It would be an understatement to say that we are bullish uranium here at Equity Guru. We love uranium. Barring the whole idea of commodities and hard assets doing well in an inflationary environment, there are real fundamentals to be bullish uranium.

The energy situation is dire in Europe. Germany is planning to fire up coal plants in order to compensate for a cut in Russian gas supplies by increasing the burning of coal. For a country that wants to go green, they sure are going backwards. I just wonder if an energy crisis in Europe just speeds up the adoption of nuclear energy being a CO2 free energy source that can handle baseload power.

In his article titled, “Uranium is the future“, our very own Lukas Kane highlighted the importance of nuclear energy being pivotal in combating the climate crisis. He said eloquently:

Attempting to beat global warming without nuclear energy is like The Edmonton Oilers trying to win The Stanley Cup without Connor McDavid. A valiant enterprise with hopeful subplots – but unlikely to succeed.

He further goes on to develop the bullish case for uranium:

Nuclear power plants produce no greenhouse gas emissions during operation,” reports the World Nuclear Organization, “and over the course of its life-cycle, nuclear produces about the same amount of carbon dioxide-equivalent emissions per unit of electricity as wind”, and even less than solar.

Uranium is required for nuclear power plants.

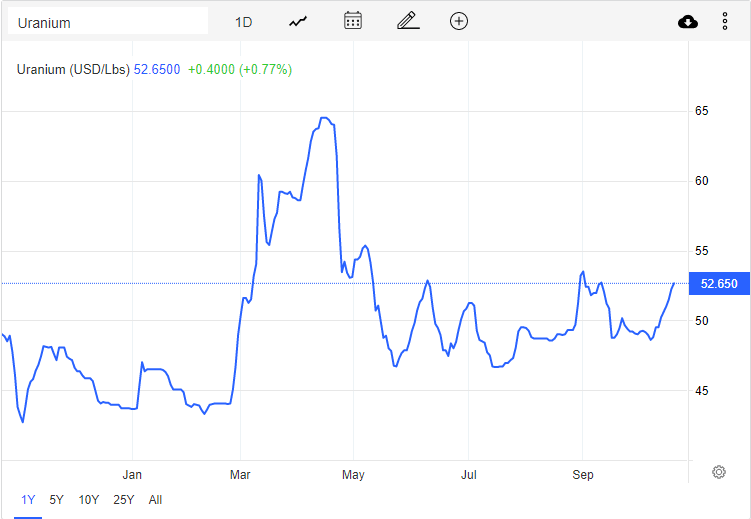

As the necessity for nuclear power becomes more obvious, the price of uranium has been rising.

Uranium was up over 47.69% at one time this year. Now it is up 7% for the year. Uranium is still holding above major support after pulling back from highs made in April when uranium hit over $65. Uranium remains in a range between $46.50 to the downside and $53.50 to the upside. Not too bad considering the falls we have seen in many other commodities. It does seem the supply side of the demand-supply equation will continue to be the primary driver for higher prices as demand increases.

From the charts, a range breakout could be on its way. Uranium really looks bullish and has seen a 6% monthly rise! If we see a range breakout, we are likely to see an epic pop in uranium stocks.

I myself am excited about small market cap uranium juniors in good jurisdictions and having a near term upcoming catalyst. Standard Uranium (STND.V) fits the bill.

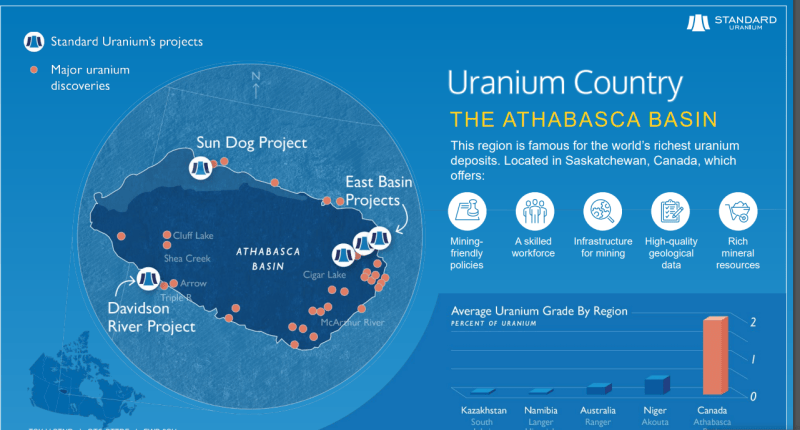

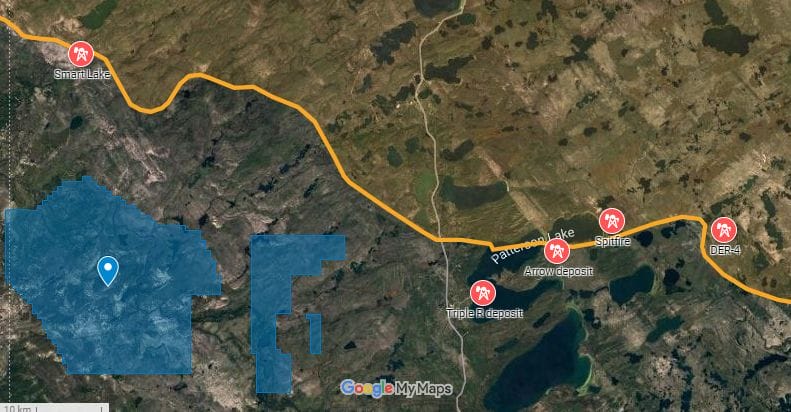

Standard Uranium is an exploration company and evaluates, acquires and develops uranium properties in Canada. Its flagship project is the Davidson River Project. The Davidson River Project is located in the heart of the Patterson Lake Uranium District (Southwest Athabasca region). Surrounded by major players in uranium exploration and development including Cameco, Orano, NexGen, Fission Uranium, Fission 3.0, Denison, Purepoint, UEX, ALX and Skyharbour. Other projects include the Sun Dog and East Basin Projects.

On May 16th 2022, Standard Uranium announced the mobilization of its exploration and drilling team to the Company’s flagship Davidson River Project.

Here are some highlights:

- Objective is to make a basement hosted high-grade uranium discovery

- Drilling to commence third week of May 2022

- Two drill rigs, helicopter-supported

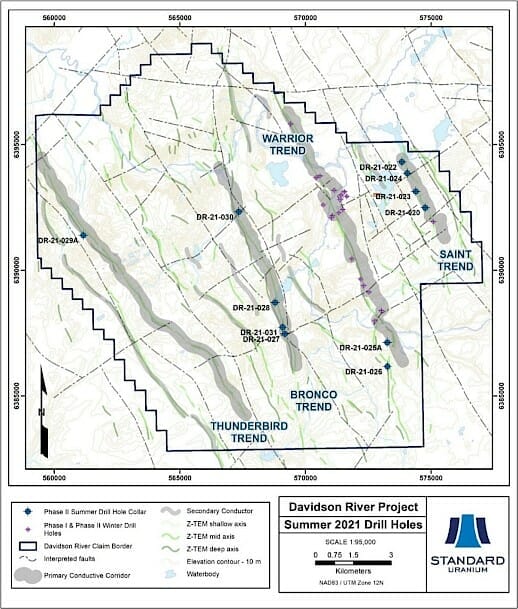

- Follow-up drilling on the southeast Warrior and Bronco corridors with vectoring information gained during the 2021 Phase II programs (Figure 1)

- Thunderbird trend basement rocks will be tested for the first time

- Increasing discovery potential of the Project through collection and interpretation of technical information from strategically planned drill holes

The Company has mobilized to begin the fourth drill campaign on its flagship Davidson River Project. The 25,886-hectare Davidson River Project is situated in the Southwest Athabasca Uranium District of Saskatchewan and contains significant untested blue-sky potential for a high-grade basement-hosted uranium discovery. The upcoming program is expected to comprise approximately 5,000 metres in 13 drill holes.

“Drill targeting will be focused on the southeast portions of the Bronco and Warrior conductors, and we will test the Thunderbird conductor for the first time,” stated Jon Bey, CEO and Chairman, “I am excited to see the drills turning again at our Davidson River Project, with the goal of proving to investors that patience will be rewarded.”

Drilling was successfully completed ahead of schedule and under budget as detailed by a July 21st 2022 press release.

Elevated radioactivity and significant structural and lithological signatures of a basement-hosted uranium-bearing system were intersected. Highly deformed and graphitic structural zones identified several new priority follow-up targets along the Thunderbird and Bronco trends.

Standard Uranium also announced a partnership with GoldSpot Discoveries (SPOT.V) to develop new and advanced drill targets on all of the company’s projects. Standard Uranium is the first uranium company to partner with GoldSpot.

Jon Bey, CEO and Chairman stated:

“It is well understood that Tier-one uranium discoveries are incredibly difficult to find. Our technical team have been very successful in hitting targets that reveal the ideal geological environment for uranium mineralization, which leads us to believe we are getting closer to a major discovery.

While identifying high quality drill targets below extensive cover, we recognize drilling on the Davidson River project is very complex and I would like to congratulate the Base Diamond Drilling team for delivering drilling results that exceeded our expectations and completing the program ahead of schedule and under budget. We look forward to again working with the Base team for our 2023 drill programs as we continue to hone-in on a high-grade basement hosted deposit.

We are also pleased to announce that we will be adding to our technical capability with the high-tech expertise of GoldSpot Discoveries who we expect will assist in refining our future drill targets via the use of their proprietary artificial intelligence software.”

Standard Uranium announced a brokered private placement for up to $3.6 million CAD. Gross proceeds of up to $3.6 million from the sale of any combination of units of the company at a price at $0.11 per unit and flow through units at a price of $0.13. In terms of warrants, they will allow holders to purchase one common share of the company at a price of $0.17 at any time on or before that date which is 24 months after the closing date of the offering.

A second private placement for up to $3.5 million was announced in early September 2022. This has been upsized to $4.5 million with the first tranche closing for $2.1 million. A non-brokered private placement at a price of $0.11 per unit and flow-through units at a price of $0.13 to raise gross proceeds of up to $3.5 million. Each unit will consist of one common share and one half of one common share purchase warrant. Each warrant entitles the holder to purchase one common share at a price of $0.17 at any time on or before that date which is 24 months after the closing date of the offering.

There is always risk when investing in a junior. You can have experienced management, assets in a good jurisdiction, assets next to past discoveries/current producers, and yet you might not find anything when the drills start churning. But if there is a find, and the chance of discovering a large reserve increases, the stock will rip. We are talking about percentage returns in the triple digits.

What adds more drama to this whole play is the fact the CEO of Standard Uranium, Jon Bey, picked up the Davidson River project as two major uranium companies were fighting for it. For more information, be sure to check out our Investor’s Roundtable on Youtube!

The highlighted blue area displays the Davidson River project. Look at the major deposits above and to the right of it. You can probably begin to understand why this land area attracted majors.

Two years of exploration on the Project (2020-2021 drilling) has confirmed lithological and structural parallels between the uranium-fertile Patterson Lake corridor and the Davidson River conductive trends, bolstering the Company’s confidence in continued exploration on the Project.

Just adds more excitement to this play, and the fact that there is a real possibility of a large discovery. All of this looks more attractive when you consider the current price action on Standard Uranium stock.

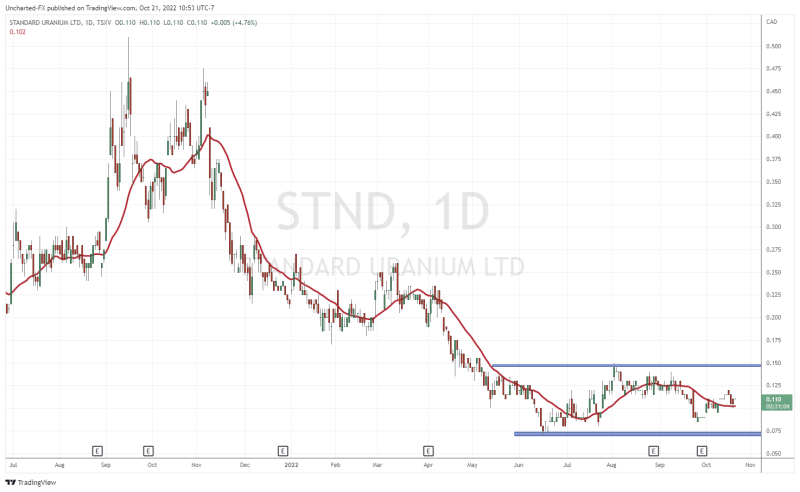

Standard Uranium has been in a downtrend and is now in the range, or consolidation phase. This is positive for technical traders as a consolidation is a phase which tends to come before a new uptrend.

Support comes in at $0.07 (which is previous record all time lows) and resistance comes in at $0.145. Support is an area where buyers enter and we can expect to see a wall of buyers at $0.07. For those wanting to enter on a technical breakout, we would need $0.145 to break. This triggers the end of the range and the beginning of a new uptrend.

I mentioned the opportunity in picking up small market cap uranium companies in this market environment. Standard Uranium has a market cap of under $20 million. $18.25 million to be exact. Smaller market cap companies have a higher chance of doubling when the right catalyst is present. This is a company that has an experienced management team, has the right assets in the best jurisdiction, have upcoming catalysts, and the stock price is the cheapest it has ever been. Too cheap when you factor in all the things I have just said in my opinion.