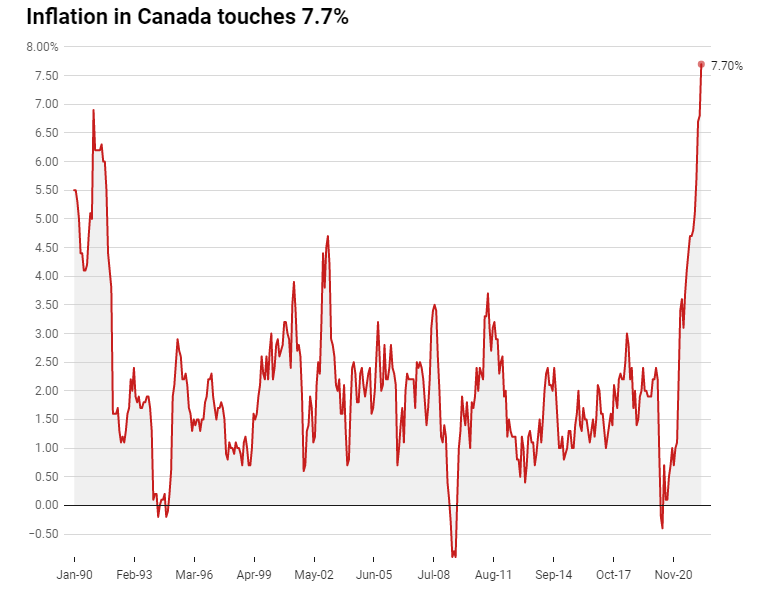

Canadians are paying more for food as inflation touches levels not seen since 1983! The consumer price index in May 2022 rose 7.7% compared with a year ago. The fastest pace in 40 years.

One effect of inflation really hitting Canadians in the wallet is rising food prices. Yes, the agricultural commodities also spiked due to geopolitics, but oil is what you should be watching. As energy costs rise, it costs more to transport food in trucks etc. Let’s not forget about higher fuel costs for farmers. All of this means that the extra costs will be passed onto the consumer. For farmers and businesses to make a profit, prices must rise.

When it comes to food inflation from the last CPI report, here are the numbers:

In May, Statistics Canada said the price for food bought at stores rose 9.7 percent compared with a year ago, matching the April increase, as the cost of nearly everything in the grocery cart went higher.

The cost of edible fats and oils gained 30% compared with a year ago, its largest increase on record, mainly driven by higher prices for cooking oils.

Fresh vegetable prices rose 10.3%.

Milk drinkers? Well get ready to see another price increase. The Canadian Dairy Commission also approved a second milk price increase this year. The Crown corporation, which oversees Canada’s dairy supply management system, said Tuesday farm gate milk prices will go up about two cents per litre, or 2.5 per cent, on Sept. 1. This comes after a milk price increase of 8.4% (6 cents per litre) on February 1st.

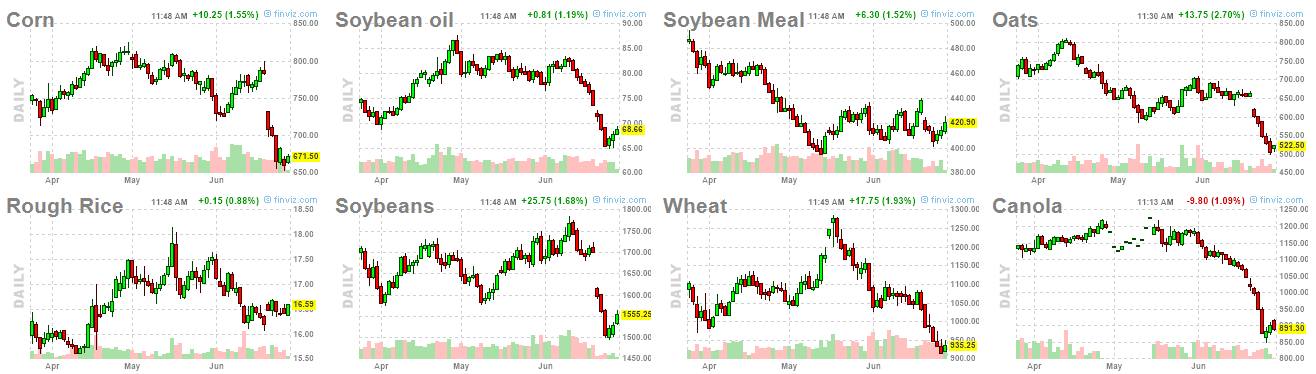

But perhaps there is a sliver of some hope. Agricultural commodities have taken a dive recently, breaking below major support zones. The same can be said about oil. I am closely following both of these asset classes to determine whether inflation will begin to peak.

So what is the best way to play price inflation? Well you can be like Warren Buffett who keeps adding to his Occidental Petroleum position. Buffett now owns 16.4% of the US energy company with a stake worth $9 billion. But I suggest that with a crisis, comes an opportunity.

Food production is what I am keen on. I don’t want to be chicken little, but food shortages will be a reality come this Fall. It isn’t just about supply chains and rising fuel costs, but unpredictable weather patterns are already disrupting the Spring planting season. We will have to find a way where we can control the growing environment rather than succumbing to Mother Nature. Indoor farming will be the future for this reason and others.

Do a google search for “fertilizer shortage” and you will see that this crisis is already beginning in certain nations. Parts of Africa and Asia are already seeing a food crisis. Reuters has just come out and said that global crop problems point to years of high food prices. A fertilizer shortage is cutting the yields of many crops.

But how about a play for rising food prices right now? I do like my supermarkets. Loblaws (L.TO) here in Canada has been my consistent long term play. I just add a few shares every month, and it has worked well. A company like this is a safe bet given the uncertainty in the markets. Loblaws pays a dividend and people will always be buying groceries.

However, I do believe there is a play to watch with recent inflation data. Without further ad0, here are the top three agricultural plays for rising inflation!

Beyond Oil (BOIL.CN)

This is a company that I recently came across. This is a company which provides solutions for food-service companies who are striving to reduce their oil costs, decrease waste and save the planet. I am talking about Beyond Oil.

Recall one major data print on the May 2022 CPI: The cost of edible fats and oils gained 30% compared with a year ago, its largest increase on record, mainly driven by higher prices for cooking oils.

Beyond Oil is a developer and manufacturer of an innovative proprietary and patented formulation which reduces the free fatty acids from cooking oil to as low as 0.1% while preserving the oil’s quality and nutritional values. Beyond Oil’s unique technology and methodology integrate into customers’ existing oil filtration systems by extending the life of frying oil, reducing costs and waste.

Recent news regards Beyond Oil entering a definitive distribution agreement with TEJA Food Group to market and sell Beyond Oil’s product to restaurants in Canada and the US. And great timing.

Cooking oil prices have risen dramatically since the beginning of the COVID-19 pandemic and are continuing to rise, causing increased cost pressures for restaurant owners and other food producers around the world.

“We have been searching extensively for a technological solution that will help our customers cope with the increasing cost pressures of frying oil, without compromising the quality and the taste of their food,” said Tom Grande, President of TEJA Food Group. “Our customers remain our top priority and we are always driven by the desire to give them the best and healthiest product. We are pleased to have entered into this distribution agreement with Beyond Oil and to have found a unique product that will give restaurants and food processors the ability to cut costs and provide healthier food to their valued consumers”.

If I was a restaurant owner and I am looking to cut down on costs, I would be inclined to do something to lower my costs for cooking oil. Beyond Oil’s food-tech product fits the bill. Dr Tamir Gedo, CEO of Beyond Oil has said Beyond Oil’s product offers a solution to reduce frying oil costs by up to $23,000 CAD per year. And we have a case study!

A testing and pilot program by Joey’s Franchising LTD has successfully been completed. Here are the results:

“During my thirty-five years in the restaurant and food service industry, we have tried all the products we could find to extend the life of our frying oil, and Beyond Oil’s product is the only one that has delivered,” said Joe Klassen, CEO of Joey’s. “Most restaurants have to change their frying oil every three to seven days, but after completing our Pilot Program in a working restaurant, we can confirm Beyond Oil’s formulation can extend the life of frying oil up to 14 days.”

The stock IPO’d recently on May 25th 2022. Big mover.

The stock has seen highs at $2.25. Not too shabby given what has happened with equities recently with the broader market sell off. I’m not someone who jumps in early on IPOs. I like to see a few weeks and months of price action to establish price levels. We have some development right now. There is some resistance at $1.85, and major support level is at $1.15. Currently, price broke below $1.85 and it appears as if a date with $1.15 is coming.

Any pullbacks would get me interested in entering a position from a technical perspective. On the fundamental side of things, Canadian inflation data showed that the cost of edible fats and oils gained 30% compared with a year ago, its largest increase on record. If restaurants are looking to reduce their costs, and do so by taking action in the short term, Beyond Oil has the product to do so.

EarthRenew (ERTH.CN)

EarthRenew is a popular company among readers. We recently had CEO Keith Driver over on Maddy’s Five easy questions. Be sure to check it out!

We here at Equity Guru also have been following the company very closely, and are big fans! Here is Gaalen’s latest 3 minute hit on EarthRenew:

I personally am a big fan of their regenerative fertilizer business. Especially given the upcoming fertilizer shortage. EarthRenew’s sustainable health solution is much more attractive than using human urine. No, I am not joking. In a bid to revive dying crops in Niger Republic, scientists are using a mineral-rich, low-cost and easily accessible fertilizer – human urine. A team of researchers from Niger, the UK and Germany are combining Oga, sanitized urine, with organic manure to increase yield of pearl millet panicle, which is a robust, quick growing summer cereal. The only downfall apparently is the smell.

Some big news (and controversial for some shareholders) came out last week. EarthRenew announced the successful closing of the issue and sale of 41,804,500 units of the company at a price of $0.25 per unit. Gross proceeds from all units are $10,451,125. For more info, you can check out this press release.

The Company intends to use the net proceeds of the Offering (i) to complete preparatory stages with respect to the development of its fertilizer blending facility in Debolt, Alberta; and (ii) for general corporate working capital.

Some people don’t like the fact that the financing was done at a discount at $0.25 when the stock was trading around $0.30 when financing was announced. You see the gap down reaction on the chart below. I say though that the company now has the funds to create and advance catalysts for shareholders. At an opportune time when the world will be hearing more about food and fertilizer issues.

The stock kept dropping on the gap down. We are now back below the $0.20 support level. The stock has the potential to drop lower to $0.15. Some positive news is that we have seen a few days of range between $0.16-$0.20. Can the stock build a base for a reversal from here?

The gap at $0.25 needs to be taken out for further bullish momentum. It should be noted that the financing includes warrants that can be exercised at a price of $0.32 per share for a period of 48 months following the date of issuance.

It is now up to Keith Driver and the team to deliver. The stock seems too cheap at these levels. EarthRenew has the funds, and an opportune macro environment for their product and services. Exciting times ahead!

CubicFarms (CUB.TO)

I live in Vancouver BC and it has been a weird Spring. Much colder, and even in June I was wearing a light jacket when I went outdoors. We had our first heat wave followed by a thunderstorm and showers. Let’s see how the rest of summer looks.

The point I am trying to make is that weather patterns are becoming unpredictable due to the climate crisis. Spring is a time when seeds are planted, and farmers expect sunshine to help allow the crops to grow. The issue is that some places didn’t have much sunshine in Spring this year.

There was a viral video here in BC where a Strawberry farmer spoke about berry crops lagging at this time in the year. “Completely wrecked” is the term farmer Amir Maan used. “We’ve never had a season like this before,” says Maan in the video. “This is not normal, I don’t know what the heck’s going on”.

Outdoor farming is experiencing some difficulties, but indoor farming is just fine. Farmer Amir Maan continues by saying, “We’re doing controlled growing climates, it’s safer for us, more sustainable, less pesticides, and we get a reliable crop”.

The climate crisis is why we will be moving to indoor farming. And it will have to occur soon. Unfortunately, the catalyst might be a food shortage before we begin to ramp up indoor farming. CubicFarms is a play for food security.

We recently had CEO of CubicFarms, Dave Dinesen, on Five Easy Questions with Maddy, and he also says the future is indoor farming:

In my most recent 3 minute hit, I detail why CubicFarms is my preferred way to play the upcoming food crisis. It isn’t just the climate crisis, but also the fact that young people don’t want to be farmers. Maybe we don’t want to do the hard labour that comes with farming, or we are too distracted with technology. Some might use the term “lazy”. Well with CubicFarms indoor farming modules, a crop can be grown just with a push of a button.

The CubicFarm System controlled environment agriculture (“CEA”) technology grows commercial scale amounts of fresh produce in modular, food-grade steel systems using the Company’s proprietary Crop Motion Technology™ moving plants throughout the system using less water, land, energy, and labour.

On the day I am writing this article, we got news from CubicFarms which has caused a BIG reaction in the stock price.

CubicFarms has announced that it has entered into agreements with NTE Discovery Park LTD for the purchase of 26 CubicFarm System modules at a sale price of CAD $4.4 million. These will be installed at Discovery Park in Campbell River BC, with the intention to expand with the sale and manufacturing of an additional 100 modules in the near future. 26 modules for $4.4 million…100 more in the future takes that to over $17 million on this deal.

“We’re excited about operating the CubicFarm System and diversifying our operations by manufacturing major hardware components, installing CubicFarms’ impressive indoor farming technologies, and localizing fresh produce for communities in B.C.,” said John Tang, Chief Executive Officer, NTE Discovery Park. “Building and operating vertical farms in Western Canada has a dual purpose of providing communities with better access to delicious fresh food year-round without importing 90% of it over long distances, thereby reducing the carbon footprint of food delivered to consumers. We are also providing new jobs with the ongoing manufacturing of CubicFarm System modules for installation across Canada and North America. We were impressed by the CubicFarm System’s lower energy usage compared to other vertical farms, and we’re proud to use power sourced BC Hydro with a hydroelectric dam located 4 kilometres from the site.”

The market loves the news. At time of writing, CubicFarms is up over 38% on the day!

A lot of technicals to talk about. We could be on the verge of a new uptrend. With this strong price action, CubicFarms will retake the important psychological zone of $0.50. We also will confirm a close above my moving average (brown line) which hasn’t been seen since March 2022. I put more strength in this crossover because in technical analysis terms, a crossover is bullish only after a long downtrend. This criteria is being met.

The one last thing that I want to see in upcoming days is CubicFarms to cross back over $0.625. This zone was support going back to 2020. We recently broke below this after breaking support at $1.00. Things looked very bearish and you can see that from the long downtrend. If we can reclaim support at $0.625, it adds another reversal and bullish confluence. Things are looking prospective on the technicals backed by good fundamental news.

Indoor farming is going to be the future and our answer to food security as the climate crisis continues. Keep CubicFarms high on your watchlist!