From the Biden administration green energy bill, to the move to renewables in the Middle East and Europe, we might not be there just yet, but green and renewable energy is coming. Governments worldwide are quickly spending big on going green as the climate crisis intensifies. Some would even say that there is a bigger incentive now as European nations wane away from Russian energy dependence.

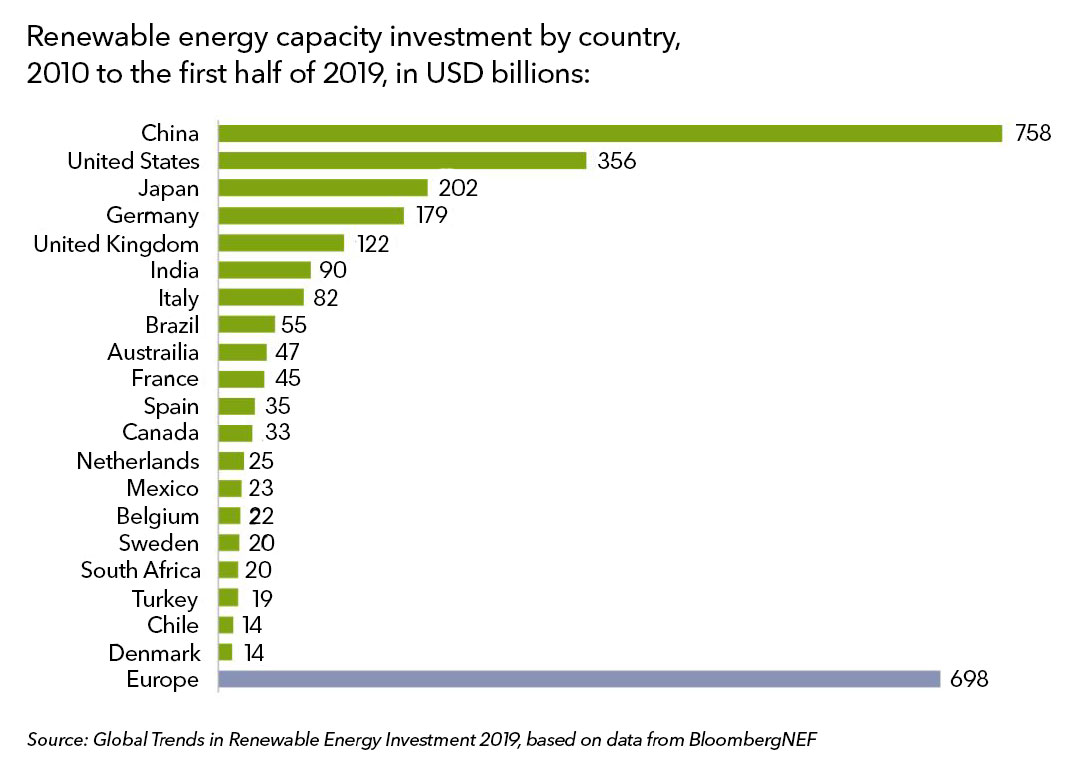

Renewable energy drew more than $2.6 trillion in investment from 2010 to 2019. Building new wind or solar capacity now costs less than adding the equivalent in coal or gas plants in two-thirds of the world. Investment has pushed solar energy to more than 8% of global generating capacity, and wind to almost 9%. And we are just getting started.

By 2026, global renewable electricity capacity is forecast to rise more than 60% from 2020 levels to over 4 800 GW – equivalent to the current total global power capacity of fossil fuels and nuclear combined. Renewables are set to account for almost 95% of the increase in global power capacity through 2026, with solar PV alone providing more than half. The amount of renewable capacity added over the period of 2021 to 2026 is expected to be 50% higher than from 2015 to 2020.

As an investor, I see big government spending which means big $$$ for this space. Here are three companies poised to gain on the move to renewable energy.

Ozop Energy Solutions (OZSC.OTC)

Market Cap ~ $116 Million

Ozop Energy Solutions invents, designs, develops, manufactures, and distributes ultra-high-power chargers, inverters, and power supplies for a wide variety of applications in the defense, heavy industrial, aircraft ground support, maritime and other sectors. The company’s strategy focuses on capturing a significant share of the rapidly growing renewable energy market as a provider of assets and infrastructure needed to store energy.

Ozop Energy Systems, a wholly owned subsidiary of Ozop Energy solutions, is a manufacturer and distributor of Renewable Energy products in the Energy Storage, Solar, Microgrids, and EV charging Station space.

Their partners include some big names:

Back in 2021, our very own Kieran Robertson wrote about Ozop’s first project, the Tesla Megapack. Recent news regards Ozop energy solutions introducing EV protection products, and Ozop energy announcing a new division named Ozop engineering and design. This wholly owned subsidiary will design and engineer energy-efficient, easy to install, “smart” digital lighting controls systems for commercial buildings, campuses, and sports, medical, military complexes throughout North America and eventually the global marketplace.

The global market for Smart Lighting and Control Systems, estimated at US$40.5 Billion in 2022, is projected to reach a revised size of US$78.8 Billion by 2026, growing at a CAGR of 14.7%

The penny stock has caught my attention. I am looking at a technical breakout pattern with a breakout above $0.03 to trigger a new upwards move. This stock sees a lot of volume per day. Enough that a breakout could lead to sustained momentum higher. The stock does appear as if it is basing. Readers know I love these types of set ups. All we need is the breakout trigger and the reversal is confirmed.

Greenlane Renewables (GRN.TO)

Market Cap ~ $136 Million

Greenlane Renewables is a pioneer in the rapidly growing renewable natural gas (“RNG”) industry. As a leading global provider of biogas upgrading systems, they are helping to clean up two of the largest and most difficult-to-decarbonize sectors of the global energy system: the natural gas grid and the commercial transportation sector. Their systems produce clean, low-carbon and carbon-negative RNG from organic waste sources such as landfills, wastewater treatment plants, dairy farms, and food waste streams.

Greenlane’s business has been built on over 30 years of industry experience, patented and proprietary technology, over 100 hydrogen sulfide treatment systems sold, and over 135 biogas upgrading systems sold into 19 countries, including some of the largest RNG production facilities in the world.

Our very own Kieran Robertson wrote a masterpiece of an article about Greenlane Renewables to kickstart 2022. Below is a nice summary of the company from his piece:

Greenlane’s biogas upgrading plants marketed and sold under the Greenlane Biogas™ brand, remove impurities and separate carbon dioxide from biomethane in the raw gas created from organic waste at landfills, wastewater treatment plants, farms, and food waste facilities. In total, Greenlane has over 125 systems throughout 19 countries and more than 30 years of experience under its belt. Keep in mind, Greenlane is the only biogas upgrading company to offer multiple core technologies:

-

Water Wash:

- the most deployed biogas upgrading technology in the world

- uses counter-flow water to scrub away impurities, without the need for chemicals or heat

- purified methane is then dehydrated, creating pure, dry RNG

- water is cleaned and reused in a closed-loop

-

Pressure Swing Adsorption (PSA):

- hydrogen sulfide is removed first

- biogas is then chilled and dehydrated

- adsorbent media traps C02, nitrogen, oxygen, and any remaining moisture

- this allows menthane to pass through as clear and dry RNG

- afterward, adsorbent media is regenerated and reused

-

Membrane Separation

- porous membranes used to separate C02 from methane via permeation

- as biogas passes through, selective membranes allow for smaller C02 molecules to pass through

- able to remove both C02 and oxygen (O2) together

- offers reliable performance and a biomethane recovery rate typically over 99%

The stock had a pop on earnings, but then rejected resistance at $1.20. Currently, we are watching for a support test here at $0.89. But just applying my technical eye, it does look like the stock will be heading lower. The next support I have comes in around $0.60. $1.00 is the major psychological zone that has been rejected. To turn bullish in the short-medium term, we want to see a pop back above $1.00.

Longer term though, any drop looks like an attractive area to buy. With the rise in Natural Gas prices (at one point Nat Gas was up 9% on the day I am writing this), renewable natural gas (RNG) might be the solution that some nations that are not endowed with large gas reserves, might turn to.

Clearway Energy Inc (CWEN)

Market Cap ~$ 6.19 Billion

Now to a safe utility stock for your portfolio.

Clearway Energy, Inc. is one of the largest renewable energy owners in the US with over 5,000 net MW of installed wind and solar generation projects. The Company’s over 7,500 net MW of assets also include approximately 2,500 net MW of environmentally-sound, highly efficient natural gas generation facilities. Through this environmentally-sound diversified and primarily contracted portfolio, Clearway Energy endeavors to provide its investors with stable and growing dividend income.

The company has multiple operating assets, and multiple assets in development. Recent news saw Clearway Energy announce the sale of their Thermal Business to KKR for a total consideration of $1.9 Billion.

“I want to again thank my former colleagues at the Thermal Business for their years of dedicated service and for providing safe and reliable operations to their customer base,” said Christopher Sotos, Clearway Energy, Inc.’s President and Chief Executive Officer. “With the closing of this divestiture, Clearway now has unprecedented financial flexibility to deliver on its long-term growth objectives.”

The Thermal Business previously owned by the Company consists of thermal infrastructure assets that provide steam, hot water and/or chilled water, and in some instances electricity, to commercial businesses, universities, hospitals, and governmental customers across the United States.

The stock is testing a major support. We actually printed a bullish candle known as the engulfing candle right here at support. That’s a very good sign. For me to rest assured of a bottom, I would want to see a close above $32 as it takes out the previous lower high.

The thing about this stock is it is your safety utility play. Regardless of what happens in the world and economy, people need to pay for energy. A type of stock you want in your portfolio given geopolitical and financial uncertainties. They also pay a nice dividend of $0.35 per share, or an annual divided yield of 4.42%.