This Market Moment is bound to trigger somebody, but ARKK looks ready to go. From a technical analysis perspective, there might not be a better set up in the markets. However, it should be noted that many Nasdaq and tech stocks share the similar market structure.

ARKK appears as it has bottomed and a new uptrend is about to begin. When it comes to money flows, Cathie Wood’s fund has seen inflows of $1.5 billion in the first half of 2022. Despite being down more than 50% in the first half of 2022. ARKK is actually down more than 70% since printing an all time record high back in February 2021. You remember those times? When speculation was fun and profitable.

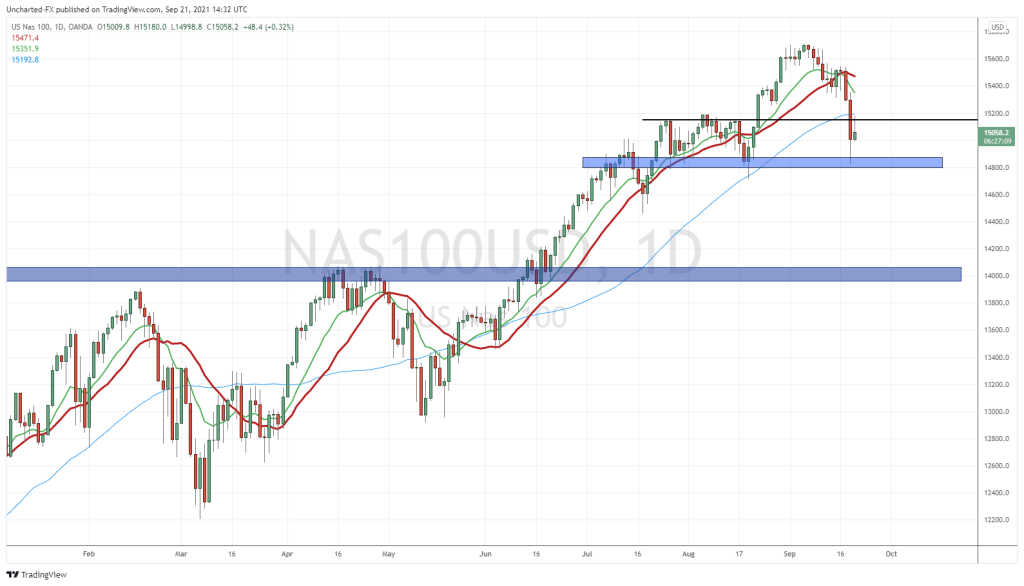

Many growth stocks fell to reality as central banks began raising interest rates. Growth stocks and the Nasdaq tend to do well when interest rates are low. When interest rates are heading higher, money flows into safer yielding assets such as bonds rather than riskier growth stocks.

The term growth stock stems from the fact that these companies are not making a profit but investor’s are pricing in future profits. Of course, it isn’t as easy as that. Speculation in tech saw epic gains as the retail crowd chased price moves.

The Nasdaq was the first of the large US indices to fall into a bear market, but with recession probabilities rising, giving hope that central banks will have to stop raising interest rates and cut rates, money might begin flowing back into riskier assets.

Cathie Wood has gotten some heat lately. Yes, she did admit she got the inflation duration wrong. Her crypto calls are questionable but if cryptos bounce back in the long term technically she will be correct. I believe what she is correct on is her idea of deflation. While the world is focusing on inflation, Cathie Wood and ARK are focusing on deflation. I agree with Cathie when she says slower economic growth will soon make more deflation rather than inflation. We’ll see how that plays out because it would also mean lower ARKK prices.

But as of now, as a swing trade, ARKK is looking very appealing.

It doesn’t get any better than this when it comes to a trade set up!

First, notice the long downtrend. ARKK went from prices above $150 down to levels below $40 in 15 months. Similar to many growth tech stocks. But now, we are seeing signs of selling exhaustion.

We have developed a range between $36 to the downside and $46 to the upside. What catches my attention is the development of a bottoming pattern as well. Looks very inverse head and shoulders to me! And this is what happens when that pattern is confirmed:

Right now the R, or the right shoulder, is forming on ARKK. As long as prices remain above $40, the chance of a reversal remains strong.

So what is the trigger? We need a daily candle close above $46 to confirm a breakout. Once this occurs, ARKK might pop on momentum for a few days before eventually pulling back to retest the breakout zone at $46 before continuing higher.

When it comes to targets, things get even more exciting. I see the next zone of resistance at around $70. Some may argue $64, but I put my major levels at zones that see multiple touches.

The technicals look prime, and strengthens on the idea that broader stock markets are bottoming as they begin to price in the top of interest rate hikes. This is then the time to pick up some good deals.

Speaking about sales, perhaps ARKK at this price level makes more sense than levels above $140. With an inflow of $1.5 billion into ARK, some people are definitely thinking this way. I will leave you off with words from Todd Rosenbluth, head of research at VettaFi, who is saying that ARK’s ‘disruptive innovation’ as a long term investment theme is drawing strong interest from investors and financial advisors. At these prices, ARKK looks appealing:

“Financial advisers are using a small slice of their portfolios to hold thematic ETFs like ARKK. Many see this [price weakness] as a buying opportunity,”