It’s Raining Gold?

- $11.675M Market Capitalization

Precipitate Gold Corp. (PRG.V) is a mineral exploration company focused on exploring and advancing its mineral property interest in Newfoundland Canada and the Dominican Republic. As of late, I have come to the realization that there is more to Newfoundland than just Jiggs Dinner and fish. Included in many of Canada’s diverse provinces and territories mined for gold, is Newfoundland.

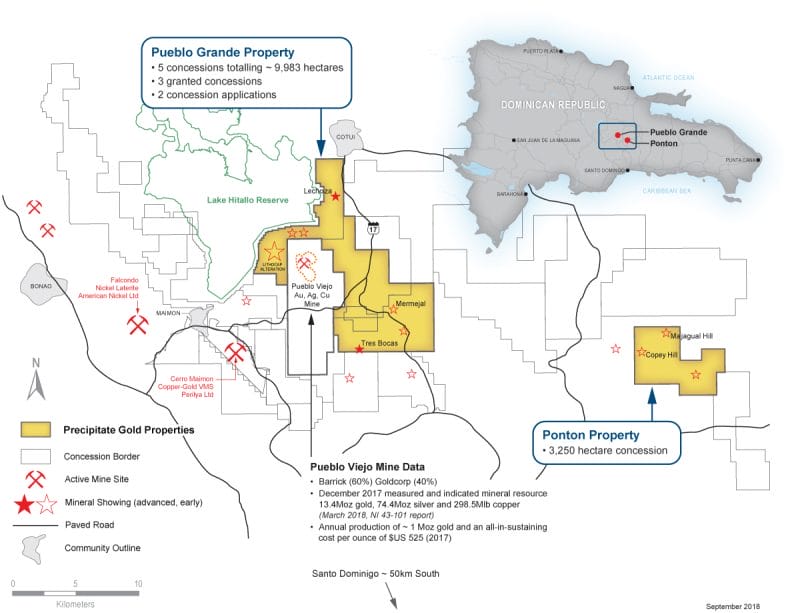

Precipitate Gold has two projects located in Newfoundland, namely, the Ace Project and the Motherlode Project. Outside of Canada, the Company is exploring its 100% owned Ponton and Juan de Herrera projects in the Dominican Republic (DR). As for Precipitate Gold’s Pueblo Grande Project in the DR, this project is subject to an “Earn-In Agreement” with Barrick Gold Corporation (ABX.TO).

For context, Barrick is another mining company with operations and projects in 18 countries, including North and South America. With this in mind, according to Precipitate Gold’s Earn-In Agreement, Barrick can earn a 70% interest by incurring USD$10 million within six years and producing a qualifying pre-feasibility study, which refers to the early-stage analysis of a potential mining project.

Pueblo Grande Project, DR

However, there have been some developments related to Precipitate Gold’s agreement with Barrick. You will have to stay tuned to find out. First, let’s talk a bit more about the Company’s most relevant properties, starting with the Pueblo Grande Project (PGP). The PGP concessions cover approximately 9,863 hectares and are located immediately adjacent to Barrick’s Pueblo Viejo Au-Ag-Cu Mine, approximately 50 km north of Santo Domingo, the capital city of DR.

According to Precipitate Gold, the property is a highly prospective and strategically located gold and copper exploration project. The latest drill results announced on July 14, 2021, revealed 17.0 m at 0.22 g/t Au from 61.5 m found down hole number 21-05 and 10.2 m at 0.44 g/t Au from 185.5 m down hole number 21-07. Drill targets were taken from 10 drill holes totaling 2,514 m, however, all other drill holes reported weak or sub-anomalous gold values.

In 2019, Precipitate completed data compilation and review of the PGP, concluding that there are eight highly prospective target areas for drill testing located within the Company’s Loma Cuaba Lithocap Zone. Of these eight targets, five have been classified as top priority targets. To be more specific, data generated from infill soil samples demonstrated numerous multi-element anomalies of surface mineralization in the targeted zones.

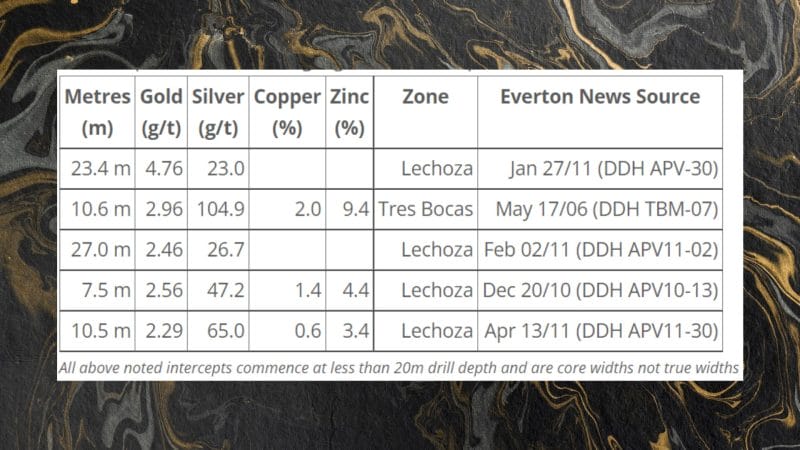

Several of these anomalies indicated northwest trends. This is noteworthy due to the fact that northwest-trending geological structures at Barrick’s neighboring Pueblo Viejo gold mine frequently host high-grade gold mineralization. Regarding PGP’s drill history, 2-high level drill discovery zones, namely Tres Bocas and Lechoza, identified mineralization within anomalies hosting elevated values of gold, silver, zinc, and copper.

Latest News

So, what are the developments I was referring to earlier? On May 13, 2022, Precipitate Gold announced that the Company and Barrick have entered into an amendment to the existing exploration earn-in agreement made back on April 13, 2020, related to the PGP. According to the amendment, Precipitate Gold has agreed to relinquish or reduce certain portions of select exploration concessions for cash consideration of USD$5,000,000 and the granting of a 3% net smelter return royalty (NSR).

“We are excited to announce this amendment to our ongoing Earn-in Agreement with Barrick as we believe the cash consideration of approximately $6,400,000 Canadian and an unencumbered 3% NSR over the Subject Areas represents a highly accretive proposition for the Company and its shareholders,” said Jeffrey Wilson, Precipitate’s President & CEO.

An NSR refers to the net revenue that the owner of a mining property receives from the sale of the mine’s product, before transportation and refining costs. That being said, Barrick has agreed to grant Precipitate Gold a 3% NSR with no re-sale restriction, rights of first refusal, or rights of first offer to Barrick. It is worth noting that Precipitate Gold’s relinquished concessions exhibit limited exploration potential with a low probability of hosting mineable mineralization, according to Mr. Wilson.

Even so, in the event that extractable mineralization is encountered, Precipitate Gold is protected via this amendment. How so? According to the terms of the amendment, Barrick has agreed that, if the extraction of mineralization is economically justifiable, it will transfer mining rights back to Preciprate at no cost. This will reinstate the relinquished concessions and remove any royalties associated with the area.

On the other hand, if at any point prior to the 10-year anniversary of the amendment Barrick wishes to transfer mining rights back to Precipitate Gold, it will provide advanced notice. If the Company accepts, it will assist in the transfer of such mining rights. Referring back to Barrick’s incurred minimum of USD$10 million, this amendment does not impact or reduce this required amount.

Looking forward, Barrick has notified the Company that its DR exploration team will continue to explore various prospective areas within the PGP. This includes three general areas of the project, all of which have demonstrated prospective geological and geochemical attributes but have been subjected to limited exploration:

- northeast of the active Pueblo Viejo mine area

- the eastern portion of the PGP

- the western portion of the aforementioned Lithocap zone

Motherlode Project, NL

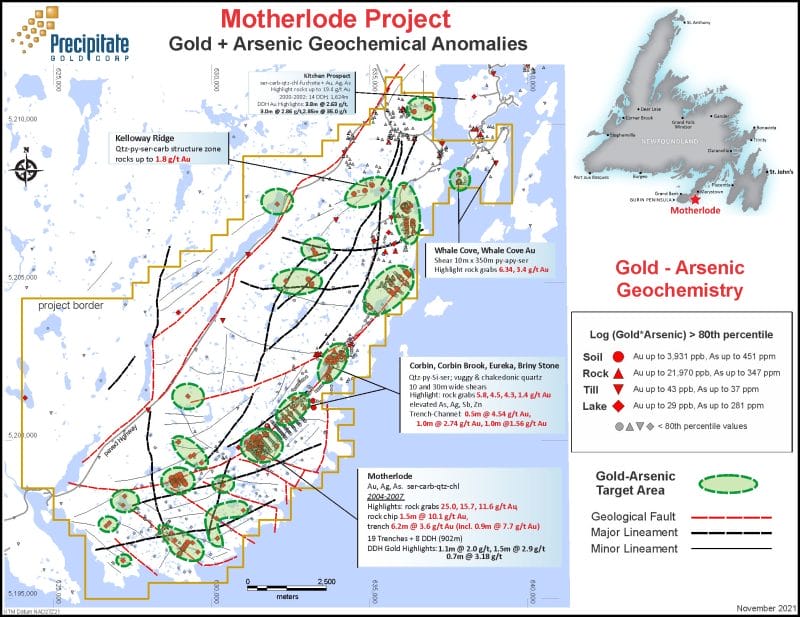

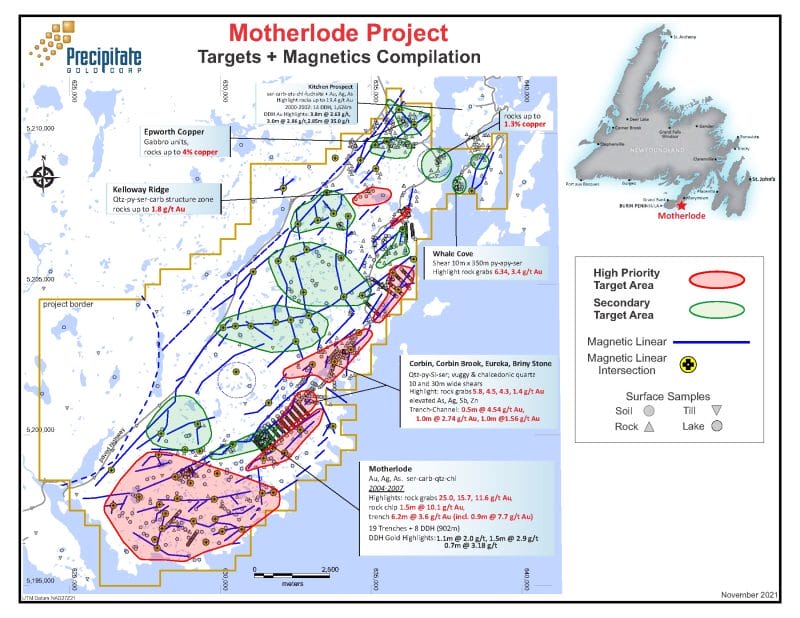

Now, time for the star of the show, depending on who you ask. Precipitate Gold’s Motherlode Project covers 12,350 hectares on Newfoundland’s south coast. To be more precise, the Company’s project is located in the southeastern region of the province’s Burin Peninsula. Precipitate Gold has defined this project as a highly prospective exploration project.

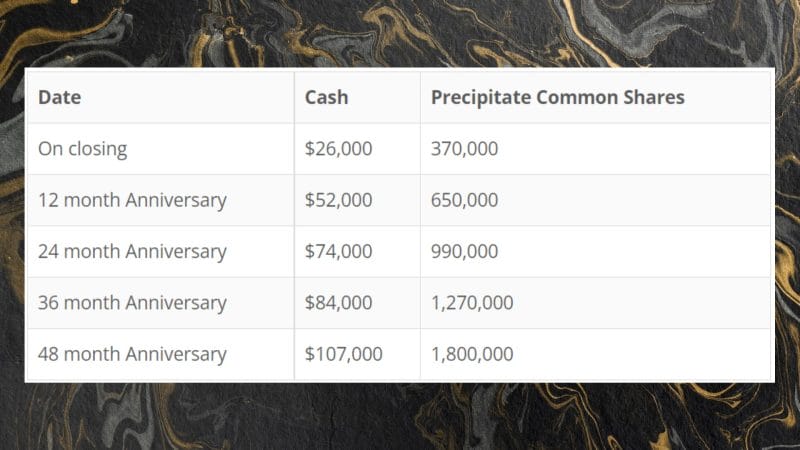

The Motherlode Project features 11 historical mineral occurrences, including 8 gold showings. With regards to Precipitate Gold’s ownership, the Company has entered into two property agreements granting it exclusive rights to earn 100% interest in a combined 6,100 hectares of mineral exploration licenses by fulfilling certain elect annual cash and share payments over a 4-year option term.

Upon completion, Precipitate Gold will have earned a 100% interest in the properties, subject to certain NSR returns of 1.5% and 2.5% to the two respective vendors. However, the Company may purchase portions of each NSR at any time for $500,000 per 0.5% to the first vendor, and $750,000 per 0.5% to the second vendor. However, Precipitate Gold also retains the right of first refusal to purchase the balance of all the NSRs at any time.

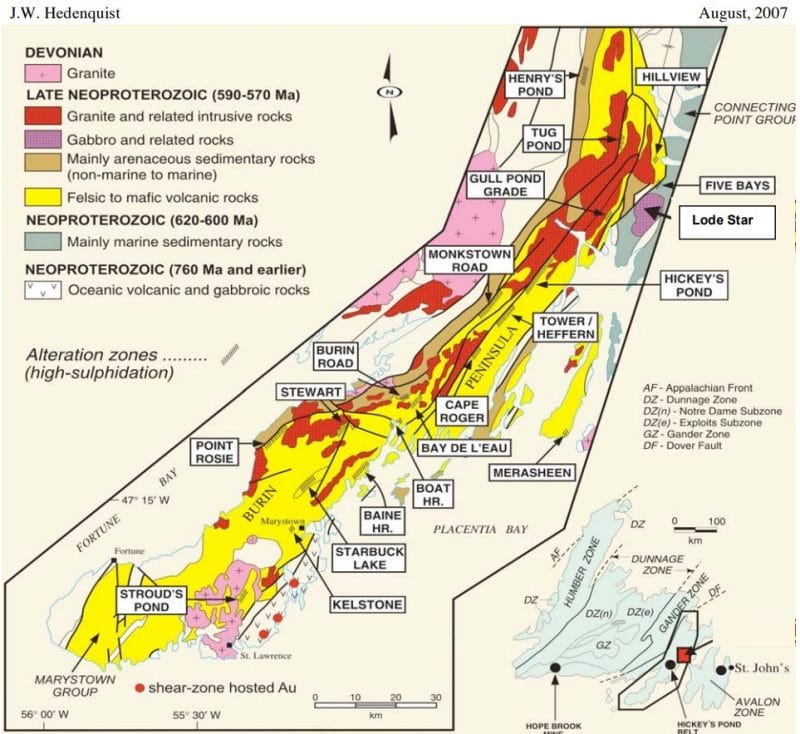

Referring back to the Burin Peninsula, historical reports indicate that gold enriched quartz veins and quartz-silica stockworks are strongly associated with high strain rocks such as shears, schists, and folds. With this in mind, the Motherlode Project features major northeast-trending, sub-vertical dipping shear-fault zones up to 30 m wide. In addition to the Motherlode Project, the Burin Peninsula is home to other high-profile gold exploration projects, including Bonavista Resources’ Hickey’s Pond.

Motherlode Select Historical Sampling Results:

- high-grade gold rock grab samples of 25.0 g/t Au, 15.7 g/t Au, 11.6 g/t Au, 6.3 g/t Au, and 4.5 g/t Au

- trench and channel results of 0.5 m of 4.5 g/t Au, 1.5 m of 10.1 g/t Au, and 6.2 m of 3.6 g/t Au

- 2007 Diamond Drill Results consisting of eight holes revealed 0.7 m of 3.2 g/t Au, 10.4 m of 0.82 g/t Au, and 1.5 m of 2.8 g/t Au

Keep in mind that these are select results listed by Precipitate Gold, however, these results are comparable to Hickey’s Pond, a nearby gold project. According to a report by Cornerstone Resources Inc., Hickey’s Pond revealed up to 12.4 g/t Au in a channel sample and 15.4 g/t Au in a grab sample. As a whole, the Burin Peninsula is largely characterized by volcanic, volcaniclastic rocks, as well as siliciclastic sedimentary units, which bodes well for gold exploration.

Latest News

Although dated, on December 1, 2021, Precipitate Gold announced results from its airborne geophysical survey of the Motherlode Project in its entirety. The survey delineated numerous explorations targets, including 7 high priority targets, 11 secondary targets, and 7 lower priority targets. These prioritized targets share important coinciding characteristics related to gold mineralization observed at the Motherlode Project, including:

- crosscutting intersections denoting potential quartz-silica-gold mineralization hosts such as faults, shears, folds, etc.

- surface sample geochemistry with elevated concentration of gold and arsenic

- preferred host rock types, particularly metavolcanic or gabbro lithologies

According to Precipitate Gold, many of the high and secondary priority areas have little to no reported historical surface sampling and none have ever seen a modern ground geophysical survey. With this in mind, the Company intends to “commence a follow-up program of detailed sampling, geological mapping, and focused ground geophysical surveying within prioritized areas for ongoing advancement and drill target delineation,” as stated by Mr. Wilson.

Precipitate Gold’s share price opened at $0.095 today, up from a previous close of $0.07. The Company’s shares were up 28.57% and were trading at $0.09 as of 1:30 PM EST.