A Golden Opportunity

- $272.18M Market Capitalization

Minera Alamos Inc. (MAI.V) provided an update on May 31, 2022, regarding the Company’s continuing progress at its 100% owned Santana gold mine. The Santana project is located in Sonora State, Mexico, and covers 4,500 hectares. Between 2008 and 2011, drilling at Santana totaled 30,000 meters (m) and outlined significant gold mineralization at the Nicho Main Zone.

“The development of the second and larger pit will provide access to the main source of known mineralization at the project supplementing current starter pit operations and allowing the Company to ultimately exit the project’s pre-commercial phase of production,” stated Darren Koningen, CEO.

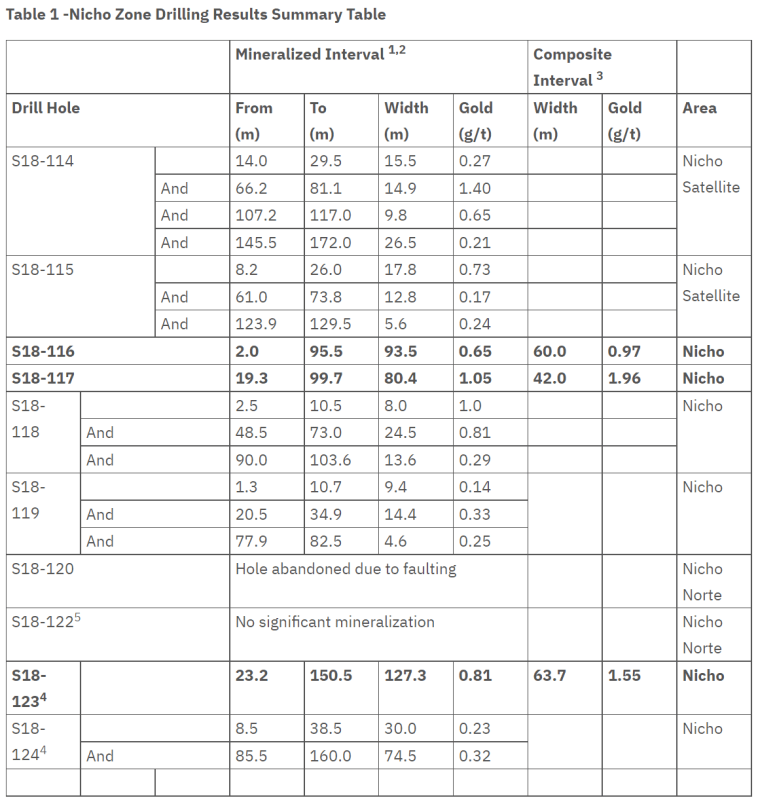

In 2018, Minera conducted its Phase 1 drill program involving 10 holes at 1500 m. This represented the Company’s first exploration drilling since 2011. Holes S18-114 and S18-115 targeted a satellite zone of gold mineralization immediately to the northeast of the Nicho deposit. With this in mind, both holes intersected multiple zones of gold mineralization.

Additionally, hole S18-123 revealed 127 m of 0.81 g/t gold (Au). Other Phase 1 drill highlights include holes S18-116 and S18-117, which contained 93.5 m of 0.63 g/t Au and 80.4 m of 1.05 g/t Au, respectively. For complete drill results, see the chart above. Two years later, on April 30, 2020, Minera announced results from its Phase 2 drill program at Santana.

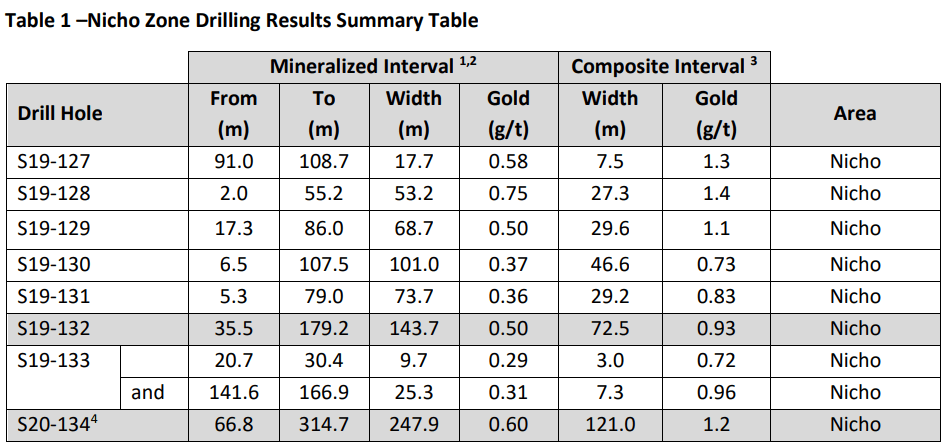

Minera’s Phase 2 program was primarily intended to evaluate the southwest and southerly extensions of the Nicho main zone in order to fully define the outer limits of the proposed Nicho pit. Phase 2 drill highlights include 143.7 m of 0.50 g/t Au at Hole S19-132 and 247.9 m of 0.60 g/t Au at Hole S20-134. With that brief history lesson out of the way, let’s talk about Minera’s latest news.

On April 7, 2022, Minera announced that it had successfully obtained a formal explosives storage permit allowing the Company to focus on development activities. This includes the initiation of Phase 3 operations at the Nicho Main Zone (NMZ). That being said, Minera announced today that the development of the NMZ is now underway with haulage and access roads largely completed.

“Costs are in line with our internal modeling and with the plans to open up the main Nicho pit this quarter, we should see a shift in mining rates that in due course will allow a growing operation to drive positive cash flows in the second half of the year,” said Mr. Koningen.

Minera also stated that limited vegetation and surface cover have been removed. The Nicho pit represents the Company’s second pit, with the first pit being the Nicho Norte starter pit. When compared to the Nicho Norte pit, Minera’s Nicho pit offers a much larger scale of the NMZ, which will assist in driving project mining rates to planned levels for the Company’s overall commercial operations.

Having now received its explosives storage permit, Minera has transitioned all production drilling and blasting activities to in-house. This has resulted in a greater than 80% reduction in overall blasting costs while increasing efficiency. Furthermore, Minera has stated that its on-site lab should be completed in the next few weeks in preparation for the Company’s first blasting at the NMZ.

Minera’s on-site lab was included on the Company’s list of Q2 2022 development plans announced on April 7, 2022. The completion of this lab is expected to reduce third-party assay costs and improve turnaround for assays. Looking forward, Minera intends to release a maiden resource report for the first phase of the Santana mining activities at the Nicho deposit once Phase 3 nears completion.

Nicho Norte Update

Speaking of, Minera has also provided an update for its Nicho Norte operations. According to the Company, gold mined and stacked on the leach pad at Nicho Norte totals approximately 18,000 oz with roughly 7,000 oz of gold recovered in concentrate. In case you didn’t know, leach pads are used to extract precious metals like gold from their ore.

However, Minera’s operations in May have been seasonally impacted by the ongoing drought affecting Sonora. Miniscule rainfall has forced the Company to locate additional local sources of water to support operations. Although, the upcoming rainy season is expected to recharge water reservoirs, enabling Minera to accelerate the recovery of gold stacked on the leach pads in Q3 2022.

Select Financials

In Minera’s latest press release, the Company shared various financial highlights from its Interim Financial Statements for the three months ended March 31, 2022. Highlights include revenues of $5,160,026 from an estimated 65% of gold production in the quarter, with the cost of goods sold totaling $2,255,305. It should be noted that the remaining gold was sold post-quarter end.

In total, Minera achieved income from operations of $1,529,128 compared to a loss of $4,166,739 in the same quarter in 2021. The Company reported a net income of $1,067,853 for the quarter to $0.002 per share compared to a net loss of $2,790,352 or $0.006 per share in the same quarter in 2021.

Minera’s cash and cash equivalents for the quarter were $8,177,510 compared to $9,379,390 at year-end. The Company attributes its increased cash position to gold sales recorded after quarter-end as well as a modest reduction in the market to market valuation of investment holdings.

Bearing this in mind, the Company announced that, subsequent to the quarter-end, it has sold its remaining 590,000 shares in Prime Mining at a price of $3.50 per share for gross proceeds of $2,065,000. Minera has also agreed to basic terms for a USD$3,000,000 unsecured working capital facility with Ocean Partners USA Inc.

Minera’s share price opened at $0.58 today, compared to a previous close of $0.58. The Company’s shares were up 5.17% and were trading at $0.61 as of 3:59 PM EST.