Dash is an open source cryptocurrency. It’s actually a bitcoin fork, and the name is also periodically used to describe the decentralized autonomous organization (DAO) run by some of its users. These are often called masternodes.

Originally conceived of as “Xcoin” by Evan Duffield after its fork from Bitcoin, it was subject in its early days to some negative press that it was little more than a pump and dump operation. It was rebranded as Darkcoin not long after, and received even worse press for being used in dark net markets. This prompted yet another rebrand, this time as Dash, which is a portmanteau of the words digital cash. It’s also worth pointing out that Dash is no longer being used in any major dark net markets.

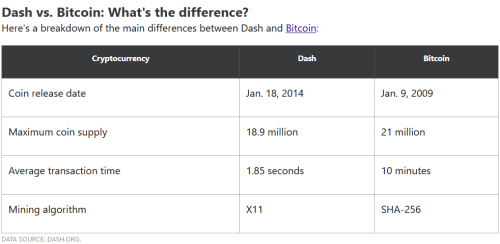

Here’s how it compares against Bitcoin:

Governance

Governance is through the DAO. All decisions are made on a blockchain through masternodes and anyone who owns 1,000 Dash can become a masternode owner. These perform standard node functions like hosting a copy of the blockchain for consensus purposes, relaying messages and validating transactions, but they also act as shareholders, with voting power for proposals on improving Dash’s ecosystem. Along with masternodes, the system also uses standard nodes and miners.

Use value

Unlike most of the other cryptocurrencies, Dash actually has a dedicated fanbase. Including the entire country of Venezuela and plenty of companies that will take the crypto in exchange for their products.

Here’s a non-exhaustive list:

- Bitfy. Crypto Super App. Visit Website.

- Cloudbet. Dash Casino. Visit Website.

- BitPlaza. Mobile Shopping App. Visit Website.

- Coinpay. Crypto Services. Visit Website.

- Crypto Gummies. CBD Gummies. Visit Website.

- Travala.com. Travel. Visit Website.

- Shopinbit. Retail. Visit Website.

- DashDirect. Retail. Visit Website.

Consensus

Coins are mined using the proof of work consensus mechanism with a hash function called “X11.” It includes eleven rounds of hashing and the block time is around two and a half minutes.

Masternodes have extra powers. “Instantsend” skips the whole mining process and instead needs a consensus of masternodes to validate a transaction, bumping transactions in line. “PrivateSend’ is meant to give optional consumer-grade privacy by mixing participating users unspent Dash before transactions can be completed.

Every time a block of transactions is added to the Dash blockchain, it generates rewards. The rewards are split three ways:

- 45% to miners

- 45% to masternodes

- 10% to Dash’s governance budget

The network uses a secondary consensus mechanism for masternodes called Proof-of-Service (PoSe). PoSe in Dash is a scoring system used for checks and balances on masternodes to ensure the quality of the extra services provided to the network. This ensures each masternode is online and at the correct block height at all times.

This consensus system actually helps to reinforce the security of the network in that rogue miners can’t engage in a 51% attack, because the masternode operators would keep the miners in check. Masternodes themselves are properly incentivized to be in the network’s best interest because each operator must lock in a 1,000 Dash commitment to the network. If they decide to cheat they risk that expensive commitment, which keeps node operators within the rules.

Controversy

Dash have a built-in mechanism that allow for the user to obscure transactions from outside view, which put it into a subcategory of coins known as privacy coins. Others include Monero, Zcash, the Haven Protocol and plenty others. The PrivateSend mechanism means you pay a small fee and the source of the funds disappears from the blockchain. It’s the cryptocurrency equivalent of wearing a red hat and blending into a crowd of people wearing the same type and color of hat. Nobody can follow where you’ve come from or where you’re going, thereby breaking your traceable history on the blockchain.

As stated above it’s been used in the past for dark markets, but it’s also been used to fund whistleblower outfits like Wikileaks.

Dash is presently trading at $59.19 per coin with a market cap of $637,281,913.

—Joseph Morton