I was just scrolling through Twitter when I came across this:

My agriculture readers know how important Ukraine is to food supply. If you recall we were taught in school that Ukraine is the breadbasket of Europe. The Ukrainian government has said the Russians have destroyed the 2nd largest grain terminal in the country. This will block 22 million tons of grains. Read the last sentence on the tweet.

“Not sanctions on Russia, but its actions are the only reason for the unfolding global food crisis”. You heard it from them. After months of warning readers that a food crisis is unfolding, and we will see the signs as early as this Fall, you have a government saying the same thing. Other western governments are doing the same, but I think they tone things down as they don’t want to cause panic and have people go out and stockpile. Which would make the situation even worse.

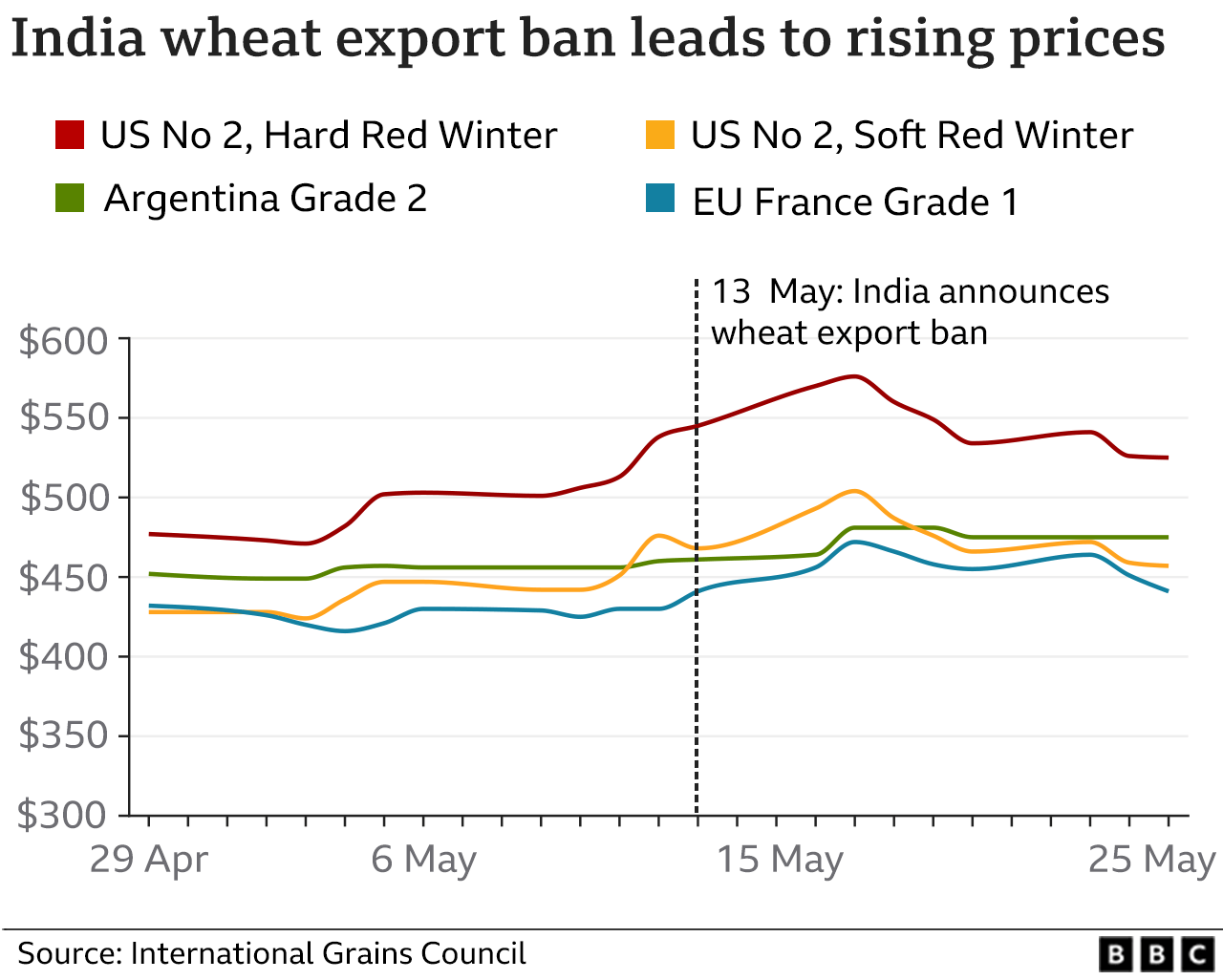

I don’t want to get too geopolitical here, but nations are taking extreme measures to protect their food security. India is a good recent example, banning exports of wheat and sugar. Don’t be surprised to see more nations do the same. And unfortunately, it will make things worse.

“If everyone starts to impose export restrictions… that would worsen the crisis,” German Food and Agriculture Minister Cem Ozdemir said after the ban was announced in May.

India is the world’s second biggest wheat producer, but accounts for less than 1% of the global wheat trade. But just before announcing the ban, India was aiming to boost exports by shipping a record 10 million tonnes of wheat this year – compared with just two million last year. It was mainly to Asian and African nations. The positive news is that even after the ban, several of these nations said they are still in touch with India to keep exports going. Its top export markets are Bangladesh, Nepal and Sri Lanka as well as the United Arab Emirates (UAE).

There is also the idea that the Russians might not want to send fertilizer to western markets. Perhaps they want to punish unfriendly nations by holding back to allow food prices to rise and maybe even, spark social unrest in the streets of major European capitals.

Ukraine gets all the attention but it isn’t the only reason for disruption. It sucks saying this, but a global issue is occurring because of unpredictable weather patterns. China, the world’s largest producer of wheat for its huge population, said in March that its winter crop could be the “worst in history” because of heavy rainfall in 2021. We still will have to wait until the harvest come Fall but things aren’t looking too great. Imagine what would happen to wheat prices if China has to go out and purchase wheat from the global markets amidst tightening supplies! Perhaps the good relations and investments in South American countries like Brazil will pay off.

Here in British Columbia Canada, farmers are warning about crop lags. We have had an unusually cold and wet Spring so far. It is now June and people are still wearing raincoats and warm jackets on some days. Strawberry season in BC has gotten “completely wrecked”. That’s what Farmer Amir Maan has said when he showed the state of his strawberries. June kicks off strawberry season in BC, but from the videos posted by Maan, they are not ready.

“We’ve never had a season like this before,” says Maan in the video. “This is not normal, I don’t know what the heck’s going on,” he says, pointing out how the unripened strawberry plants are damaged. “This should be loaded, there’s barely any fruit on here.”

However, Maan shows that the berries are growing in his indoor greenhouses. For those who have followed my work from day one on agriculture, this is what I have predicted. Indoor farming will be the future as we deal with unpredictable weather patterns. What used to be great land for farming may instead be where we install solar panels and wind turbines instead.

There is also this game going on where some farmers are not purchasing fertilizers and soybeans because they believe prices will come down lower. If they wait until the last minute, it could lead to major transportation bottlenecks.

Zerohedge covered this very nicely:

That’s a problem because the agriculture-heavy country and food-source for half the globe, imports nearly 85% of its fertilizer and Russia is the main origin. As supplies have normalized, prices have declined over the past weeks, but farmers still aren’t buying. They are waiting for further price cuts, according to Marina Cavalcante, an analyst at Bloomberg’s Green Markets.

“Farmers have the expectation that prices will keep falling after declines last week and in the previous one,” she said. “So they’ll wait for further decreases to buy.”

And here is an example in supply/demand game theory: Brazil is the world’s biggest shipper of several crops, including soybeans. Farmers can delay their purchases until the eve of the soybean seeding in September. But if they all wait too long, a last-minute rush could lead to inland transportation bottlenecks that may leave some of them empty-handed anyway.

There is another problem: there just may not be enough actual fertilizer coming out of Russia, which has decided to punish the world by sending food prices for western nations to record highs and spark social unrest in the process. After all, the biggest reason prices are so high is because there is just not enough supply. And while speculators may have pushed prices somewhat higher than they should be, any farmers hoping that prices will fully renormalize will be disappointed.

We can summarize all of this by using the term, “demand destruction”. This is already impacting poorer third world countries. The African nation of Chad, Africa’s 5th largest country, declared a food emergency due to a lack of grain supplies. Neighboring nation Niger is also feeling the pressure with milk, sugar, oil and flour prices skyrocketing. The middle class is having trouble affording food. Imagine how worse it is for the rural population.

People may not like it, but we have been correct in our analysis here on Equity Guru. Prepare for some rough times ahead, but there will be light at the end of the dark tunnel. As an investor, we should expect more food shortage and food price headlines to be front page news. I continue to see lower stocks of food at my local supermarkets and by Fall, I expect things to be even worse.

Agricultural commodities and ETFs are going to be a great long term play, as well as the major agriculture companies. Let’s take a look at some ag commodity plays.

In terms of a major agriculture chart break, we have to look at soybeans. A major breakout is taking place with soybean futures climbing above 1725. The highest price for soybeans is 1789 which printed back in 2012. Soybeans seem ready to break that and rip into all time record highs. Soybeans was mentioned in that Zerohedge article I quoted above.

For those looking to play this soybean move, I suggest taking a look at Teucrium’s Soybean Fund (SOYB). SOYB has already printed new all time record highs. Major breakout above $29, and I think prudent long term investors will place their stop loss below $28 and ride. When I use the fibonacci trading tool to determine next levels, I get $31.20 and $34.44.

How about sugar? Above is Teucrium’s sugar fund, CANE. I personally trade sugar futures (both raw and white) but this is a good way to gain exposure through the markets. Sugar has been ranging in a flag pattern, and if we breakout to the upside, we will move to test resistance at $10.10. The intriguing part for CANE is the upside potential. If you zoom out on the monthly chart:

I see a cup and handle forming. We could be set for an explosive move in sugar. Recall that India has included sugar in its banned export list.

From a technical perspective, Teucrium’s wheat fund is what the sugar fund might do on the monthly chart. WEAT broke out above $8.00 which I covered months ago. Technically, WEAT remains bullish above $8.00. The daily chart is quite choppy right now, but major headlines as we get to harvest season could be the trigger for the next upside. The wheat markets are definitely going to be making more financial headlines in the future.

Teucrium’s corn fund continues to rally. On the monthly chart we are seeing some rejection at $30 on the monthly chart. However, the uptrend remains intact and I can see this breaking out down the road. I would watch the $25.50 zone if wheat does pullback, but on the daily chart we do see some choppiness.

Can’t decide on wheat, corn, sugar and soybeans? No worries! Teucrium has you covered! Their Agricultural fund, TAGS, is an easy way for investors to be exposed to the price of corn, wheat, soybeans, and sugar futures in a brokerage account. Currently TAGS is holding an uptrend with resistance above at $36.25. The trendline is holding so far.

As I write this, the stock markets had an epic dump, and closed below a major support level. In other words, more downside is expected. This could impact agricultural stocks. But Teucrium really emphasizes the diversification aspect.

They say on the fund site:

- Agricultural commodities have a historically low correlation with U.S. equities making TAGS a potentially attractive option for portfolio diversification.

- Commodities typically behave differently than other asset classes and can help enhance portfolio diversification.

Money will still need to flow somewhere for returns even in a falling market. Fund managers are not paid to sit on cash and in treasuries. I expect with macro headlines on agriculture and agricultural commodities, big money will flow into this space for yield. The long term monthly charts indicate we are just in the beginning innings of a larger move. This is the opportunity for the retail crowd to get ahead of the move.