Summer tends to be slow for markets. But this time it feels different. With all the headlines of inflation and interest rates, traders knew this July was going to be busy. But I don’t think anyone knew how crazy things would get.

Major things are happening around the world. Let’s admit it: things are blowing up. In the market, there is one currency that has the potential to do the same. And this is before we even begin to talk about the 3 major market moving events!

There are protests in many parts of the world. If you follow my agriculture sector roundups, you will know there are a handful of African countries which are experiencing unrest due to high food and fuel prices. This combo tends to be the culprit in other parts of the world too.

Asia is also seeing some crazy things. I am sure you have seen the issues in Sri Lanka. The government shut off the fuel taps and people ended up storming the Presidential Palace. China appears to be cracking. Major videos showing people trying to remove money from the banks and things don’t turn out positive. This has been ongoing for a few months, but things are getting more violent now. A financial crisis could be brewing. Then there was also the assassination of former Prime Minister of Japan, Shinzo Abe, which shook the world and Japan.

Europe isn’t faring too well. Energy costs in Germany have been soaring resulting in the rationing of hot water, the dimming of street lights, and closing pools. We aren’t even in Winter folks. Imagine how bad things will get then.

German manufacturing is likely to slow down dramatically with electricity costs spiking. The next few days could get even more rough as Russia temporarily halts gas flows for maintenance works. This was scheduled and runs to July 21st. The Europeans are fearful that this maintenance could extend longer…perhaps a weapon used by the Kremlin to cause havoc in Europe. At a time when Europe is already dealing with an energy crisis.

My thinking is that this obviously was going to happen. Europe has implemented harsh sanctions on Russia and nobody in Europe was fearing retaliation? European countries want to lessen their dependence on Russian energy, but they are definitely not prepared. It will take time to diversify.

We cannot forget about the Dutch farmers. This has led to other farmer protests around Europe, but small in scale compared to the Netherlands. In my opinion, the Dutch government has ensured a food crisis in Europe. You can find out why here. But the media will probably blame the Russians.

Let’s finish off the ‘world blowing up’ portion by talking about Covid in Summer. It’s back. Hong Kong is bringing back their tracking bracelets to ensure Covid patients stay indoors. In the US, California is seeing a surge which might see the return of mask mandates. Definitely something not many were expecting since viruses tend to weaken during summer months. It looks like we have stronger variants. Imagine how Fall and Winter will be. Just another thing to add to the uncertainty and fear category.

On the market front, there is one chart indicating fear and uncertainty:

The US Dollar is breaking out. People are running into the safe haven reserve currency. I bet Asian and European money flows are running into the Dollar giving this move more strength. More is likely to follow as we see other parts of the world experience some sort of unrest.

With this dollar strength, watch for issues with emerging market countries with large US Dollar denominated debt. But that won’t be the only worry. Major currencies will also take a hit which will increase inflationary pressures.

Such as the Euro which has hit parity.

Also the Japanese Yen which is at 24 year lows. Hasn’t been this weak since 1998!

Now, let’s talk about three dates.

July 13th 2022

Oh yes folks, we are already approaching a key market moving date.

For us Canadians, it is when the Bank of Canada raises interest rates. The market expects rates to rise by 75 basis points taking the rate to 2.25% from 1.5%. Let’s see what that does to the real estate market.

Many others will be focusing on US CPI data. Will inflation show signs of peaking? Or will it just get worse? This is huge for markets because it could affect the trajectory for how many more interest rate hikes we will see.

With the drop in oil and other commodities, there are some positive signs that non-monetary inflation will be dropping.

July 27th

We end the month off with a bang.

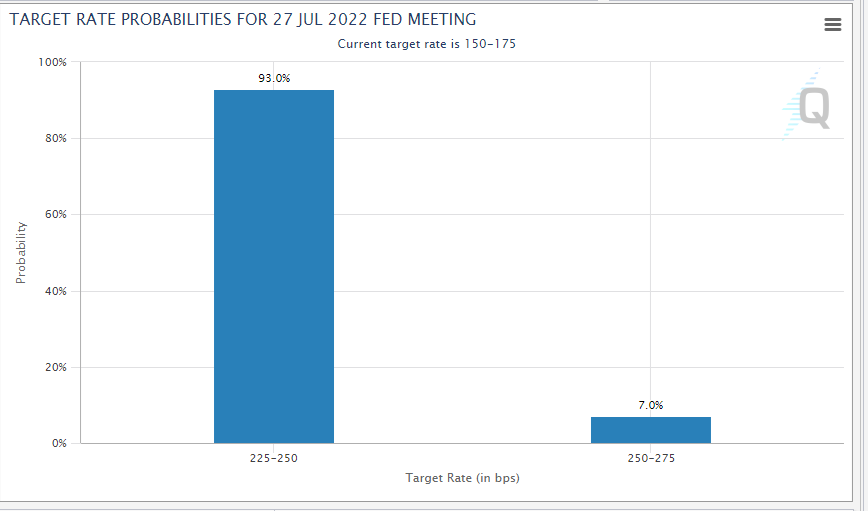

First off, we have the FOMC meeting. The Fed is expected to raise interest rates by another 75 basis points.

As always, traders will be tuning into the press conference with Powell to hear what he has to say regarding future rate hikes. The CPI data released on the 13th will definitely be instrumental in the rhetoric Powell takes. If we see signs of peak inflation, the Fed might take a wait and see approach. If inflation continues to surge higher, then the Fed may need to up their hawkish tone.

But all of this gets complicated because…

July 28th

We get the US Q2 GDP data. This is the data print people will be watching to determine whether the US enters a recession. Remember, Q1 GDP growth was negative. The criteria for a recession is two consecutive quarters of negative growth. If Q2 GDP data comes negative, then the US is officially in a recession. Remember, GDP is lagging because when a recession is officially announced, it means the US has been in a recession already for 6 months!

The price action we are seeing with oil and other commodities definitely hint at an economic slowdown. This could be positive for inflation data because a recession tends to mean a slowdown in demand.

The real drama comes with central banks, in this case the Federal Reserve. Typically in a recession, central banks begin to cut rates to spur the economy. Will the Fed be able to do this even with inflation numbers possibly increasing? This is the big question (and uncertainty!) going forward.

As of now all US market indices are ranging but remaining below their resistance levels. A break above resistance is required to begin a reversal. But for now, we cannot count out further downside. A lot of catalysts ahead this month which will certainly be market moving and determine where equities want to go next!