We’re a week out for the Vancouver Investor and Resource Conference and in the interests of full disclosure: I’m still not a resource or mining guy.

That doesn’t necessarily mean the time was wasted. On the contrary, post VRIC I’ve managed to have some interesting conversations, learn quite a bit more about how this industry works, but nobody is tapping me for mining stories even now. Nor should they.

But there are curious companies with strong narratives and without drilling aspirations that are definitely worth your time and attention. I detailed three in the previous story and will rehash them below, and even offer a chance to see how they’ve fared in the week following the conference.

Here are three of the many companies I talked with.

Windfall Geotek

Windfall Geotek (WIN.V) isn’t technically a miner. They’re a tech company, and more specifically an artificial intelligence company, with a product that simplifies the lives and jobs of miners. They have been around for 15 years and have spent all that time developing their CARDS analysis and data mining techniques.

It combines public and private datasets related to mining, like drill hole, surface data and geophysical data into algorithms that calculate and highlight areas where a client company may consider drilling next to find sufficient minerals.

The company’s target market is junior miners and the reasoning is fairly solid. These companies are often looking for a technological edge and a leg-up on the competition, and having the latest in AI and machine learning at your service could easily provide that boost.

The company’s latest deal involves the creation of two gold signature programs on Opus One Gold’s Vezza North, Vezza Extension and Noyell projects, helping them find new drill targets by using the CARDS tech to identify sites that show the same signatures as known mines and deposits.

There hasn’t exactly been much in the way of stock movement a week after VRIC, but today they’re up 7.5%. Even if that’s only a fraction of a penny.

Defense Metals

I mentioned earlier that I’d picked up a thing or two about a thing or two regarding resource and mining while listening to the mining folks around the offices, and Defense Metals (DEFN.V) and more specifically, the ongoing geopolitical narrative surrounding rare earth elements (REE), is one of the things I picked up.

Defense Metals used to be a client of ours and during their tenure, I learned about how China effectively enjoys a global monopoly on rare earth elements.

These metals are required for a considerable list of the technologies we use everyday, including smart phones, digital cameras, some computer parts, semiconductors, and also used in industries like renewable energy, military equipment, glass making and metallurgy.

So the fact that China has such a heavy control over these is something of a big deal.

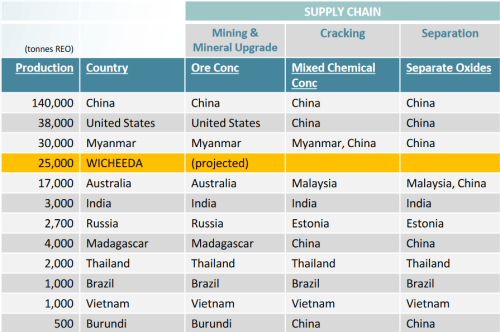

So much in fact that China actively supplied between 85% and 95% of the global demand for these particular metals, most of them sourced from Myanmar. That’s a scary amount of leverage to give any country, and it’s been enough to get President Joe Biden on board regarding the need to reduce our reliance on China for these metals.

Wicheeda project

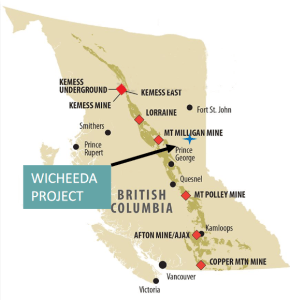

In the above supply chain image, you’ll have seen an entry called Wicheeda. That refers to Defense Metals REE British Columbia resource project. Mostly these projects are generally out in the middle of nowhere and companies have to port in their resources, everything from the power, the gas and the port-o-potties. In this case, the project is close to a major forestry service road connecting to Highway 97, as well as as major hydroelectric power line, a major gas pipeline, and the CN Railway line in Prince George, BC, which also has loads of experience with mining and can offer up a little help with a skilled workforce.

When you factor in the growing demand for REE given the lack of global supply, it’s a good time to get into a company like this and that’s one of the reasons I chatted with them at the VRIC.

If you factor in that Defense Metals took a bit of a mid-month dip likely right around when VRIC was going on and then promptly rebounded to where they now sit at $0.24 (and down 2% today), you get the idea that DEFN broke even in terms of price. Their booth wasn’t interesting, but the gentlemen they had manning it was both informed and informative, which probably provides a benefit in terms of visibility.

RE Royalties

There’s something distinctively Canadian about a company that incentivizes pro-social behaviour, don’t you think? May I introduce RE Royalties (RE.V)? They’re a lender that deals specifically with cleantech companies. At present, the company owns 104 royalties on solar, wind, hydro, battery storage and renewable natural gas projects in Canada, Europe and the United States.

The Canadian incentive referred to earlier involves the provision of capital in support of the renewable energy market in support of a transition to a low-carbon economy. They borrow the revenue-royalty model from the mining and resource industry and use it to offer capital to small-to-mid-scale renewable energy projects.

In many cases, these companies may not have the usual capital raising options open to them and this represents a significant niche. Their focus has been on the transition to low-carbon, and in doing so they find opportunities in distributed energy, energy efficiency, energy storage, renewable fuels, electric vehicles. Now that climate change is becoming an outsized concern, we need to see more companies like this doing the rounds.

For most of RE’s lifespan they’ve been hovering around the $0.90 mark with what our chart wizard Vishal Toora would called a resistance point at roughly a dollar. Right now, they’re under their usual range, coming in today at $0.81 after a sell-off that started on the 11th of this month. That’s actually quite promising for a company with this type of portfolio and may represent a significant buy signal for the savvy investor looking to get into a company with strong ESG and upside.

—Joseph Morton