The May 24, 2022 “In Gold We Trust Stagflation 2.0” report predicts that gold will push back to $2,000 an ounce in 2022 and get up to $5,000 an ounce by 2030.

“Just as in 2018, when we warned of the inevitable consequences of the attempted turning of the monetary tides, we are now issuing another explicit warning,” the report states, “In addition to wolfish inflation, a bearish recession now looms.”

“The Federal Reserve runs the risk of overestimating the impact of rate hikes and balance sheet reductions on containing inflation, just as it has underestimated the impact of rate cuts on boosting inflation,” continued the report.

Hard assets like gold, silver, copper, lithium, REEs and zinc are all defensive weapons against global money printing.

Below is a video summary of the “In Gold We Trust Report”. Jump to minute 15:35 to hear the phrase “Dancing Sasquatch Guy” uttered in dulcet German tones.

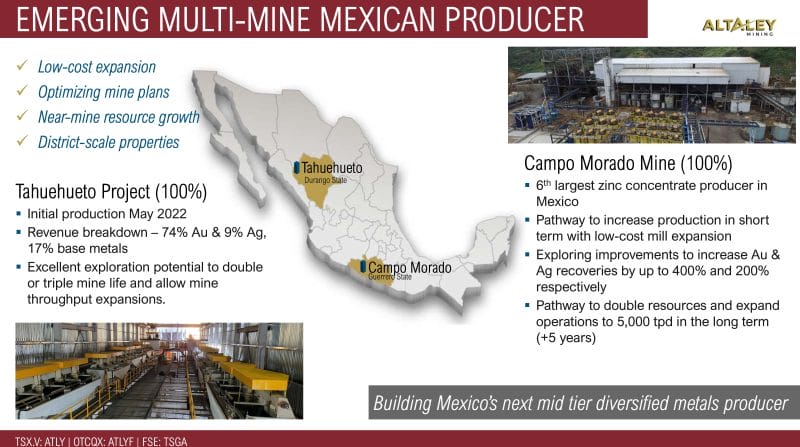

Altaley Mining (ATLY.V) is a $68 million company with two 100% owned Mexican gold, silver, and base metal mining projects.

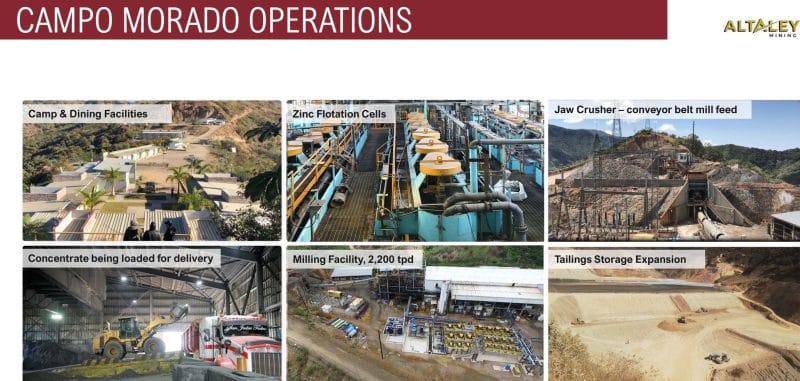

Campo Morado is currently producing at an average of 2,200 tonnes per day and is currently estimated to be Mexico’s 6th largest zinc producer.

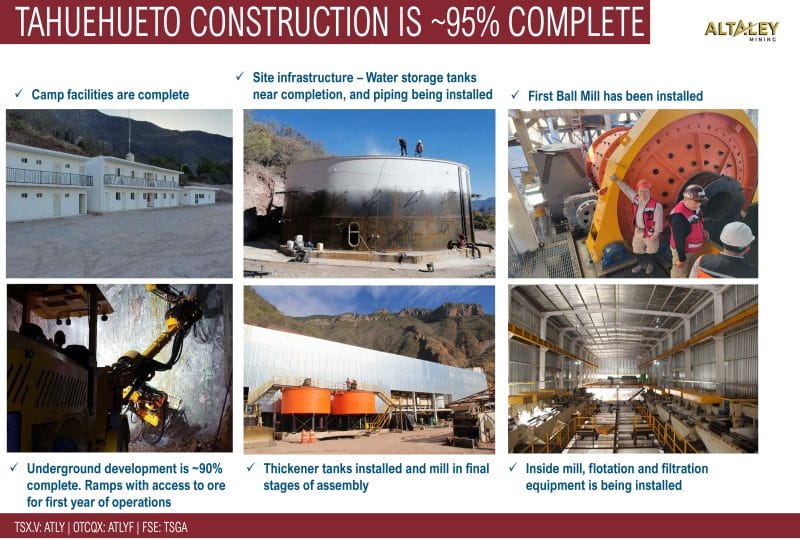

Tahuehueto has a nearly-completed 1,000 tonne per day processing facility production of gold, silver, lead, and zinc. Full production is targeted for Q3-Q4 2022.

Like most junior resource companies, Altaley has taken its licks over the last few years. In March of 2018, it was trading at .94. Over the next two years, the SP sunk to .05. It’s currently trading at .29.

During this time, gold prices bounced from $1,400/ounce to $2,000/ounce and back to $1,850. But ALTY’s volatility hasn’t just been a function of the metal prices.

In 2020, ALTY lost $6 million in funding for its Tahuehueto gold project when the Mexican bank Accendo Banco lost liquidity (and its operating license). Accendo Banco held $12 million of the project’s funding.

ALTY did not curl into the foetal position and make gurgling baby noises.

The plucky two-asset company generated $8 million towards the Tahuehueto gold project from its Campo Morado Mine. It raised a further $5 million from a financing.

The former CEO Ralph Shearing, stepped back in. In this excellent April 9, 2022 video, Mr. Shearing talks to Crux Investor about ALTY’s current business objectives.

On May 16, 2022 Altaley Mining (ATLY.V) announced that it has initiated pre-production mining and mill commissioning operations at its Tahuehueto Gold Mine in Durango, Mexico.

A one-ball mill capable of processing up to 500 tonnes per day (tpd), is now operational. Concentrate deliveries are expected in June, 2022, bringing ATLY its first revenues.

“The robust cash flows anticipated from Tahuehueto should allow us to accelerate our debt repayments,” stated Altaley Mining CEO Ralph Shearing, “Our cash flow modeling suggests all loan debt may be repaid in under two years.”

“We will also re-initiate exploration activities to expand reserves and resources, which exploration I am convinced, can unlock the hidden, undiscovered ultimate potential of this district-scale project allowing mine expansion and extension to the current life of mine.”

“Tahuehueto’s processing facility is operational allowing for milling up to 500 tpd with flotation cells, concentrate thickeners and concentrate filters successfully tested and operational,” states ATLY.

“During the commissioning phase of the first ball mill, a bulk concentrate will be produced and as soon as possible thereafter, the Company will process a separate precious metal rich lead concentrate and a zinc concentrate. Copper concentrate production is planned to be initiated late 2022”.

Altaley’s underground mining contractor has developed access to four stopes, two on the El Creston structure and two on the Perdido structure, providing multiple working faces more than fully capable to supply adequate mill feed for the mine’s start-up 500 tpd phase.

Current Production acceleration Plan:

2 nd Ball Mill installation

Installation of the second 500 tpd ball mill to increase milling capacity to 1000 tpd is planned to be completed in Q3, 2022.

Crushing Circuit

The company is completing construction of the mine’s permanent crushing circuit, which will contain a primary jaw crusher and secondary cone crusher with associated vibrating screens and storage hoppers.

Tailings Thickener and Dewatering

The tailings thickener is functional and tailings filter presses for dewatering are will be operational by June 2022.

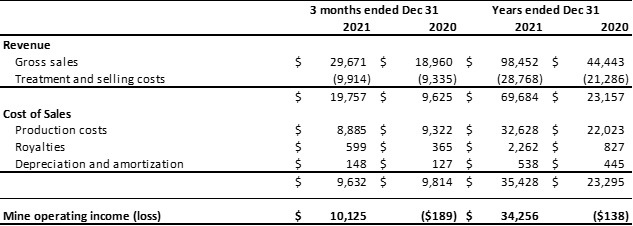

On May 2, 2022, ALTY released its consolidated financial statements and MD&A for the year ended December 31, 2021.

2021 Financial Highlights

- 121% increase in gross revenues to $98.4M

- Mine operating profit increased to $34.2M from a 2020 loss of $138K

- Basic earnings per share of $0.15

- Positive net income of $36.2 million, up from the previous year’s loss of $11.6M

“We will build on these excellent 2021 results as we continue our improvements at Campo Morado and very soon, enter production at our Tahuehueto gold mine where we expect robust economics to significantly increase our revenues and profitability,” stated CEO Ralph Shearing.

Zinc is an anti-corrosive added to iron or steel to prevent rusting. Zinc prices started rising late last year, months before the conflict as the cost of electricity in Europe forced some major European producers to temporarily close down production.

Zinc price drivers

- Disruption of zinc concentrate supplies due to the suspension of large zinc mines as a result of the COVID-19 pandemic

- Persistent environmental restrictions in China and mine closures and disruptions in other countries

- Recovery of zinc consumption levels in China, the US, and other countries due to rebounding construction levels. China has been implementing a number of infrastructure projects such as construction of railways, airports, and metro lines.

Campo Morado Mine Highlights:

- 2021 average AISC of $0.83/lb Zn. and C1 cash cost per lbs of US$0.60

- Produced 45,778 tonnes of zinc concentrate grading an average of 46% zinc, 2.12 g/t gold, 658 g/t silver and sold approximately 45,680 tonnes of zinc concentrate generating 2021 revenue of USD $52.14M

- Produced 9,936 tonnes of lead concentrate grading an average of 22% lead, 1.65% copper, 6.08 g/t gold, 776 g/t silver and sold 9,657 tonnes generating 2021 revenue of USD $8.96M.

- Mined 689,963 tonnes of ore grading 4.27% zinc, 1.09% lead, 124 g/t silver and 1.06 g/t gold.

- An estimated 689,963 tonnes of mineralized material were processed during year ended December 31, 2021

Campo Morado Mine Q4 operating income for the three months and year ended December 31, 2021, and 2020, is comprised of:

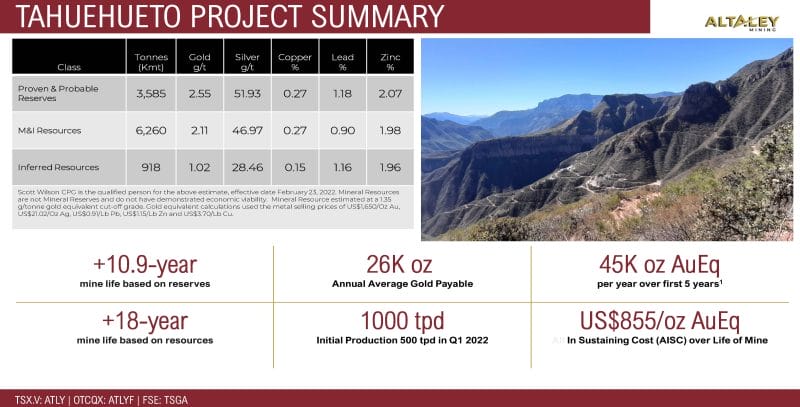

On April 26, 2022 ALTY filed an updated technical report, including a Preliminary Feasibility Study (PFS), for its Tahuehueto Project in Durango, Mexico, following a March 7, 2022 calculation that under-estimated the PFS economics. The updated data gives a 30% improvement to the overall economics of the project.

- 2022 Prefeasibility Study improves 2017 PFS increasing throughput to 1,000 tonnes per day returning a post-tax NPV of NPV of $161.3 million.

- IRR of 65% with a 2-year payback period (5% discount rate).

- Total Life of Mine Capital Cost estimate of US $56.9 million with project construction over 95% complete and initial pre-production targeted during April 2022.

- Life of Mine All in Sustaining costs (AISC) estimated at US $844 per gold equivalent ounce at $1,647.52/ounce Au, $21.64/ounce Ag, $0.92/pound Pb, $1.14/pound Zn and $3.60/pound Cu)

- Proven & Probable Reserves of 3.58 million tonnes grading 2.55g/t gold, 50.06 g/t silver, 1.92% zinc, 1.11% lead, 0.26% copper.

- 10.9-year Life of Mine (LOM) utilizing mostly low-cost bulk underground Sub-level Open Stoping mining method with average annual production of 25,987 oz of gold, 453,952 oz of silver, 827 tonnes of copper, 3,155 tonnes of lead and 6,123 k-lbs of zinc.

- Significant opportunities exist to expand the Projects Mineral Resources and Reserves base with near mine and regional exploration.

“As our Tahuehueto mine ramps up to full production during Q2-Q3 2022, increased cash flow will allow Altaley to recommence exploration drilling and unlock the ultimate potential of our Tahuehueto district scale project,” stated ALTY CEO Ralph Shearing.

“As soon as the Federal Reserve is forced to deviate from its planned course, we expect the gold rally to continue and new all-time highs to be reached, warns the “In Gold We Trust Stagflation 2.0” report.

“We believe it is illusory that the Federal Reserve can deprive the market of the proverbial “punchbowl” for any length of time, and we seriously doubt that the transformation of doves into hawks will last,” the report added.

As this report suggests, it may turn out that living-on-your-credit-card for decades eventually has (negative) consequences.

If so, look for companies like Altaley to explode to the upside.

ALTY is currently trading at .28 with a market cap of $77 million.