Attempting to beat global warming without nuclear energy is like The Edmonton Oilers trying to win The Stanley Cup without Connor McDavid. A valiant enterprise with hopeful subplots – but unlikely to succeed.

Many Canucks are stressed out that a Canadian team has not won The Stanley Cup for 29 years. The global warming issue is even more urgent.

Global warming will shave 11-14% off global economic output by 2050 according to a report from insurance company Swiss Re – amounting to $23 trillion in reduced annual global economic output.

Nuclear power plants produce no greenhouse gas emissions during operation,” reports the World Nuclear Organisation, “and over the course of its life-cycle, nuclear produces about the same amount of carbon dioxide-equivalent emissions per unit of electricity as wind”, and even less than solar.

Uranium is required for nuclear power plants.

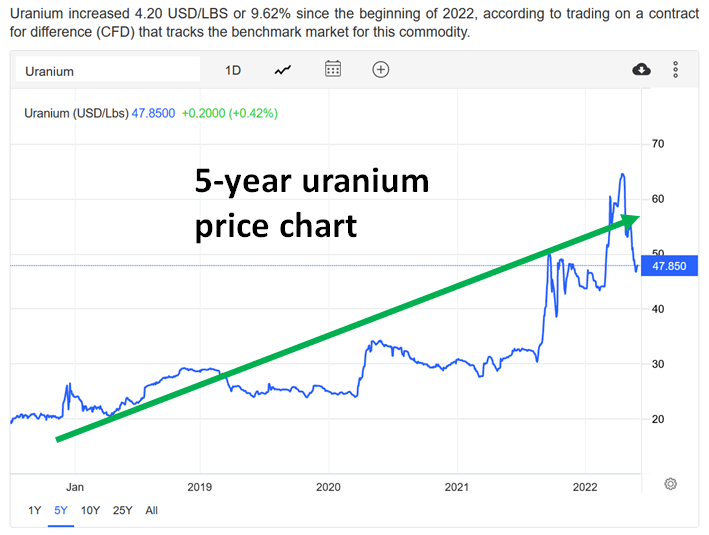

As the necessity for nuclear power becomes more obvious, the price of uranium has been rising.

Here are 4 small uranium companies with big upside.

Azincourt Energy (AAZ.V) is a $21 million company focused on the strategic acquisition, exploration, and development of alternative energy/fuel projects, including uranium, lithium, and other critical clean energy elements.

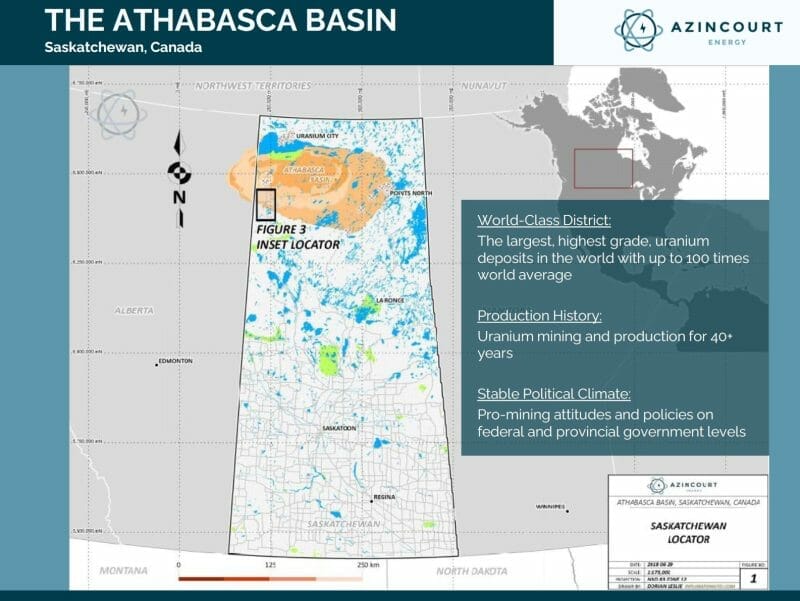

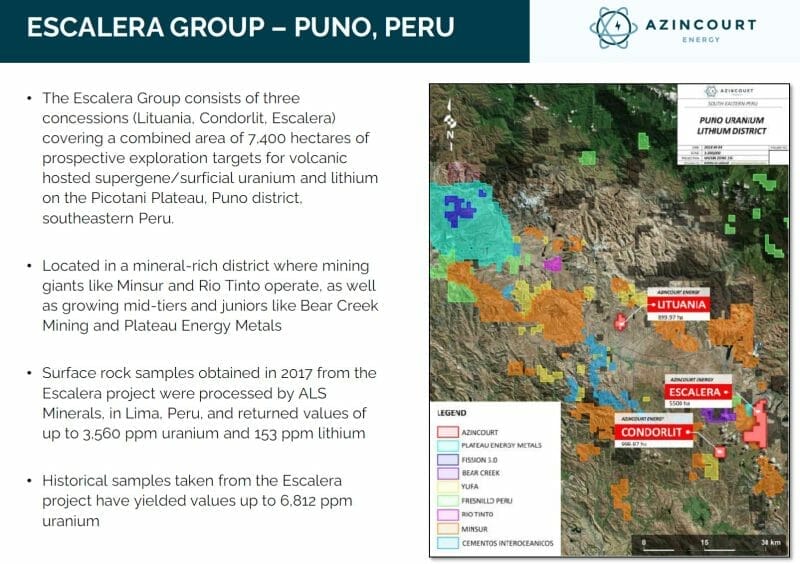

AAZ is developing its majority-owned joint venture East Preston uranium project, and its recently acquired Hatchet Lake uranium project, both located in the Athabasca Basin, Saskatchewan, Canada, and the Escalera Group uranium-lithium project, located on the Picotani Plateau in southeastern Peru.

On April 19, 2022 Azincourt announced a 2.5/1 share consolidation.

On April 07, 2022 AAZ announced it has signed an L.O.I with Oberon Uranium, whereby Oberon would be granted an option to acquire the Escalera Group, a 100%-owned series of uranium-lithium exploration located in southern Peru.

Oberon Uranium is a private uranium company which has the option to acquire 100% of the Lucky Boy uranium project, a past producing uranium mine located in Arizona, USA.

Under the terms of the LOI, Oberon has 90 days to conduct due diligence on the Projects, following which Oberon has the right to negotiate an option to acquire 100% interest in the Projects from the Company by completing the following proposed payments and expenditures:

- $25,000 cash and 100,000 shares of Oberon upon signing a definitive agreement;

- $25,000 cash, 250,000 shares and $50,000 in work expenditures on or before the 12-month anniversary of the definitive agreement;

- $50,000 cash, 250,000 shares and $200,000 in work expenditures on or before the 24-month anniversary of the definitive agreement;

- $50,000 cash, 250,000 shares and $250,000 in work expenditures on or before the 36-month anniversary of the definitive agreement; and

- $100,000 cash, 250,000 shares and $500,000 in work expenditures on or before the 48-month anniversary of the definitive agreement;

For a total commitment of $250,000, 1,100,000 shares and $1,000,000 in work expenditures. During the term of the option, Oberon will be responsible for all costs and expenses associated with maintaining the Projects in good standing, including any required regulatory filings and maintenance fees.

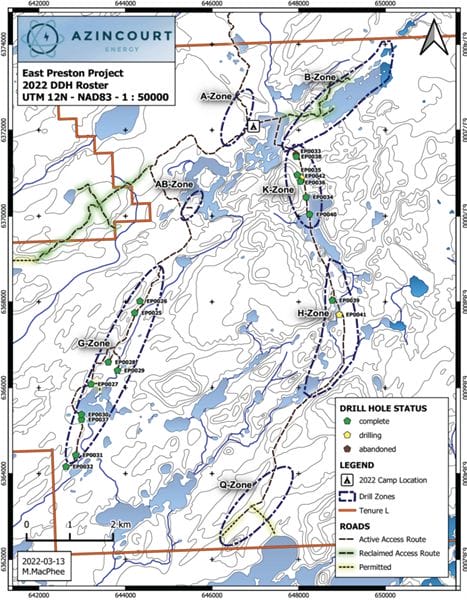

The Winter 2022 exploration program at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada, has been completed.

A total of 5,004 meters was completed in 19 drill holes over eight weeks duration. Drilling was focused on the G-, K-, and H-Zones.

A total of 420 samples were collected throughout the program and sent to the Geoanalytical Laboratory at the Saskatchewan Research Council in Saskatoon, Saskatchewan for analysis.

Complete assay results, expected to be received beginning in late April, 2022 and into June, will be reported once received, reviewed, and verified by the Company’s QP.

“The discovery of these alteration zones, both along the same trend, covering almost two kilometers of ground within these two separate zones, is a very important development,” said President and CEO, Alex Klenman. “With 5,000 meters of drilling we were able to establish 1,700 meters of alteration, that’s a pretty good ratio.”

“We know that alteration is associated with uranium deposition, acting as a halo proximal to deposition. The area in and around these zones is now a clear priority for continued drilling. The assay results will give us a really good idea of what we’re into and we’re eager to see what comes back from the lab,” continued Klenman.

March 16, 2022 AAZ announced that two drill rigs are operational on the East Preston project. 15 drill holes are complete, one was abandoned, and two are in progress on the K- and H- Zones.

“We are encouraged by the response we are seeing in the K-Zone,” said VP, Exploration, Trevor Perkins. “The extensive alteration we have encountered is very encouraging. I am curious to see what H-Zone may reveal and how it relates to what we are already seeing in K-Zone. This just reinforces the need to focus extensively in these areas,” continued Mr. Perkins.

“The extension of the alteration, now to over a kilometer in length, is a significant development,” said Alex Klenman, President and CEO. “The zone is large and appears to be getting larger, and it’s showing very positive geological characteristics. This is what we need to see, what we want to see.”

“Chasing this type of alteration has been established as an effective method of making meaningful discovery. The fact that this zone continues as we move south speaks to the need to keep drilling in this area. We’re excited by the results so far and we’re eager to see what more holes in this area reveal,” continued Mr. Klenman.

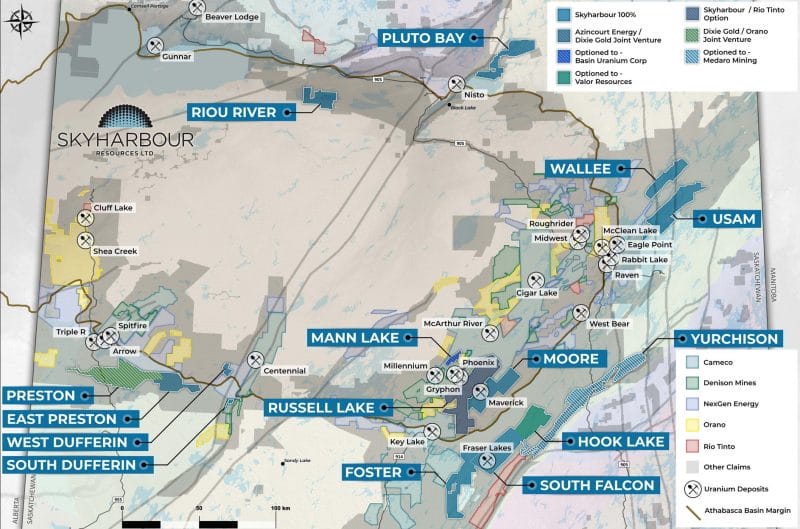

Skyharbour Resources (SYH.V) is a $60 million company that controls 15 uranium and thorium exploration projects in Canada’s famed Athabasca Basin. Ten of the projects are drill-ready, covering over 450,000 hectares of land. That’s a land package 1,300 X bigger than NYC’s Central Park.

Skyharbour has acquired from Denison Mines, a 100% interest in the Moore Uranium Project which is located 15 kilometres east of Denison’s Wheeler River project and 39 kilometres south of Cameco’s McArthur River uranium mine.

Moore is an advanced stage uranium exploration property with high grade uranium mineralization at the Maverick Zone that returned drill results of up to 6.0% U3O8 over 5.9 metres including 20.8% U3O8 over 1.5 metres at a vertical depth of 265 metres. The Company is actively advancing the project through drill programs.

On May 19, 2022 SYH announced that it has entered into an Option Agreement with Rio Tinto Exploration to acquire up to 100% of the Russell Lake Uranium Project which comprises 26 claims covering 73,294 hectares of prospective exploration ground strategically situated between the Company’s Moore Uranium project (to the east) and Denison Mines’ Wheeler River project (to the west).

“This is a significant transaction for Skyharbour and involves the acquisition of a premier exploration property adjacent to our Moore project,” stated Jordan Trimble, President and CEO of Skyharbour Resources, “Uranium properties with the pedigree and prospectivity of Russell Lake are few and far between given the very strategic location, notable historical exploration and findings, as well as the numerous property-wide targets with the potential to generate new discoveries.”

“Additionally, we welcome Rio Tinto as a new strategic shareholder and project partner. We have a shared vision for the exploration of the various prospective target areas that remain to be fully tested on the Property using modern exploration methods and techniques. We look forward to working with Rio Tinto to generate a new meaningful discovery in the years to come.”

Deal Highlights:

- Option to acquire an initial 51% and up to 100% of Rio Tinto’s 73,294 ha Russell Lake Uranium Property strategically located in the central core of the Eastern Athabasca Basin of northern Saskatchewan.

- Both Highway 914 servicing McArthur River and a high-voltage power line connected to the provincial power grid run through the Property’s western claims.

- Skyharbour, as operator, can earn an initial 51% interest in the Property by paying CAD $508,200 in cash, issuing 3,584,014 common shares to RTEC, and funding CAD $5,717,250 in exploration on the Project, inclusive of a 10% management fee to Skyharbour, over a period of 3 years.

- Skyharbour has a second option to earn an additional 19% interest for a total of 70%, and a further possible option to obtain the remaining 30% interest in the Project for an undivided 100% ownership interest.

- The Property has been the subject of significant historical exploration efforts including over 95,000 metres of drilling in over 220 drill holes. This provides the Company with an excellent dataset to direct subsequent exploration on high-priority areas with the potential for near-term discovery of high-grade uranium mineralization.

- Previous exploration work has identified numerous highly prospective target areas, some of which host high-grade uranium mineralization in historical drill holes. Furthermore, there are over 35 kilometres of untested conductors on the Property in magnetic lows, which are indicative of pelitic basement rocks conducive to uranium deposition in the Athabasca Basin.

- The Property has a permitted and functional exploration camp suitable for over forty people, and conveniently located near Highway 914 and within 5 km kilometres of Denison’s Phoenix deposit. The Property’s claims are in good standing for 2-22 years from banked assessment credits.

- This transaction adds another drill-ready, advanced-stage uranium exploration asset to Skyharbour’s project portfolio and offers significant operational and exploration synergies with the adjacent Moore uranium project.

“Perhaps best characterized as a cash-rich Athabasca Basin land baron, Skyharbour holds an extensive portfolio of projects beyond its flagship property,” wrote Equity Guru’s Greg Nolan on October 21, 2021, “all strategically located—all boasting significant discovery potential”.

“In order to push these projects further along the exploration/development curve, management deploys the Prospect Generator Model (PGM), where strategic partners fund exploration and make cash/share payments for a majority stake in the project.

Multiple irons in the fire via these partner-funded programs = multiple shots at a new discovery.” – End of Nolan.

Blue Sky Uranium (BSK.V) is a $32 million company that controls a district-scale (300,000-hectare) uranium and vanadium exploration project in southern Argentina.

Nuclear energy now supplies 10% of the world’s electricity and is responsible for one-third of global carbon-free electricity.

Vanadium is used as a steel additive in crankshafts, gears, tools and knives. Brain surgeons typically use vanadium scalpels.

After a series of deadly building collapses, the Standardization Administration for the People’s Republic of China, announced a new rebar standard – requiring the use of vanadium.

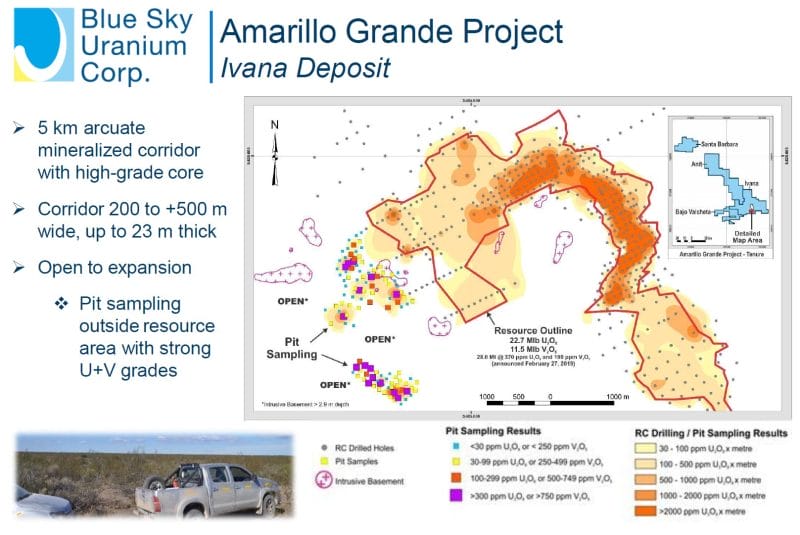

On April 11, 2022 BSK announced the resumption of its 4,500 metre exploration drilling program with new holes planned at the Ivana Central target, located 10 kilometres north of the Company’s Ivana Deposit at its wholly-owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province, Argentina.

Six holes totaling 286 metres were drilled at Ivana Central in 2020 before the program was paused, leaving approximately 1,200 metres to be completed at this target. Two of the first six holes at Ivana Central intersected anomalous uranium, including 120 ppm U3O8 over 1 metre in hole AGIC-01.

“Ivana Central is the next area we are evaluating in our continued push to identify and delineate new mineralization and deposits at the district-scale Amarillo Grande project,” stated Nikolaos Cacos, Blue Sky President & CEO, “We look forward to completing this tranche of drilling so that we can plan detailed follow up and advance to testing other targets in the Ivana area.”

BSK is part of the Grosso Group, lead by Joe Grosso. The group has a vast network of local and regional contacts in Argentina. Joe Grosso is in the Argentina Mining Hall of Fame.

“Joe Grosso can get a meeting with anybody in Argentina at any time,” confirms Niko Cacos, President and CEO of Blue Sky.

We asked Cacos to explain the difference between a “district” and a deposit.

“A single deposit, could occupy a footprint, maybe 10 kilometers wide,” explained Cacos, “We have 300,000 hectares of tenements. A corridor that is 145 kilometers in length by 50 kilometers wide. Almost the distance from Vancouver to Seattle.”

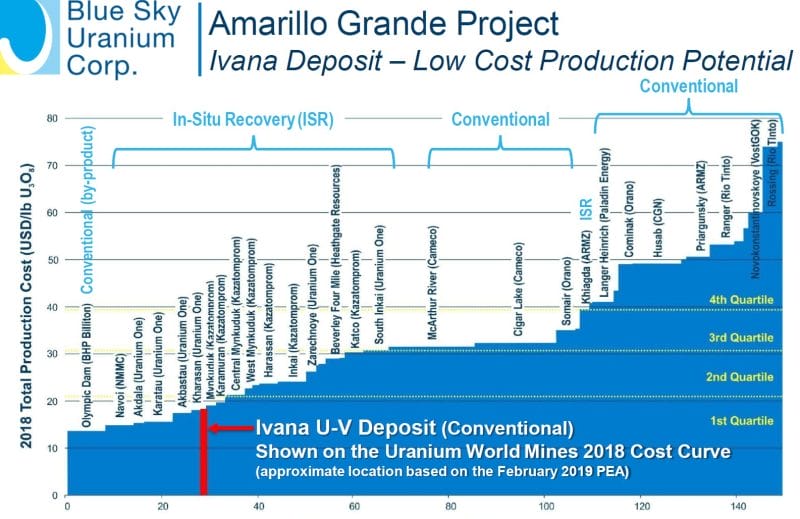

A Preliminary Economic Assessment (PEA) on the Ivana deposit, confirmed an inferred mineral resource estimate of just under 23 million pounds of uranium and 11.5 million pounds of vanadium.

“The PEA numbers indicate that if the project was in production today, it would rank amongst the lowest operating costs on the planet,” stated Cacos.

BSK has also identified at least four areas as compelling targets with a high potential for making additional new uranium-vanadium discoveries, similar to the Ivana deposit.

“In Argentina, we have a very few farmers on our land package,” confirms Cacos, “You can probably count them on fingers of both hands. We’ve signed formal agreements. Blue Sky has permission to do drill work on the farmer’s land. We’re on good terms with everybody.”

The PEA anticipates an open pit mine with a 13-year life-of-mine (LOM).

The PEA also reveals attractive economics. At USD $50/lb U3O8 and USD $15/lb V2O5 the post-tax NPV is USD $135.2M, IRR is 29.3% and capex is USD $128.05M.

“The $128 million capex includes a $28 million contingency,” stated Cacos, “If we add more pounds of uranium, the capex is not going to increase much. Whatever pounds we add will be gravy.”

“With all in sustaining costs of $18 a pound, if this project was in production today with current prices, it would make money,” added Cacos.

Standard Uranium (STND.V) is a $14 million company focused on the identification and development of prospective exploration stage uranium projects in the Athabasca Basin in Saskatchewan, Canada.

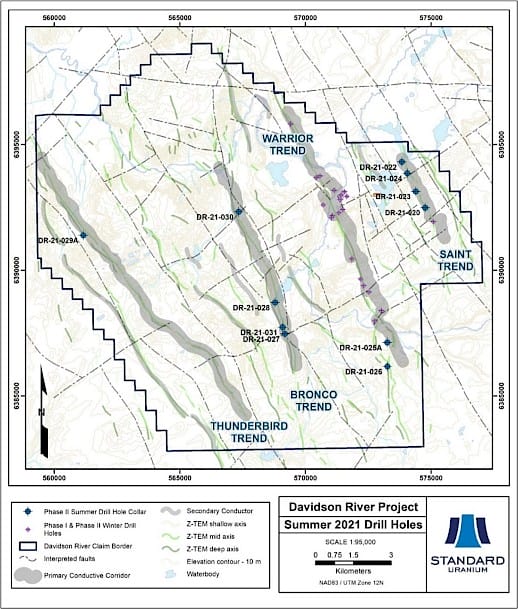

Standard Uranium’s Davidson River Project, in the southwest part of the Athabasca Basin, Saskatchewan, is comprised of 21 mineral claims over 25,886 hectares.

Davidson River is highly prospective for basement hosted uranium deposits yet remains relatively untested by drilling despite its location along trend from recent high-grade uranium discoveries.

May 16, 2022 STND announced the mobilization of its exploration and drilling team to the Company’s flagship Davidson River Project.

The focused drill program will follow up on prospective structures and alteration intersected during previous programs and test brand new areas.

Key Focus Points:

- Objective is to make a basement hosted high-grade uranium discovery

- Drilling to commence third week of May 2022

- Two drill rigs, helicopter-supported

- Follow-up drilling on the southeast Warrior and Bronco corridors with vectoring information gained during the 2021 Phase II programs (Figure 1)

- Thunderbird trend basement rocks will be tested for the first time

- Increasing discovery potential of the Project through collection and interpretation of technical information from strategically planned drill holes

The Company has mobilized to begin the fourth drill campaign on its flagship Davidson River Project. The 25,886-hectare Davidson River Project is situated in the Southwest Athabasca Uranium District of Saskatchewan and contains significant untested blue-sky potential for a high-grade basement-hosted uranium discovery. The upcoming program is expected to comprise approximately 5,000 metres in 13 drill holes.

The spring/summer drill program will follow-up on the most prospective basement structures and alteration zones intersected to date and begin testing new target areas along the four major exploration trends on the Project.

Several kilometres of graphitic conductors remain to be tested at Davidson River, and the basement rocks of the Thunderbird trend remain unexplored to date.

Two years of exploration on the Project (2020-2021 drilling) has confirmed lithological and structural parallels between the uranium-fertile Patterson Lake corridor and the Davidson River conductive trends, bolstering the Company’s confidence in continued exploration on the Project.

“Drill targeting will be focused on the southeast portions of the Bronco and Warrior conductors, and we will test the Thunderbird conductor for the first time,” stated Jon Bey, CEO and Chairman, “I am excited to see the drills turning again at our Davidson River Project, with the goal of proving to investors that patience will be rewarded.”

The Orano Group lists Reasons for Turning to Nuclear Energy to Combat Global Warming:

#1 A Low-carbon energy – Nuclear power is one of the world’s energy sources that emits the least greenhouse gas Its very low CO2 emission rate – four times less than solar.

#2 Constant and controllable energy – Nuclear power provides continuous electricity thanks to its robust production system, able to adapt to variations in electricity demand.

#3 Competitive energy – Nuclear power is one of the least expensive sources of electrical power generation.

#4 Energy that is essential to the electricity mix – Nuclear and renewables must combine together to sustain the low-carbon energy transition

#5 – Energy that preserves health – Nuclear power emits no fine particles, nitrogen dioxide, sulfur dioxide, nitrates or phosphates into the atmosphere.

Just as The Edmonton Oilers require Connor McDavid’s participation to win The Stanley Cup – the world needs nuclear energy to beat global warming.

Full Disclosure: Azincourt Energy is an Equity Guru marketing client