Conference season is back! I have been to my fair share of mining/metals/commodities conferences. In Vancouver, I have been to multiple Metal Investor Forums, and a few Sprott natural resource symposiums. I have been fortunate enough to attend the world’s largest mining convention, the Prospectors & Developers Association of Canada, or better known simply as PDAC.

But my favorite has always been the Vancouver Resource Investment Conference (VRIC). It holds a special place in my heart as it was the first major conference I attended years ago, and my first steps into the mining space. I have learned a lot, and have had some of the best memories meeting people and chatting to speakers I had up to that point, only seen on Youtube.

I remember my very first conferences were hectic. Running all over the place to attend all the talks that I wanted to hear. Oh, and my legs were destroyed post conference. Very tiring. Now, I wear comfy shoes and take time for breaks.

Because of the scope of VRIC, it might be daunting to new investors. But let me give you some advice, and what I will personally be doing.

First off, take a look at the agenda. Are there any workshops that catch your interest? For me, Chris Parry’s “Finding your Storyline: Stand Out of Stand Down”, Chen Lin’s “Silver The New Lithium” are just a few that I have circled. Anything silver or uranium is on my list.

You will see there are a lot of company showcases. I used to attend many of these in the past, however you can find these corporate presentations on the companies website. In my opinion, a better use of time is to go visit the company’s you like at their booth, where you can speak face to face with management or employees.

Ah, and this is a very important part that I neglected to bring up earlier. This is the first in person VRIC since January 2020. Many conferences are coming back so it will be interesting to see the turnout. The attendance might seem trivial, but it is important in determining the popularity and sentiment in the sector. A lot of people show up to VRIC when gold and other commodity prices are high. Trust me, I have been to VRICs when gold is boring. Not a great turnout and you can just feel the hopeless sentiment. With gold recently printing all time record highs, and the price much higher now than it was for VRIC 2020, I think the turnout and sentiment will be positive.

By far the busiest VRIC I attended was in 2018. Cryptocurrency speakers were at the show, and Bitcoin had hit record highs of $20,000 at that time. There were a lot of young people in attendance. That’s the thing about these VRIC conferences. I remember the first VRIC I attended, I was one of the few younger attendees. Mining wasn’t too popular with the young crowd in those days, and one can argue it still isn’t today. VRIC has brought in more mainstream speakers that resonate with the younger crowd like Timothy Sykes. This year we have Robert Kiyosaki who might draw in the younger crowd.

To be honest, I don’t think this will be a problem. Many young people have begun looking at financial markets and safe havens during the pandemic. Let’s not forget that WallStreet Silver is a big thing. By the way, the creator of WallStreet Silver will be at VRIC. I might need to attend his workshop just to speak with my fellow silver apes.

When it comes to specific companies, the conference attendee is spoiled for choice. I mean there will be over 200 companies there with booths. My approach is more specific now after attending these conferences and participating in the precious metal markets. I really like my royalty and streamers, and these are the companies I watch out for personally. I have a soft spot for silver and am quite bullish on the white metal. Naturally, I will be scoping out many silver companies. The questions I ask are basic. I ask about the jurisdiction, the company’s biggest accomplishment last year, the company’s top goal for this year, and if the company has the cash to do what it wants to do. Because I am such a nerd, the conversation usually turns to the price of gold and silver and why precious metals are where you want to be. If the management is lucky, I might even show them pictures of my large global silver bullion collection.

When it comes to the gold price, the precious metal is bouncing at my uptrend and support at $1800. Looking for a close above $1850-$1860 to reclaim what was once support now turned resistance. Then, the big level comes in at $1920.

I just wrote about silver recently. A huge support zone has broken. Yikes. Read my most recent thoughts on where I see silver going next. It is going to be a very important week for silver, and why I am more focused on the white metal.

Given the strength in the US Dollar and the price action of precious metals, I fear we could see some more weakness in metals. I will be looking for bargains at VRIC. Particularly smaller market cap companies which don’t have much lower to go, but can have huge upside potential.

Here are three on my list:

Puma Exploration (PUMA.V)

Market Cap ~ $30 Million

Puma Exploration is a junior gold explorer focusing on an emerging new gold camp in New Brunswick, Canada.

Their properties, Williams Brook, and Jonpol and Portage, are located in a geological zone that is home to Atlantic Canada’s gold deposits. Puma completed a geophysical survey of the three properties in Q1 2021 and will continue to explore these properties in 2022.

The company announced surface samples collected at Williams Brook which all returned high-grade gold. The four grab samples graded came above 100 g/t gold. A few more new high-grade zones were recently reported with near surface high-grade gold intersections of 34.93 g/t gold over 3 metres within a wider zone assaying 6.47 g/t over 16.90 metres.

“These first results are very exciting. Every hole intersected gold mineralization, and hole WB22-25 is one of the most impressive, with more than 34 g/t gold over 3 metres. That hole contains the highest individual gold grade since the beginning of drilling in 2021, with 183 g/t Au over 0.50 metres. We are systematically building our model and demonstrating again, step by step, the gold potential of the O’Neil Gold Trend and the entire Williams Brook Project,” said Marcel Robillard, President and CEO of Puma Exploration.

Drilling at Williams Brook is ongoing, and the company has cash in the bank for an aggressive 2022 drill campaign. Good results mean a good catalyst for the stock.

The stock recently tested a major support zone at $0.30. We bounced nicely with very nice strong volume. If we can climb above $0.40, the really get things going by taking out the recent lower high.

Searchlight Resources (SCLT.V)

Market Cap ~ $2.1 Million

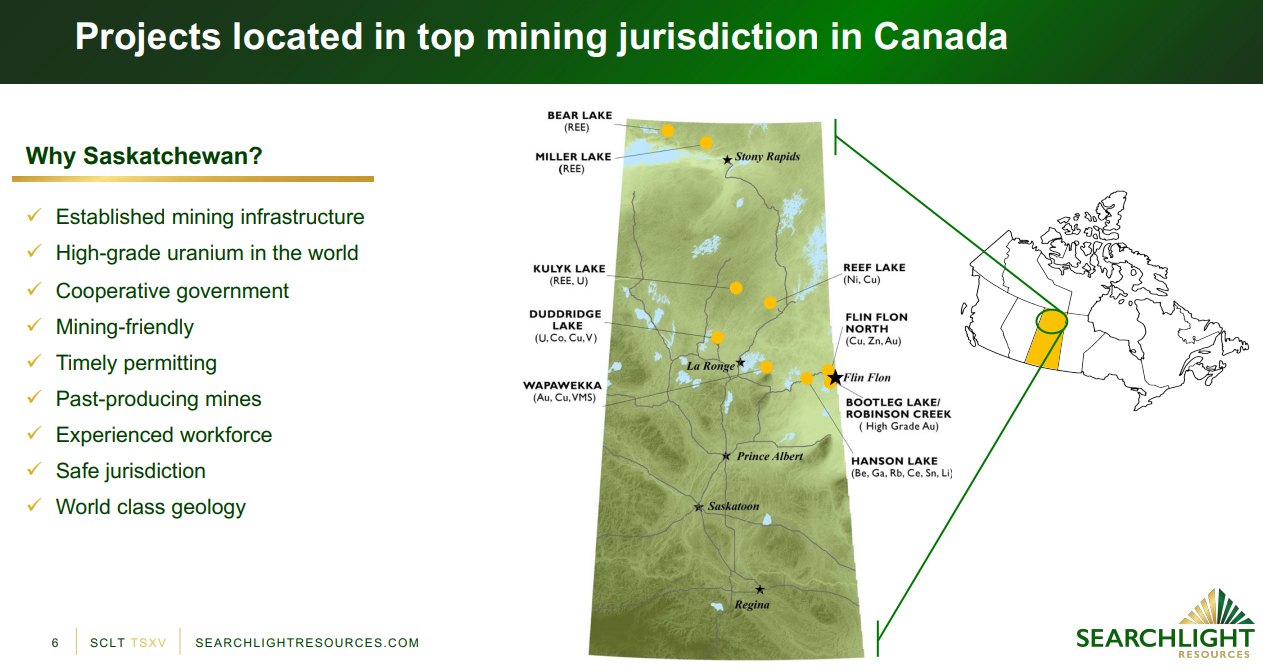

Small cap but high upside potential. Searchlight Resources is a junior explorer focused in a top location for mining investment: Saskatchewan, Canada. The company focuses on exploration for gold, uranium and battery minerals holding 1300 square kilometres of claims.

Recent news shows that Searchlight is focused on their Uranium asset at Duddridge Lake, and Gold at Robinson Creek.

Searchlight has identified uranium targets from an airborne survey.

“The Duddridge Lake project hosts a suite of Critical Elements including copper, cobalt, and vanadium in association with a known uranium deposit. In past exploration the focus has been on uranium, though we see potential for a multi-metal exploration focus”, says Stephen Wallace, Searchlight’s CEO

The drill holes at Robinson Creek have been compiled. Highlights include:

- Compilation of 70 historical drill holes from the 1940s and 1980s

- 60 drill holes have gold intersections greater than 1 g/t Au

- 45 gold intersections greater than 2.0 g/t Au over at least one metre

- Multiple wide gold intersections:

- 2.46 g/t Au over 57.60 m in DDH 81-2

- 7.59 g/t Au over 10.94 m in DDH HB-6

- 3.80 g/t Au over 21.00 m in DDH R07-1

- 2.15 g/t Au over 32.00 m in DDH 81-1

- The drill intersections and the 2021 magnetic survey outline a mineralized zone with a strike length of approximately 1,000 metres

“At Searchlight we are assessing the Robinson Creek property from a different perspective than past explorers. We see the potential of combining this shallow, relatively high-grade gold deposit into a larger consolidated gold project with our brownfield Bootleg Lake Gold holdings nearby”, stated Stephen Wallace, CEO.

The stock is in a broader structure. The breakout way back above $0.05 was the key. We now wait for a higher low to form with a close above $0.12. It does appear like a $0.05 support test is once again possible. That’s what I will be watching for.

Volcanic Gold (VG.V)

Market Cap ~ $11 Million

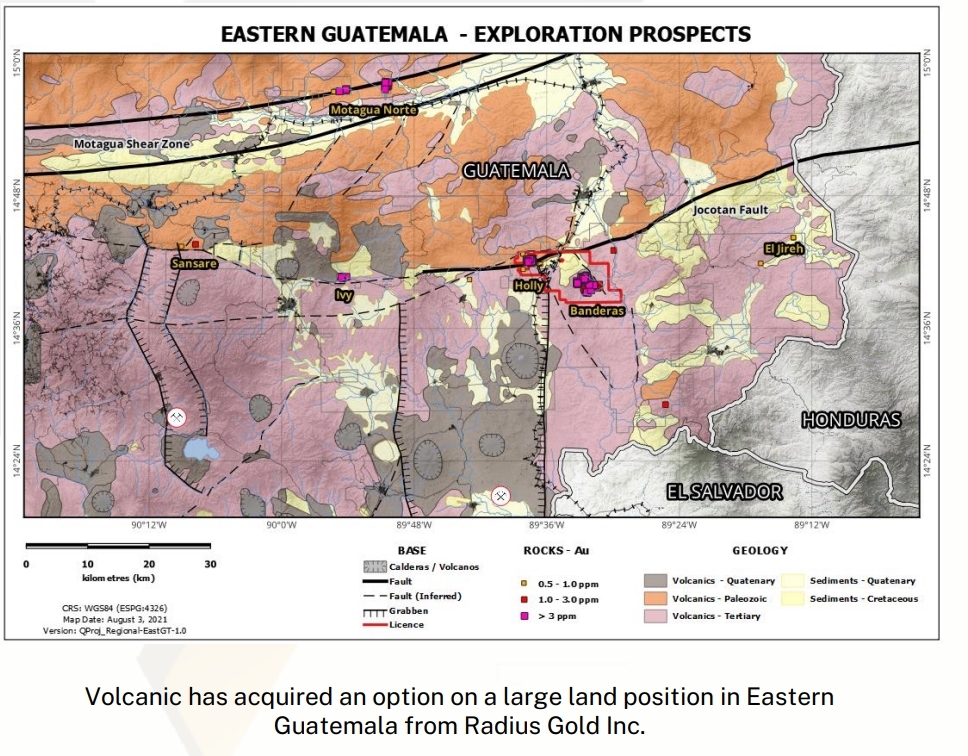

Volcanic Gold is bringing together an experienced and successful mining and exploration team focused on building multi million ounce gold and silver resources in underexplored countries. The country of focus is Guatemala.

Not a country that comes to my mind when I think about mining, but then I did some research. The same geological belt in mineral rich Mexico extends down to Guatemala. There are operating mines in the country and Pan America in 2019 spent $1 Billion to acquire control of Tahoe, and there have been other deals made.

According to Volcanic Gold’s power point presentation, for every $1000 spent on exploration in Mexico in the past 20 years it is estimated that less than $1 dollar has been spent in Guatemala. Underexplored for sure.

Volcanic Gold sees prospects in Eastern Guatemala. The company can earn a 60% interest in the Holly and Banderas projects by spending the cumulative amount of $7 Million USD on the exploration of the properties within 48 months from the date of the agreement.

Holly is near Bluestone’s gold deposit which is under development, and shares key features of high grade deposits in Mexico. Ongoing drilling has produced results to 4.58 metres at 79.84 g/t gold and 5,053 g/t silver.

Recent drill results from Holly have been quite promising. Here are highlights:

La Peña vein Hole HDD-22-030 intersected 11 .4 g/t Au and 1,150 g/t Ag over 1.52m within a broader interval of 10.68 m grading 2.07 g/t Au and 389 g/t Ag.

La Peña vein additional sampling of Hole HDD-22-022 reported 11.2 g/t Au and 522 g/t Ag over 1.53m

“The gold and silver discovery we have made at Holly is significant. The new high-grade intercepts demonstrate continuity within the La Peña vein system. With final results in hand the Company is working to complete a maiden resource calculation with the aim of showing the high value and minimal impact of developing these resources and the concrete benefits and sustainable employment for our local communities,” stated Simon Ridgway, President and CEO of Volcanic.

The stock has recently broken below a major support zone at $0.315. I would want to see price reverse and close back above this zone. Currently, the stock is testing the major psychological support at $0.25. There is a potential to get a bid here. If not, the stock looks like it will be heading lower to the next support which comes much lower at $0.125.