’s biological fungicide, which reduces traditional chemical use, provides disease control and improves crop yield, is a scalable long-term solution – enhancing the overall export value.”

Bioglobal will now move forward on registration trials of Bee Vectoring’s biological fungicide with Turkish authorities. These are official research trials that are required for regulatory submission. From there, the two companies will work on a commercial agreement to market and distribute Bee Vectoring’s product.

“Turkey is an important producer of agricultural products, and bee pollination plays a vital role in Turkish agriculture with an estimated 300,000 bumble bee hives(1) sold in the country annually,” said Christoph Lehnen, BVT Business Manager for Europe, Africa and Middle East. “Eastern European countries are major importers of Turkish produce. Therefore, our immediate market focus in Turkey will be to target strawberry and tomato growers, with plans to expand into oilseed such as rapeseed (canola), and other berries and vegetables. BVT products registered in the USA have been awarded a zero-residue rating, which will greatly assist in selling and marketing BVT in Turkey.”

Be sure to check out Maddy’s five easy questions with Bee Vectoring’s CEO Ashish Malik!

On the charts, Bee Vectoring is also selling off alongside most of the market. We actually took out the major support at around $0.24. This support was the last level before printing new all time record lows. Any new lows Bee Vectoring makes will print new record lows. We know now the funding took place at $0.17 so let’s hope we see support established here. We do want to see a rise back above $0.24 to confirm a reversal. The company will have cash in order to initiate a catalyst for the stock price.

Loblaws (L.TO)

Readers know that Loblaws makes up a significant portion of my long term portfolio. This is my DRIP play. Building my position until dividends will be enough to purchase entire shares themselves.

With news of an upcoming recession, and inflation, people may stop spending at certain places but supermarkets will always see an influx of customers. Loblaws has been trending in recent days as a strike has been avoided. Superstore employees have accepted a new contract offer from Loblaws. Could you imagine what would have happened if about 10,000 grocery and warehouse workers decided to strike?

It seems others are seeing the value in Loblaws as the stock printed new all time record highs by breaking out above $120. With a recession and food price rising headlines, it is prudent to have a dividend paying company which provides an essential service.

Deveron Corp (FARM.V)

Another agriculture company bucking the trend is Deveron Corp. The company recently made moves in the carbon credits space, which I believe will be huge for the future. If you are looking for a future investment idea I would really take a deeper look at carbon credits.

In recent months, Deveron Corp announced that it acquired Agri-Labs, a leading soil lab and agronomy company.

The chart of Deveron has caught my eye. Especially given what is happening to most other charts. Deveron is strong and actually had a 13% green day on July 13th! Technically, we have done really well since bouncing from support at around $0.40. It appears as if Deveron is ready to reclaim a price area which once was support. If we can get a strong close back above $0.60, it would be a very bullish sign!

The next few companies are going to be charts that are at major inflection points.

Sprouts Farmers Market (SFM)

Sticking with the grocery theme, Sprouts Farmers Market has a nice set up and also has a big catalyst in earnings upcoming on August 3rd.

A few things stand out on this chart. Firstly, we are above my moving average, and seeing buyers step in as we retest my moving average. Always a good sign. Secondly, I spot a cup and handle like pattern forming. To trigger this famous reversal pattern, we need a close above $27.60. The real action begins when Sprouts Farmers Market confirms a close above the gap. We are talking about the price heading back above $30. A gap fill is a very bullish technical indicator!

Maple Leaf Foods (MFI.TO)

Maple Leaf Foods still has some things it has to do on the charts before I turn bullish. The structure is intriguing. Major support at $25 has held. The downtrend still remains as you can see with my downward sloping trendline. Maple Leaf Foods has made multiple swings already which means a reversal could happen sooner than later. I can’t call that now, but if we can close above $26.50 on the daily. We add a trendline break and also confirm a mini cup and handle reversal pattern. Those both would be immensely to the bullish case!

MustGrow Biologics (MGRO.CN)

There hasn’t been news out in a long time, but MustGrow made splashes when it announced an exclusive agreement with Sumitomo corporation.

In recent months, the stock has been holding onto support at $2.75. Buyers are quick to step in whenever we dip below as evident by the large wicks. We know this is an important zone. The question is: can we build a platform here for another leg higher?

To begin, we must break above $3.30 which would then take us for a run up to $4.00. If instead we breakdown, then $2.00 is the next support level to consider.

Itafos (IFOS.V)

Itafos Inc. operates as a phosphate and specialty fertilizer platform company. The company produces and sells monoammonium phosphate (MAP), MAP with micronutrients, superphosphoric acid, merchant grade phosphoric acid, ammonium polyphosphate, single superphosphate (SSP), SSP with micronutrients, and sulfuric acid.

No major news out this week. But the stock is at a major support zone. In a previous agriculture sector roundup, I spoke about the reversal pattern triggered when we broke below $2.60. We have now hit the major target level at the $1.60 zone. From here we will have to wait and see if the selling pressure exhausts. Watch for signs of a range developing to indicate a potential reversal.