I saw my first Bitcoin ATM in 2012. I was still in what I jokingly call my apprenticeship period in terms of crypto, and had only started to learn about Bitcoin and its promise, so seeing an ATM in the back of my favourite coffee-shop was something of a novelty.

I’d eyeball it and pause to look at the screen and decipher its use on the way to my seat. While there, though, I’d forget about it. Studying for exams will do that. Fast forward ten years and that Bitcoin ATM’s still there, it’s dusty with a cracked screen, and there’s absolutely no way in hell I’m ever using one of those.

And that’s how I feel about Bitcoin Well (BTCW.V), which deals in these scam and hack magnets. Granted, they’ve also since branched out to offer both online over the counter services where you can buy your bitcoin in person directly from a human (which has its own set of problems) but the majority of what they do involves Bitcoin ATMs.

Two things wrong with Bitcoin ATMs?

Hacks

Bitcoin ATMs give folks the opportunity to convert their dollars into crypto, but they’re easily compromised with their server address, applications and security being the culprit.

The Kraken cryptocurrency exchange released a report about how generally unsafe these boxes are last year. They discovered multiple hardware and software weaknesses in the most commonly used cryptocurrency ATM: The General Bytes BATMtwo. Multiple approaches were discovered through the default administrative QR code, the ATM management system, the Android operating software and even in the hardware case of the machine.

The Kraken team discovered that a large number of ATMs were configured using the same default admin QR code, which meant that anybody with this code could access it. There’s also the matter of a lack of a secure boot mechanism, and vulnerabilities in the ATM management system.

Then of course there’s the problem associated with having an unattended antiquated technology in a field where techno-nerds regularly challenge each other to find technological ways to get something for nothing. It’s not even about the money—not really. It’s about who’s the smartest guy in the room for these guys, and getting your hands on a piece of software designed to hack into one of these machines is easy if you know where to look.

Scams

The second thing wrong with Bitcoin ATMs is their increasingly terrible reputation. Every time you hear about one they’re the locus for some variety of scam or they’re being hacked. Scammers call or email, or contact via social media, pretending to represent a government agency, some branch of law enforcement or maybe a prize promoter for a lottery. Sometimes they even go the old-fashioned love-con route where they pretend to be some Parisienne hairdresser down on her luck.

Eventually, no matter what route they choose to approach, they get their marks to withdraw money from their bank or maybe their investment accounts, while staying on the call throughout to direct them to a nearby crypto ATM to deposit their fiat, buy Bitcoin, and give them the QR code with the crypto address on it.

After they scan that code, the money’s gone and so are they.

There were more than 1,500 reports of scams using crypto ATMs, with the dollar amount lost being in the $28 million range, according to the FBI’s Internet Crime Complain Centre (IC3) 2021 Internet Crime Report.

The IC3 also fielded more than 4,325 complaints with losses of over $429 million from confidence or love-cons who also reported investments and crypto.

Is there a saving grace?

Yes. Too be fair, they are gradually making the move to more online services.

They’re offering a Visa Debit card and have suggested in subsequent releases that they’re gradually developing their online ecosystem. Users can create an online account where the custody of their bitcoin stays with them (which is the Bitcoin Well model), as the company directs all account transactions to an address or wallet in the customer’s control.

Here’s what they’re presently offering:

- Sell bitcoin and receive an Interac e-transfer;

- Sell bitcoin and receive a direct deposit into any Canadian bank;

- Use bitcoin to pay your bills;

- Buy bitcoin automatically (monthly) with the bitcoin savings plan;

- Create an on-line account and buy bitcoin with Visa Debit.

They also have an open, permissionless network, which allows you to use any wallet you like.

No diversification

Bitcoin Well hasn’t diversified at all beyond Bitcoin. They’ve set up shops around the country where you can buy Bitcoin in person, and their website offers some variety of customer education, but there’s an entire ecosystem out there to be exploited.

The problem with Bitcoin maximalists is that they’re leaving money on the table. A lot of money. That’s not necessarily to say that this company falls under the category of Bitcoin maximalist, but that in focusing on one asset rather than diversifying out to include at least one or two alternative options—be they altcoins, NFT, metaverse, decentralized finance, or literally anything else—they can better improve their options.

There are circumstances in which a strong product servicing one asset like Bitcoin could be lucrative for a company. This isn’t one of them. When you can use your phone to download the app for an exchange and be trading in a far more secure environment in a multitude of cryptocurrencies and blockchain-based sub-sectors, the idea of buying just Bitcoin off of a shady ATM or in person from an actual human, seems patently ridiculous.

One remaining concern

There is one actual remaining question and that’s where does Bitcoin Well’s Bitcoin actually come from. They’re not a miner and they don’t have any off-take deals with Bitcoin distributors, so they have to settle for borrowing their bitcoin from third parties. The companies calls these “use of coin agreements.” The third party includes Adam O’Brien, the CEO of Bitcoin Well, among other undisclosed arms length parties.

There’s something unsavoury about a CEO who finds a way to pay himself twice.

He collects a paycheque from the company as CEO, but also gets a kickback from the Bitcoin loan he’s made to the company. The company pays a fixed monthly fee for these bitcoins, which are approximately 8-10% of the principle value of the coins loaned. Considering that the total amount paid under these agreements for three and nine months ended September 30, 2021 was $109,596 and $185,868, and you get the idea that their $4.7 million cash position isn’t going to stay that way for long.

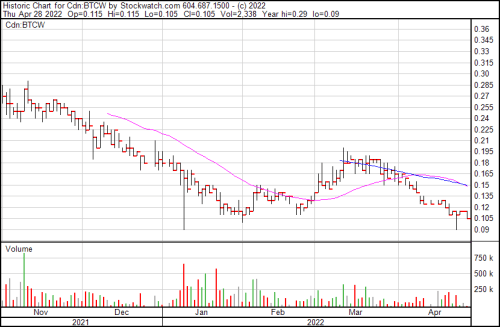

The steady decline continues. This may be representative of the general malaise of the cryptocurrency and blockchain space right now as the core asset has managed to erase all of its gains from the previous year. There’s also a strong probability that this isn’t the bottom for BTCW.

—Joseph Morton