Cryptocurrencies generally have one or more of core three problems. They either don’t scale—meaning transactions take too long to clear—aren’t secure or aren’t decentralized. Security is likely going to be a much larger concern in the future as demand for transactions on blockchains grow, and decentralization has always been a concern. Fantom was built as a solution to these problems.

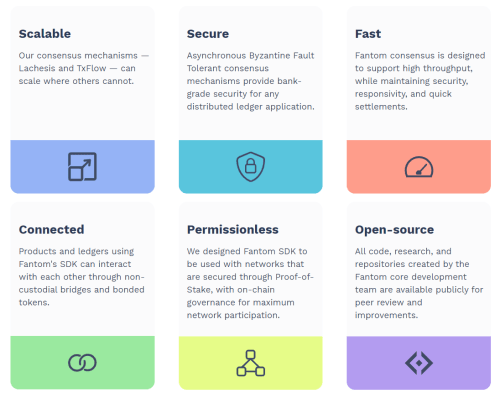

Fantom is a scalable, secure smart-contract platform that’s completely compatible with ethereum. It’s mainnet deployment, called Fantom Opera, is built on Fantom’s Lachesis consensus mechanism, which we’ll get into later. Fantom is a leaderless, asynchronous and byzantine fault tolerant Layer 1 blockchain protocol.

That last sentence needs a lot of unpacking, so let’s get started.

Lachesis is:

- Asynchronous: Participants have the freedom to process commands at different times.

- Leaderless: No participant plays a “special” role.

- Byzantine Fault-Tolerant: Supports one-third of faulty nodes, including malicious behavior.

- Final: Lachesis’s output can be used immediately. There is no need to wait for block confirmations; transactions are confirmed in 1-2 seconds.

Consensus mechanism

First thing you have to know is that blockchain types are nerds and we nerds love Greek mythology.

Lachesis was one of the three fates in Greek mythology. Her sisters were Clotho and Atropos. Clotho spun the weave of a person’s life, Lachesis measured it and Atropos cut it. It’s a nerd thing.

How does Lachesis work?

Each node contains a file composed of event blocks, each of which contain transactions. That’s basically the same as Nakamoto consensus. The file organizes the relationship between events, and are used to determine the order those events came in, and therefore the transactions, on each node independent of each other.

Event-blocks are then divided into two piles: confirmed and unconfirmed. New additions are considered unconfirmed while event-blocks from the past few passes are all confirmed and put into order by the nodes. Consensus comes when batches of confirmed event blocks, where each batch of event-blocks form a larger block. These larger batches of finalized blocks form the final chain.

If you’re confused, the problem here is one of terminology. Larger blocks are collections of confirmed event-blocks.

Lachesis nodes don’t send blocks to each other, either. Instead, only events are being synced between nodes. Validators don’t vote on the steady-state of the network like in Proof-of-Work mining. Instead, they periodically exchange transactions and events with peers.

Fantom provides security through Proof-of-Stake, which prevents centralization and doesn’t include a heavy operational cost in electricity usage. Lachesis provides institutional-grade security to networks, and offers absolute finality, which means transactions can’t be reverted like in networks operating with probabilistic finality.

Finality explained

There’s honestly a big debate on the best type of finality but we’re going to truncate and summarize for understanding.

Proof of Work (or Nakamoto Consensus) uses probabilistic finality. In order for a block to be finalized and the transactions verified on the blockchain, a number of blocks need to pass. Any subsequent block can be used to invalidate a previous block, but as blocks pass by (generally about an hour’s worth) the probability that the ledger is correct grows.

It takes longer but is generally considered more stable.

Absolute finality does none of that. The block closes and finality is assured right there. This seems great in theory, but it lacks the checks and balances of continual closure, and there’s a possibility that errors in the ledger may begin to appear.

That’s one of the key problems associated with Fantom and other coins using absolute finality.

Wallet options abound as well. Fantom does come with its own wallet option called the fWallet, but you can also go to Metamask, Ledger Nano will hold it, Coinbase’s wallet will hold it and plenty others.

How does it work in DeFi?

It’s begun to find a home in the decentralized finance ecosystem where it offers something called asynchronous byzantine fault tolerant (aBFT) consensus. It’s considered to be faster, cheaper and more reliable, and also more secure than its predecessors.

If you’re going to get involved in Fantom DeFi ecosystem, you’re going to have to trade in your FTM for something that will operate in the ecosystem. For example, in terms of functionality, you can use FTM to mint a USD backed stablecoin called fUSD (or fantom USD) which you can use to get access to the tools of decentralized finance. For example, you can use your fUSD to trade for other assets, or lend it out to earn interest and borrow other tokens.

The fMint process allows you to mint fUSD, which is a USD backed stablecoin on Fantom. You choose the amount and rebalance at any time by adding or removing your FTM.

You can also buy and sell synthetic assets from your Fantom wallet. (A synthetic asset is a tokenized derivative that mimics the value of another asset. For example, fUSD is technically a tokenized stablecoin) You can use FTM or fUSD to trade 176 different assets that represent tokens outside of Fantom’s ecosystem. These include Bitcoin, Ethereum and plenty of others.

At the time of writing Fantom was trading at $1.17 with a $2,960,722,683 market cap and was 46th in size.

—Joseph Morton